Click the green Start a new application or update an existing one button. Log in to Marketplace account Select your this year application be sure youre not choosing last years coverage application Select Tax forms from the menu on the left View or download each Form 1095-A All 1095-As are also available with your Marketplace messages.

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

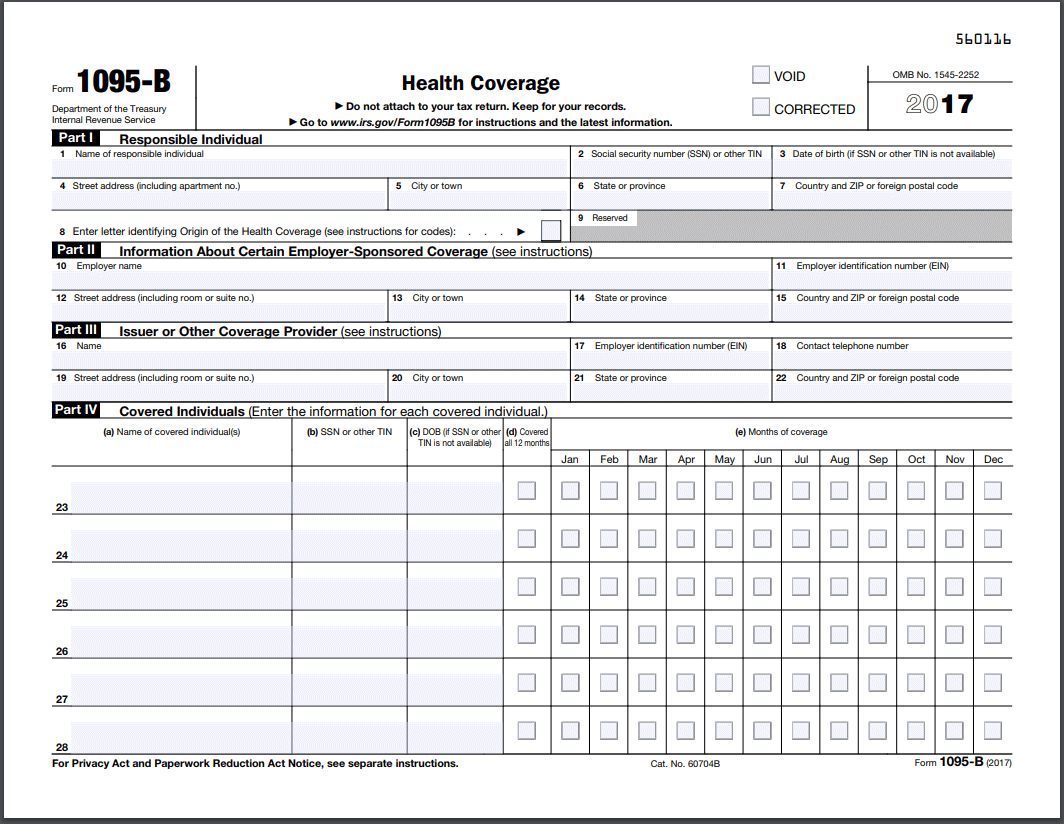

If you are in need of a 1095-B form contact your Service Pay Centers as described on the TRICARE ACA page referenced above.

:max_bytes(150000):strip_icc()/1095b-741f9631132347ab8f1d83647278c783.jpg)

Where do i get my 1095 form. Pay Centers must provide your 1095-B form within 30 days of your request. Theres only one place where you can get a copy of your 1095 tax form. Use the table below to identify where to find it and when you are likely to get it.

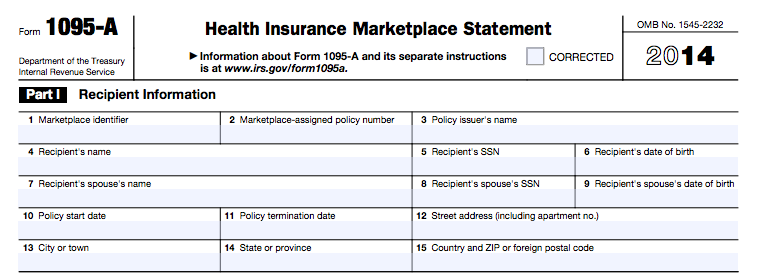

Use the California Franchise Tax Board forms finder to view this form. Download all 1095-As shown on the screen. The form 1095-A is used to report health insurance purchased through Healthcargov or your states Health Insurance agency The form 1095-A is mailed to taxpayers on January 31 of the year.

Form 1095-C is filed and furnished to any employee of an Applicable Large Employers ALE member who is a full-time employee for one or more months of the calendar. Contact them directly ONLY your insurer will have access to it and can provide you with a copy. Download your tax form from Kaiser Permanente.

Log in to your HealthCaregov account. How to find Form 1095-A online. Provide this information to the IRS and to the recipient of the statement as soon as possible after discovering that the statement was sent in error.

How to find your 1095-A online Log in to your HealthCaregov account. If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A If your form is accurate youll use it to reconcile your premium tax credit. All 1095 forms are sent by the insurance carrier that you had for the year in question.

During tax season Covered California sends two forms to members. If you are trying to access ESS while on a mobile device or from a personal computer please use these. I did not get an Affordable Care Act 1095-B or 1095-C form even though I had minimum essential coverage.

When the pop-up appears select Open With and then OK. The downloaded PDF will appear at the bottom of the screen. If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement.

If a Form 1095-A was sent for a policy that shouldnt be reported on a Form 1095-A such as a stand-alone dental plan or a catastrophic health plan send a duplicate of that Form 1095-A and check the void box at the top of the form. Internet Explorer users. Log into Employee Self Service ESS.

The federal IRS Form 1095-A Health Insurance Marketplace Statement. What do I do. Form 1095-B is used by providers of minimum essential health coverage to file returns reporting information for each individual for whom they provide coverage.

有關 Form 1095-A最低基本保險 Minimum Essential CoveragePTC 或 SLCSP 表的疑問請致電社區健康宣導者熱線Community Health Advocates Helpline1-888-614-5400 如果您認為您的 Form 1095-A 填寫有誤請致電 NY State of Health1-855-766-7860. Click here if you purchased your plan via healthcaregov. Information about Form 1095-B Health Coverage including recent updates related forms and instructions on how to file.

Sign on to consent to receive the form s electronically then download copies of your form. Under Your Forms 1095-A for Tax Filing click Down-load PDF and follow these steps based on your browser. There are several different 1095s.

The California Form FTB 3895 California Health Insurance Marketplace Statement. Click Save at the bottom and then Open. Under Your Existing Applications select your 2020 application not your 2021 application.

Select Tax Forms from the menu on the left. If you did elect for electronic delivery or would like an electronic copy of the form for tax purposes please use the following steps to retrieve your 1095-C. Get screen-by-screen directions with pictures PDF or follow the steps below.

This form may also be available online in your HealthCaregov account. You may call your Health Insurance Marketplace to avail a copy or visit the website. ALE members must report that information for all twelve months of the calendar year for each employee.

If you get healthcare from your employer contact your companys benefits department.

/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)