2021 Manufacturer printable Gilotrif coupon is not available at present but you can still get savings with this Gilotrif discount card. Which coverage stage are you in.

Starting Your Patients Co Pay Assistance Gilotrif Afatinib

Starting Your Patients Co Pay Assistance Gilotrif Afatinib

BI Cares Patient Assistance Program includes a number of medicines 1-800-556-8317.

Gilotrif copay card. You are a United States Resident. Click on a tab below Deductible. With this Gilotrif Rebate Card Price for 30 tablets of Gilotrif 40mg brand is from 601907722288.

When youre ready to use this coupon simply present the coupon to your pharmacist with a valid prescription for your medication. Gilotrif offers may be in the form of a printable coupon rebate savings card trial offer or free samples. Yes No This field is required.

Request or activate your NovoLog Savings Card. Please make a selection. Save between 10-75 on Gilotrif prescription.

Gilotrif Co-pay Assistance Program. Patient Access Network Foundation. This offer is only available to.

BI Cares Patient Assistance Program - Ofev. Eligible participants in the Copay Card Program Program may receive annual savings up to 3000 for PROGRAF tacrolimus capsules or ASTAGRAF XL tacrolimus extended-release capsules. Prescription Hope is not a Gilotrif coupon card or insurance policy.

If you have insurance and are looking for patient assistance or copay assistance for Afatinib Gilotrif we have provided links that may help. BI Cares Patient Assistance Program Gilotrif Monday Friday PO. Coupon Value and Save.

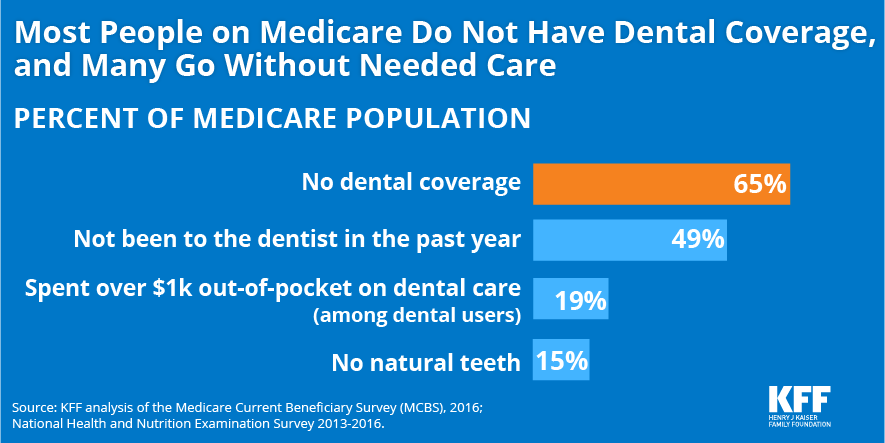

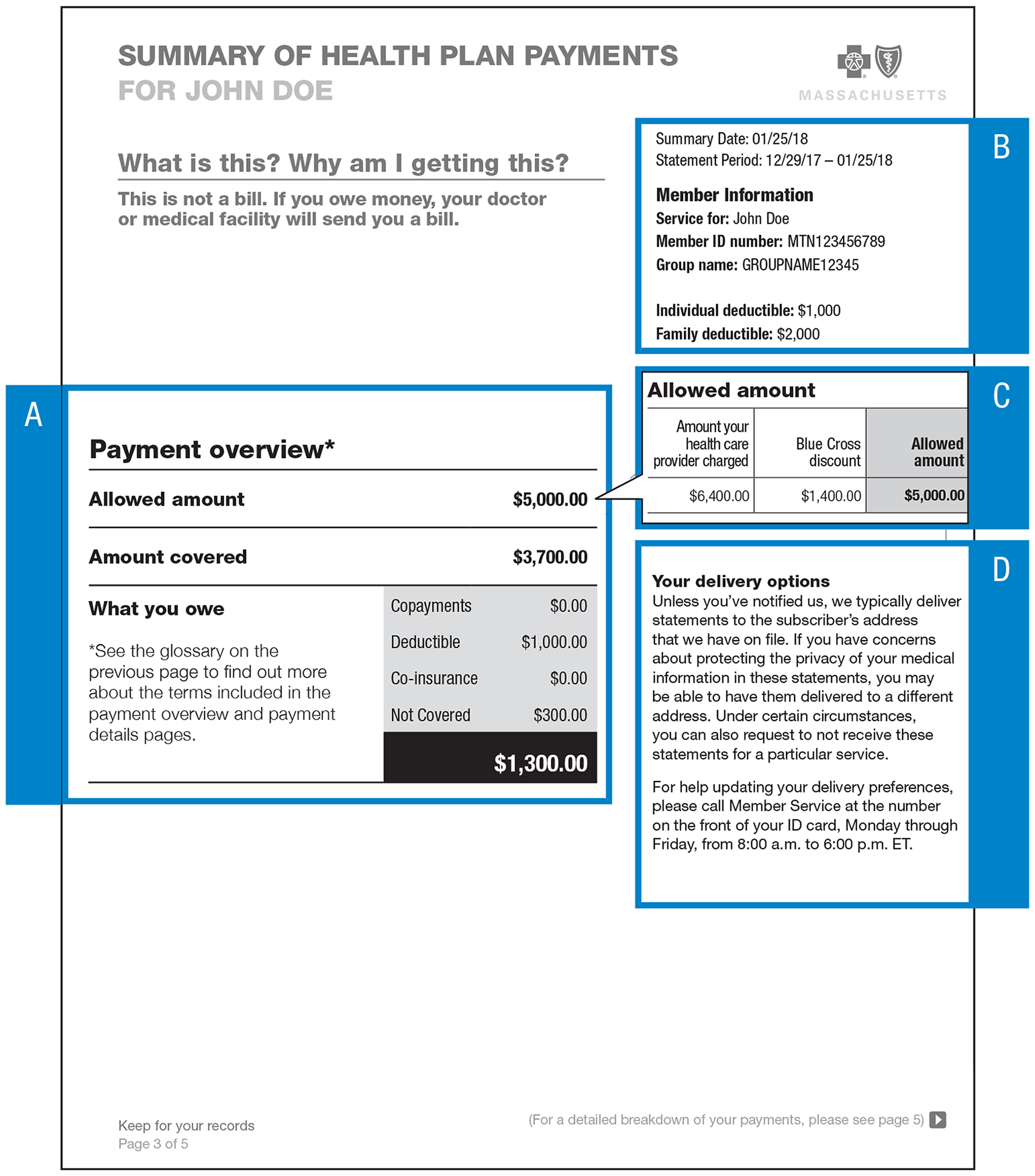

How much is my Gilotrif co-pay with Medicare. Depending upon your income they may be able to help cover the cost of. Co-Pay Range 294 349.

Program Applications and Forms. Some offers may be printed right from a website others require registration completing a questionnaire or obtaining a sample from the doctors office. PROGRAF Granules Children with trouble swallowing capsules can take PROGRAF as an oral suspension.

Your VIVITROL Co-pay Savings Program card The VIVITROL naltrexone for extended-release injectable suspension Co-pay Savings Program provides up to 500month of co-pay or deductible expenses related to VIVITROL therapy for you with no duration limits. For assistance with our program please call our toll-free number Monday Friday from 830 am. Help eligible patients reduce their copay Learn.

Want to register via text and save your Novo Nordisk Savings Card to your phone. Please answer the following eligibility questions before proceeding to enroll in or activate the Bayer Savings Card. Encourage your patients to make the most of their treatment by taking advantage of one or more of the following programs.

In the Deductible co-pay stage you are responsible for the full cost of your prescriptions. If you have Medicare and are enrolled in a Medicare Part D plan use this discount to save on any prescriptions that are excluded from coverage. Visit our Patient Assistance page and click the links to various patient assistance programs for help paying for Afatinib Gilotrif.

Patients must have prescription drug coverage for PROGRAF or ASTAGRAF XL. Copay Card The PROGRAF Copay Card Program is intended to help eligible patients with commercial insurance offset the cost of their prescription copay. The Co-pay Assistance Program ensures eligible patients pay no more than 0 per month for GILOTRIF conditions apply.

1-855-297-5905 BI Cares Patient Assistance Program Gilotrif The Boehringer Ingelheim Cares Foundation BI Cares Patient Assistance Program is free of charge to. Program is subject to eligibility requirements and Program terms and conditions. Terms and Conditions Eligibility for Alkermes-Sponsored Co-pay Savings.

Our program is also not a Gilotrif Generic. However sometimes the discounted price is less than your co-pay in which case you may choose to use the discount instead of your insurance. BI Cares Patient Assistance Program - Gilotrif.

What if the pharmacy wont accept the discount card. Learn more by calling 1-877-546-5349. Your Medicare deductible cannot exceed 360 in 2016.

Co-Pay Range 74 344. If you have commercial insurance such as insurance you receive through an employer you may be eligible to pay as little as 25 per 30-day supply of NovoLog for up to 24 months with a maximum savings of 100 per 30-day supply. Please make a selection.

Yes No This field is required. Start a PA. Prescription Hope is a national advocacy program that works with any coverage you may already have.

English Spanish Others By Translation Service. You are the policy holder of your health insurance is over 18 years of age. Patient Access Network Foundation PAN This is a copay assistance program.

Box 5697 Louisville KY 40255 830 AM 600 PM ET Phone.