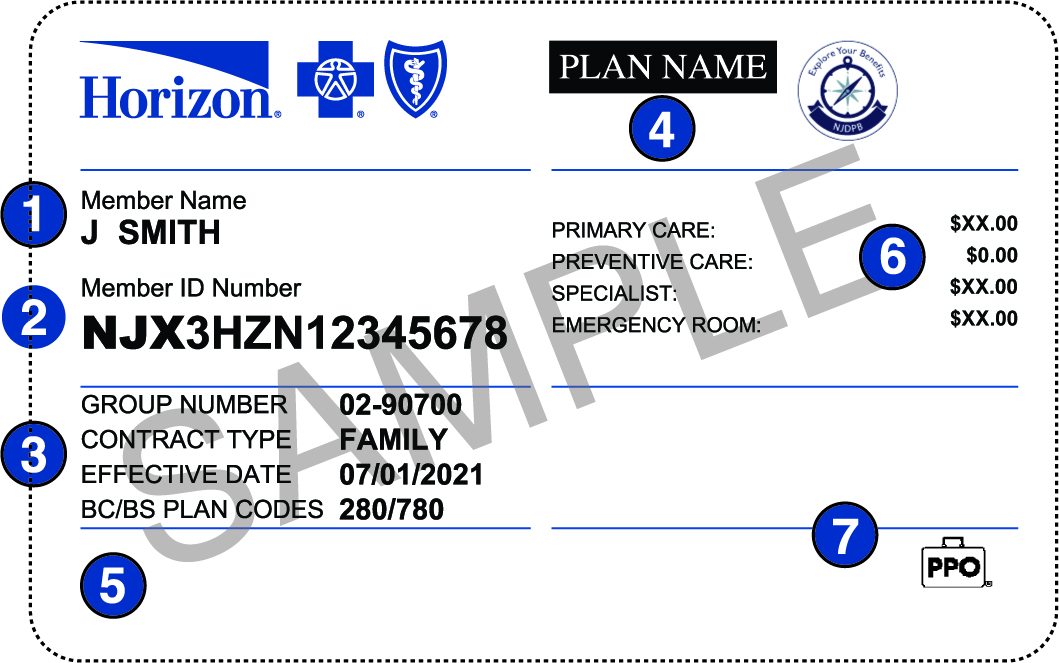

However a PPO gives you more choices about how you use it. 1 PPO is short for Preferred Provider Organization and allows patients to choose any physician they wish either inside or outside of their network.

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Additionally patients with a PPO can.

Why would a person choose a ppo over an hmo. How a PPO effects your wallet. With a PPO plan you wont need to get a referral as you would with a HMO plan. You can go to any health care professional you want without a referral inside or outside of your network.

Ease comes with a higher price tag. Like an HMO a PPO also has a network of approved doctors and hospitals. The trump voting public will shy away from being responsible with their health the moment they are faced with out of pocket maximums in a single year.

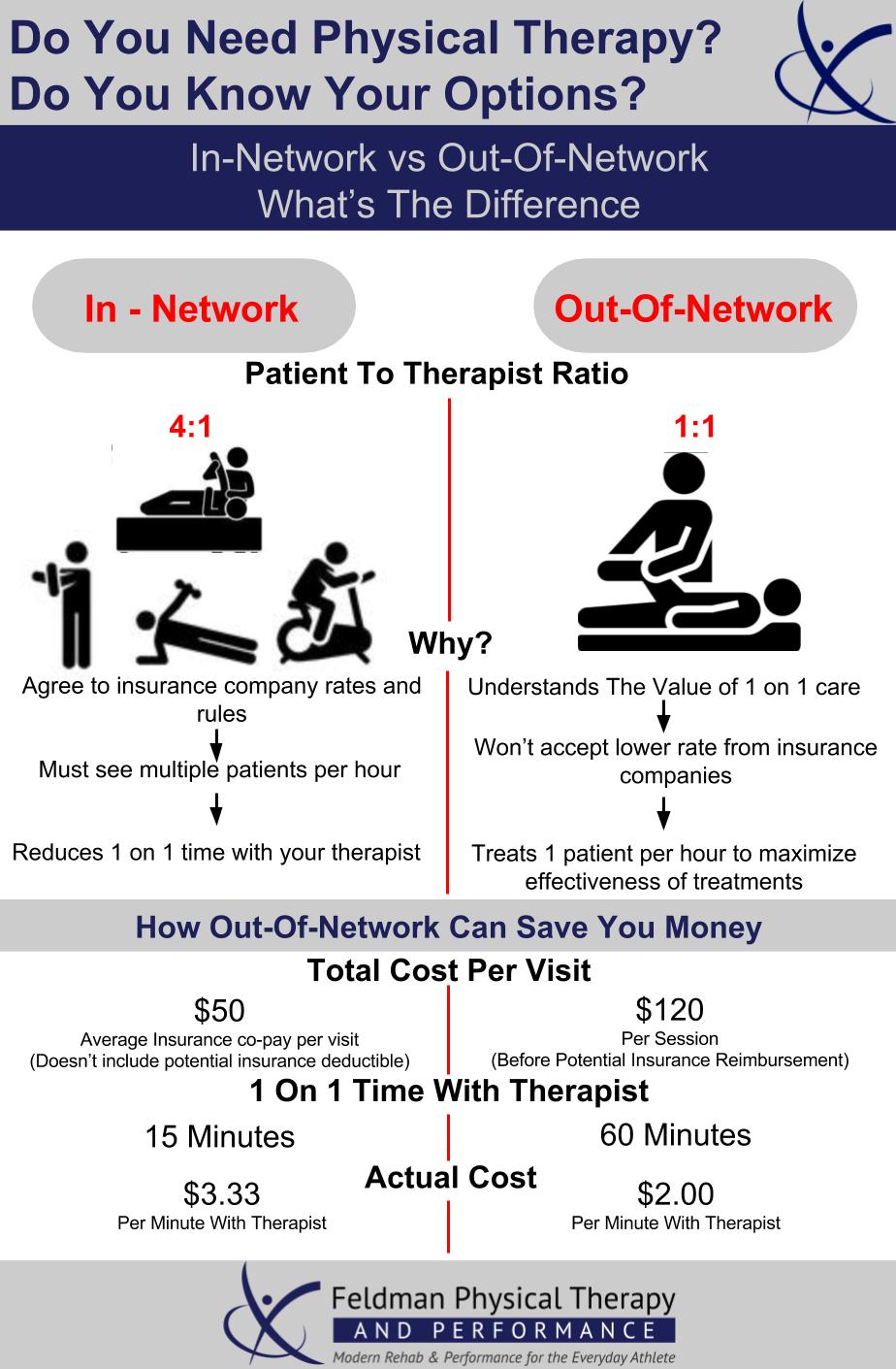

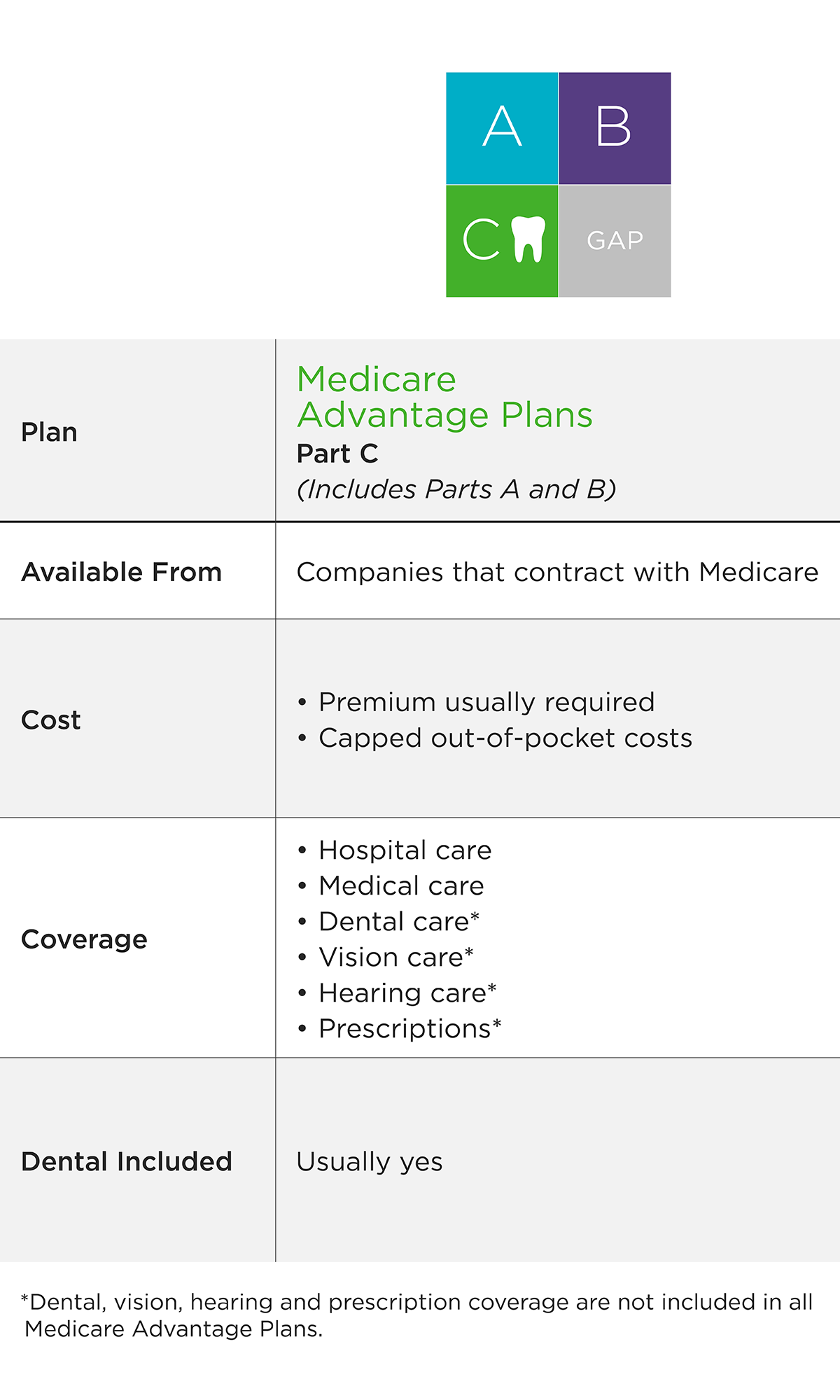

PPO plans give you flexibility. Chronic illness and the lack of routine preventive care is what taxes our system over the long haul. 2 HMOs and PPOs are both types of managed care which is a way for insurers.

If you dont like any of the doctors the PPO offers you can also see a doctor thats not in its network. More flexibility to use providers both in-network and out-of-network. A PPO health insurance can provide more flexibility for an employee and this may be one good reason why an employee may prefer a PPO plan over an HMO plan.

You can usually visit specialists without a referral including out-of-network specialists. A person chooses a PPO over an HMO for the freedom to go out of network and get medical services from doctors and hospitals that are not in network. Learn vocabulary terms and more with flashcards games and other study tools.

I am a fifty year old health care provider for. That means the amount you have to pay before coverage kicks in could be as little as zero bucks. There are also fewer restrictions on seeing.

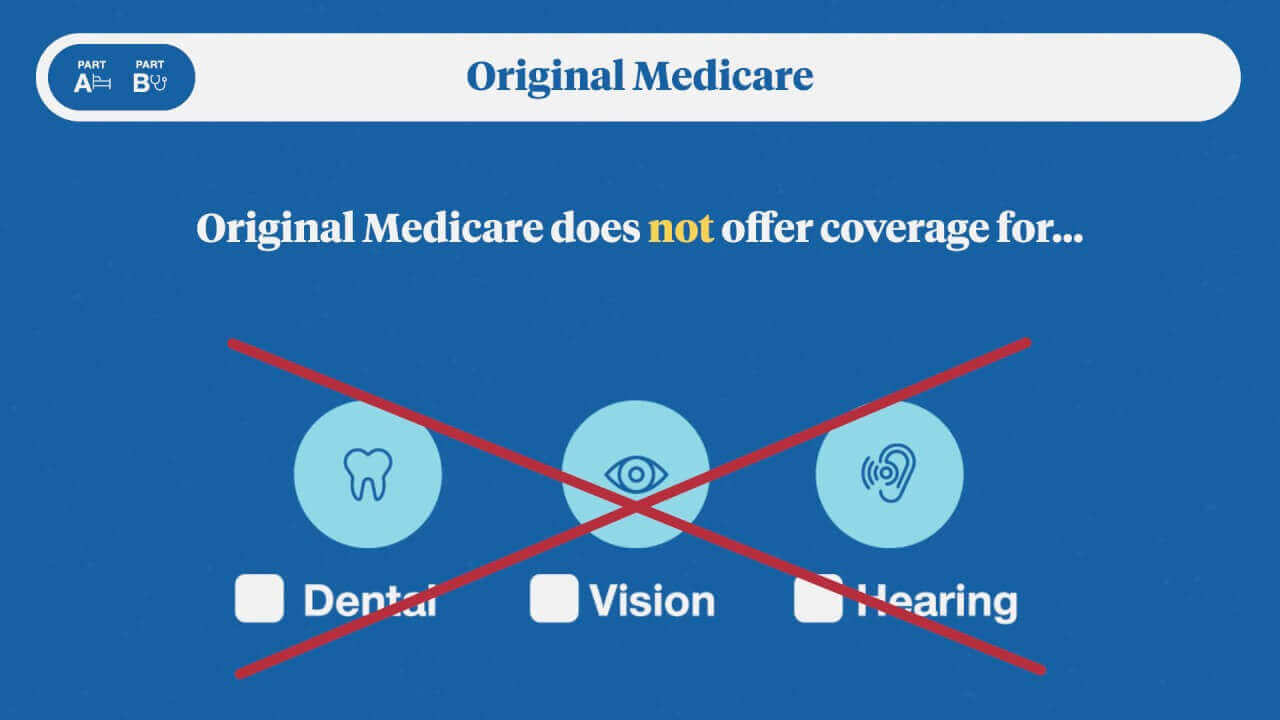

With a PPO the deductible like the monthly premium is typically higher than an HMO. To start HMO stands for Health Maintenance Organization and the coverage restricts patients to a particular group of physicians called a network. If your medical condition requires regular visits to a specialist a PPO plan would be right for you.

This why governmental control and mandates for healthcare are essential. Start studying HMO vs PPO. A PPO plan can be a better choice compared with an HMO if you need flexibility in which health care providers you see.

Below is a table outlining the basic differences of the two kinds of plans. Why would a person choose a dental PPO over an HMO even though its pricier. However these plans may come with higher premiums and copays as well as.

PPO plans allow members to choose in-network specialists without getting a referral which saves time and gives patients a bit more freedom of choice for their medical providers. The latter rule even applies to specialists. Another key selling point to an HMO is its low or no annual deductible.

But they are not the only doctors that a person with a PPO plan can visit. Well if you prefer a plan that gives you more flexibility thanks to a bigger network of providers and the ability to get at least some coverage for out-of-network dentists a PPO might be more appropriate. You dont need a primary care physician.

A PPO plan offers greater flexibility when choosing a doctor. For example you could see an orthopedist or chiropractor in a PPOs network without visiting a primary care doctor first. Unlike an HMO a PPO plan allows members to see any health care provider who is within the insurance companys network without a referral.

Unlike an HMO which is limited to a smaller number of physicians who are contracted with the insurance provider a PPO leaves patients with a greater number of possibilities. PPOs typically have a higher deductible but theres a reason why. Why would a person choose a PPO over an HMO Brainly.

PPO plans also have a provider network and these physicians often offer incentives and benefits. Staying inside your network means smaller copays and full coverage. In 2018 the average PPO cost 3019 annually compared to an HMO which cost 2764 annually.

The lack of PCP referral requirements makes this the preferred type of plan for individuals who need to regularly visit specialists. Well youre paying for access to a. Since the Affordable Care Act better known as Obamacare passed individuals and families und.