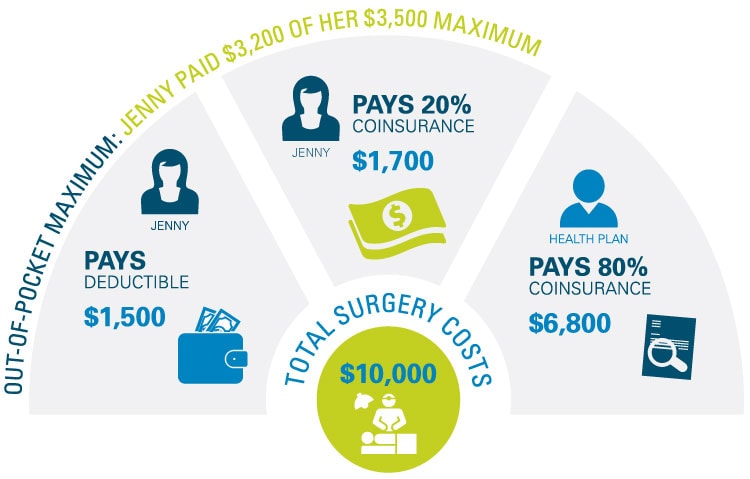

If there are other out-of-pocket expenses. In many plans there is no copayment for covered medical services once you have met yours out of pocket maximum.

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

Once a person meets their maximum your Medicare Advantage provider is responsible for paying 100 percent of the total medical expenses.

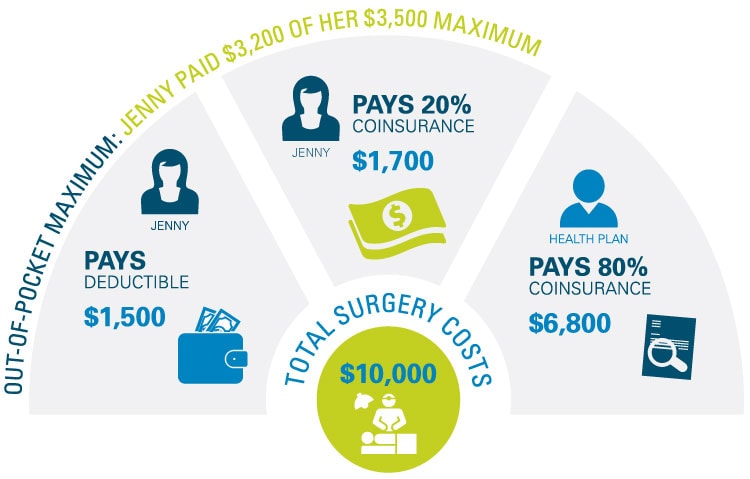

Out of pocket maximum meaning. Its the most youll have to pay during a policy period usually a year for health care services. All plans are different though so make sure to pay attention to plan details when buying a plan. An out-of-pocket maximum is a cap or limit on the amount of money you have to pay for covered health care services in a plan year.

Some health insurance plans call this an out-of-pocket limit. All plans are different though so be sure to pay attention to plan details when purchasing a plan. This brings you to a total of 8000.

It could be talking back not making enough dough money scheming behind her pimps back. An out of pocket maximum is the set amount of money you will have to pay in a year on covered medical expenses. Its called an out-of-pocket max or maximum.

7150 You pay the first 5000 of covered medical expenses towards your deductible. Once your out-of-pocket limit is met your health insurance plan will cover 100 of all your eligible medical expenses. The out-of-pocket limit doesnt include.

For prescription drugs deductible of 5 per prescription to a maximum out-of-pocket expense of 150 per person in any one calendar year cmgca du gouvernement et de lemployeur sur la santé et la sécurité des employés ou aux parties de ces documents concernant la santé et la sécurité des employés laccès aux dossiers médicaux étant toutefois subordonné. Out-of-pocket is a pimp term. This can be very frustrating for employees however if they are constantly short on cash that they need to be repaid.

If the ho whore is out of pocket that means she is out of line. Your out-of-pocket maximum is the absolute most you will have to pay towards your medical costs for the duration of your health insurance policy. When you reach it your insurer will pay for all covered services.

After you spend this amount on deductibles copayments and coinsurance for in-network care and services your health plan pays 100 of the costs of covered benefits. An out-of-pocket maximum is a predetermined limited amount of money that an individual must pay before an insurance company or self-insured employer will pay 100 of an individuals covered health care expenses for the remainder of the year. Out-of-Pocket Maximum OOPM Out-Of-Pocket Maximum or Out-of-Pocket Limit is the most you will have to pay for covered medical services in your plan year.

This is the maximum amount that the policy holder will be expected to pay out-of-pocket each year. Many times insurance companies will have out of pocket maximums or deductibles that mean an employee only ever has to pay so much of their own money in a year before being reimbursed. The out-of-pocket maximum is also known as the out-of-pocket limit.

OOPM includes copayments deductible coinsurance paid for covered services. When the Maximum Out- of-Pocket is reached the Plan will pay 100 of eligible covered expenses for the remainder of the Plan Year. Now you owe your coinsurance amount on the rest of the medical costs of 15000 for a total of 3000.

An out of pocket maximum is the set amount of money you will have to pay in a year on covered medical costs. In most plans there is no copayment for covered medical services after you have met your out of pocket maximum. If you meet that limit your health plan will pay 100 of all covered health care costs for the rest of the plan year.

Maximum Out-of-Pocket means the maximum amount of coinsurance each Participant or family is responsible for paying during a Plan Year before the coinsurance required by the Plan ceases to apply. The most you have to pay for covered services in a plan year.