Our business traveler plan empowers employers and employees to protect their agenda and travel without worry that an unexpected accident illness or injury could jeopardize their investment. Short-Term plans provide a limited coverage option.

Short Term 12 Blu Ray Uk Import Amazon De Brie Larson John Gallagher Jr Destin Daniel Cretton Brie Larson John Gallagher Jr Dvd Blu Ray

Short Term 12 Blu Ray Uk Import Amazon De Brie Larson John Gallagher Jr Destin Daniel Cretton Brie Larson John Gallagher Jr Dvd Blu Ray

The ability to earn a living.

Short term blue. We offer STD programs tailored to meet the needs and cost expectations of. 12 hour or less. These goals are but not limited to.

2 hours to 3 hours. You can protect yourself and eligible dependents during those times between coverage or outside enrollment periods choosing coverage for just one month or up to six months. Short-Term plans provide temporary coverage with limited benefits to cover hospital physician and emergency services as well as many specialized services.

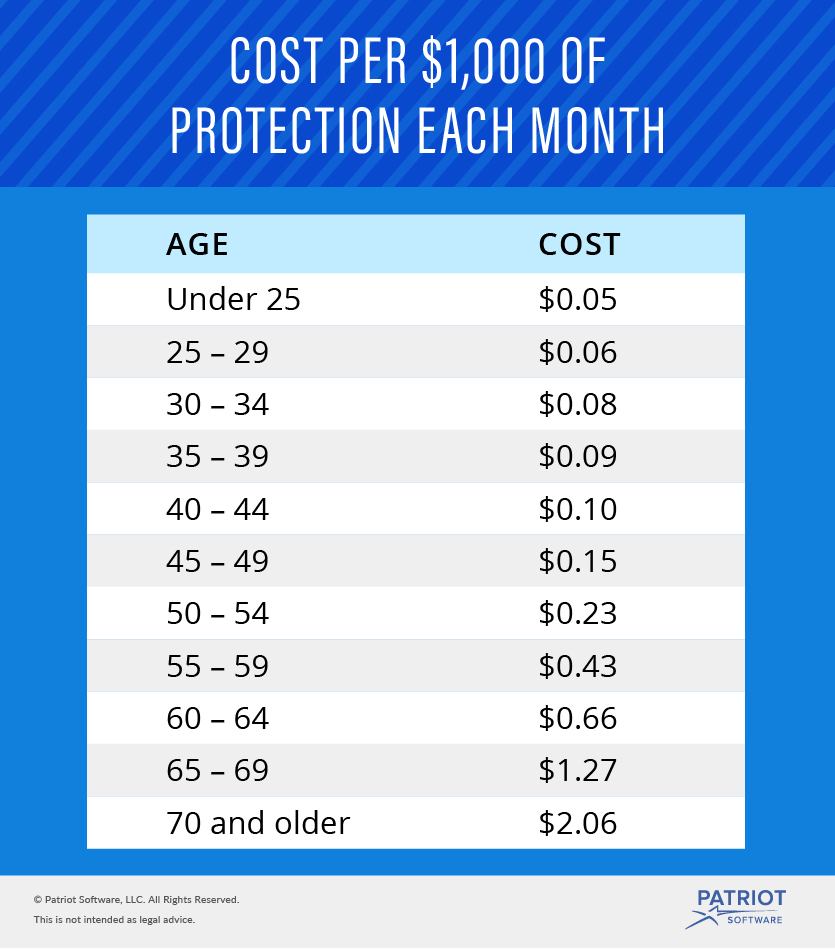

Our Short-Term Disability STD plans pay benefits when sickness or injury prevents you from working full time. Tasks to-dos to be accomplished within a short time frame not more than a year. Coverage under a Short-Term plan is limited to either three-month coverage or up to one year.

The short-term goals are short for a purpose. 3 hours to 4 hours. We offer STD programs tailored to meet the needs and cost.

Enjoy the freedom to live fearless. 6-1-70 of the Blue River Municipal Code. Short-Term health insurance plans from Blue Cross and Blue Shield of Texas deliver outstanding coverage and service.

Blue Term SM short term health plans. Blue Term SM short-term health insurance plans can help fill gaps in your coverage during times of transition. BCBSTX is the leader in Short-Term health insurance plans in.

Theyve started a new job and are waiting for benefits to start. Short Term Blue 364 Days of Coverage for Individuals and Families. 5 hours to 6 hours.

Coverage under a Short-Term plan is limited to either three-month coverage or up to one year. They bridge the gap between where you are right now and where you want to be. 7 hours to 8 hours.

Short Term Blue Plus 36 Months of Coverage for Individuals and Families. Short-Term plans provide a limited coverage option. 8 hours to 9 hours.

If youre looking for a traditional health plan go here to learn more about our. 12 hour to 1 hour. An accident or illness can endanger an individuals most important asset.

Short-Term Coverage - Blue Cross Blue Shield Global Traveler Group travel medical plan. These short-term actions will help you to achieve your long-term bigger goal. Trusted for over 80 years.

They offer temporary health insurance to help pay unexpected health care costs while youre not covered by a traditional health plan. Coverage under a Short-Term plan is limited to either three-month coverage periods or up to one year. Bills and everyday needs dont stop because someone cant work.

In addition to our standard Short-Term plans. Have limited coverage with our Preferred-Care Blue Short-Term PPO plans. Protect yourself and your family with the compassion of the cross and the security of the shield.

Coverage for Individuals and Families. This plan provides group travel medical benefits and services for business. Short Term Blue 364 Days of Coverage for Individuals and Families.

4 hours to 5 hours. Coverage for Individuals and Families. Common Plan Benefits - Plan Year Deductible.

Big Blue Deck Short-Term Parking. Short-Term plans provide you with a package of healthcare benefits to cover hospital physician and emergency services as well as many specialized services. 3000 per Individual - Convenient Phone Video Consultations through Teladoc.

1 12 hours to 2 hours. Short-Term plans provide temporary coverage with limited benefits to cover hospital physician and emergency services as well as many specialized services. Healthcare coverage is one of the most important decisions you make.

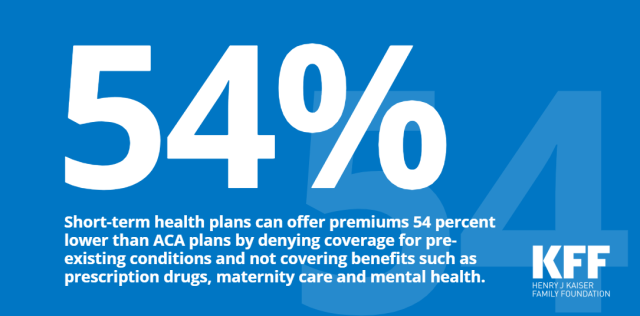

It will help you to set your focus and see where. Short Term Individual Family Plans Blue Cross of Idahos Short Term PPOsmoffers a limited benefit program for temporary coverage. - No Coverage for Pre-Existing Conditions.

1500 Individual 3000 Family - Prescription Drug Contract Maximum. The Short-Term Rental Application is required by Sec. An accident or illness can endanger an individuals most important asset.

1 hour to 1 12 hours. Our Short-Term Disability STD plans pay benefits when sickness or injury prevents you from working full time. Theres nothing in the world like Miamiand theres absolutely nothing in Miami like Blues Travel Rentals LISTINGS One Bedroom Apartment with Ocean Pool View.

Bills and everyday needs dont stop because someone cant work. One-day gap in coverage required before re-enrolling in this plan. 6 hours to 7 hours.

Policies are medically underwritten and. There may be times when your clients need a health plan to fill in a gap between traditional insurance coverage such as if. 9 hours to 24 hours.

They missed open enrollment and dont qualify for a special enrollment period. Choose the card that opens doors in all 50 states. The ability to earn a living.

In addition to our standard Short-Term plans.