This is a 35-star Medicare Part D prescription drug plan. Stand-alone plans offer additional prescription drug coverage only and are an option if you are on Original Medicare insurance or you have a Medicare health plan that does not include Part D coverage.

Drug Channels Preferred Pharmacy Networks Dominate In 2021 Medicare Part D Plans The Scoop On Cigna Cvs Health Humana Wellcare And More

Drug Channels Preferred Pharmacy Networks Dominate In 2021 Medicare Part D Plans The Scoop On Cigna Cvs Health Humana Wellcare And More

Shop Candy.

Walgreens part d plan. To help Medicare beneficiaries understand their prescription plan coverage options when Medicare open enrollment begins Walgreens. Together Walgreens and Express Scripts have extensive experience serving the healthcare needs of Medicare beneficiaries and this is another way we can help them get the most value from their Part D plan said Kermit Crawford Walgreens President of Pharmacy Health and Wellness. The American Association of Retired Persons AARP has partnered with Walgreens to formulate an easy low-cost and convenient plan for Part D holders.

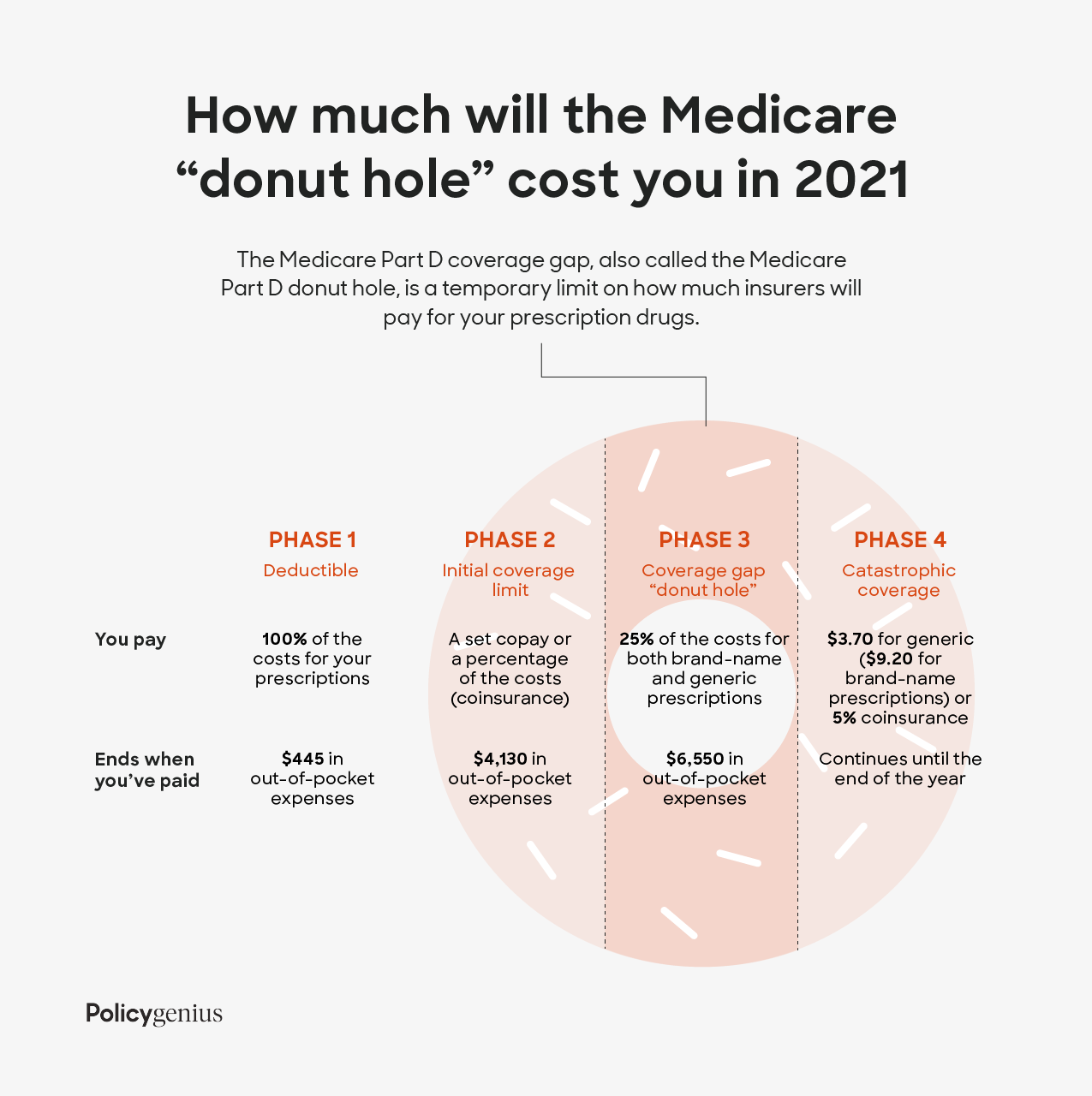

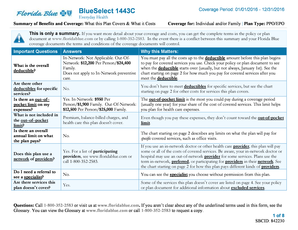

The Federal government sets guidelines for what medications Medicare Part D plans must cover. The plan will cover only a certain amount of this drug for 1 copay or over a certain number of days. These limits may be in place to ensure safe and effective use of the drug.

While Cignas Part D Plan premiums can be a bit on the costly side 288 for the Essentials plan from between 360 and 460 for the Secure plan and from between 550 and 600 for the Extra. If your doctor prescribes more than this amount or thinks the limit is not right for your situation you or your doctor can ask the plan to cover the additional quantity. AARP MedicareRx Walgreens PDP is a Enhanced Alternative Medicare Prescription Drug Plan PART D by UnitedHealthcare.

Walgreens is in the networks of hundreds of other Medicare prescription drug plans for 2015 in addition to participating in these preferred pharmacy networks. By serving as a preferred network provider Walgreens can offer plan. Walgreens will have preferred network relationships with six new Medicare Part D plan sponsors and PBMs who support them for 2015 including Express Scripts which features Walgreens as the only national pharmacy chain in two of its prescription drug plans.

Stand-alone plans offer additional prescription drug coverage only and are an option if you are on Original Medicare insurance or you have a Medicare health plan that does not include Part D coverage. Plans include commonly used generic and brand name prescription drugs but each plan has. Part D savings and drug coverage you can rely on Why Walgreens customers choose the Express Scripts Medicare PDP Value or Choice plan Low copays at your local Walgreens 1 0 deductible for many generic drugs.

2021 MJH Life Sciences and Pharmacy Times. Dairy Eggs. 15 Walgreens today announced it will be a part of preferred pharmacy networks of four national Medicare Part D plan.

DEERFIELD Ill---- With the Medicare Annual Election Period set to begin Oct. Variety. A Medicare Prescription Drug Part D plan can help cover the costs of your medication.

Sale on Candy. Walgreens will continue to be a part of preferred pharmacy networks with three national Medicare Part D plan sponsors. The AARP MedicareRx Walgreens PDP plan.

AARP MedicareRx Walgreens PDP is a Enhanced Alternative 2021 Medicare Part-D Prescription Plan by UnitedHealthcare. Canned. Make sure your prescriptions are covered in each plans list of covered medications.

This Part D plan offers low premiums and additional savings if prescriptions are filled at Walgreens or Duane Reade locations. However the prescription drugs covered vary from plan to plan. The AARP MedicareRx Walgreens PDP plan has a.

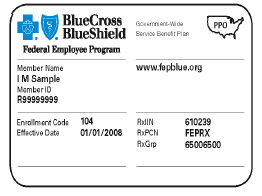

Other new preferred network relationships for 2015 include. AARP MedicareRx plans offered through UnitedHealthcare can help you save money on your prescription drugs and give you peace of mindeven if your health changes. Details Drug Coverage for the UnitedHealthcare AARP MedicareRx Walgreens S5921-383 PDP in Florida.

The new AARP MedicareRx Walgreens PDP plan insured through UnitedHealthcare is designed to appeal to cost-conscious consumers who are looking for Part D prescription drug coverage and. The AARP MedicareRx Walgreens Plan has a. Medicare Part D plans offer coverage for common generic and brand name prescription drugs.