Some families get a thousand dollars a month in savings even those making up to 154500 a year. This means that you received 250.

Covered California Health Insurance Income Guidelines

Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients.

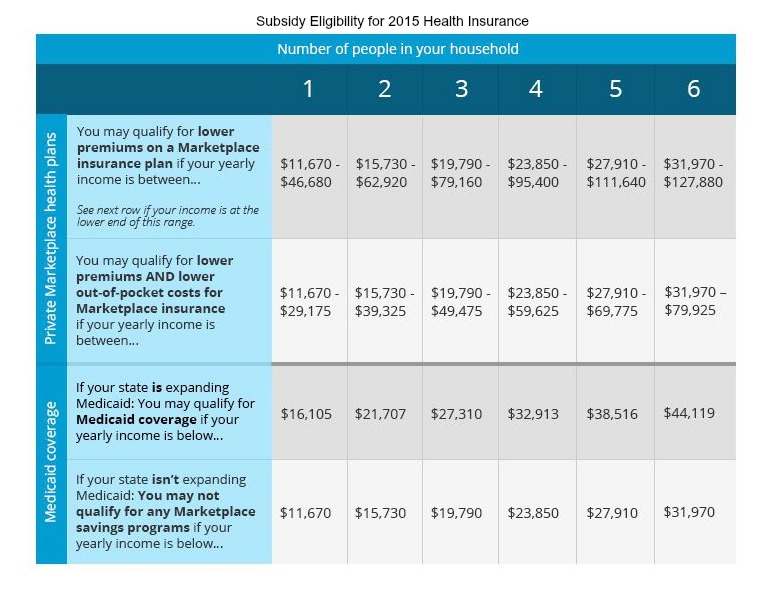

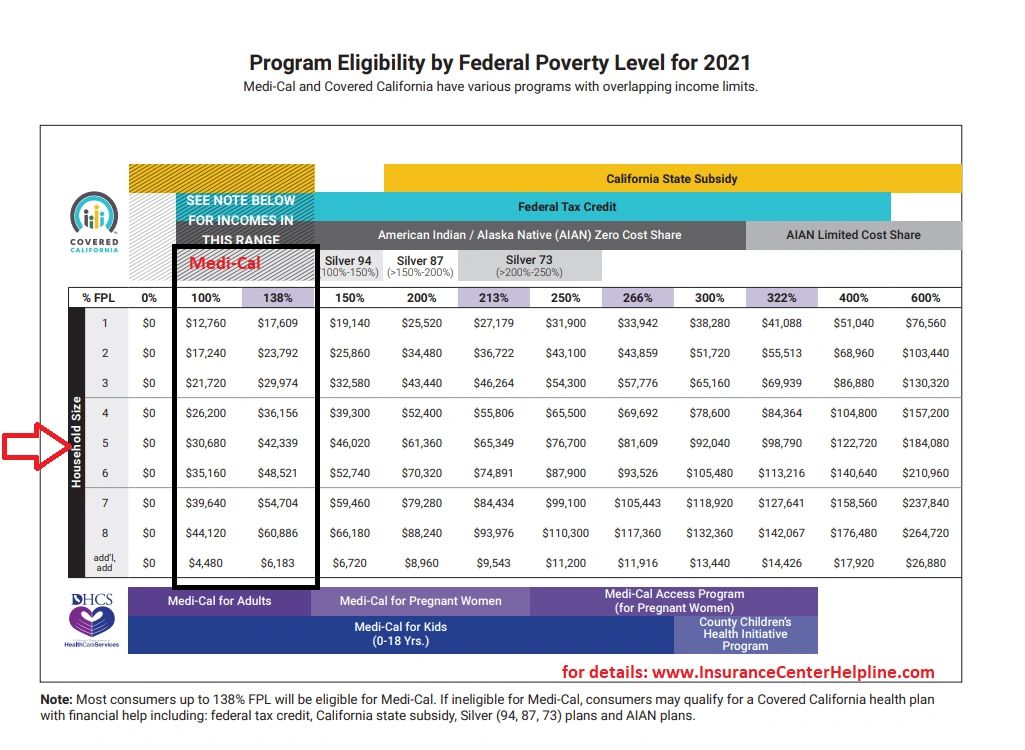

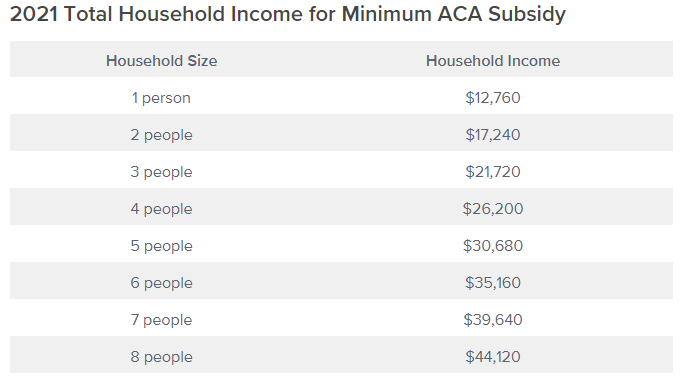

Covered california eligibility income. MAGI MC is for the Medi-Cal rules and APTCCSR is for Covered California subsidies. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. If it says that your income type is not counted you dont need to put it on yourapplication.

Dates covered and the net income from profitloss. Unless you qualify to be exempted you could pay tax penalties if you go for more than two months without any coverage. Any financial help you get is based on what you expect your household income will be for the coverage year not last years income.

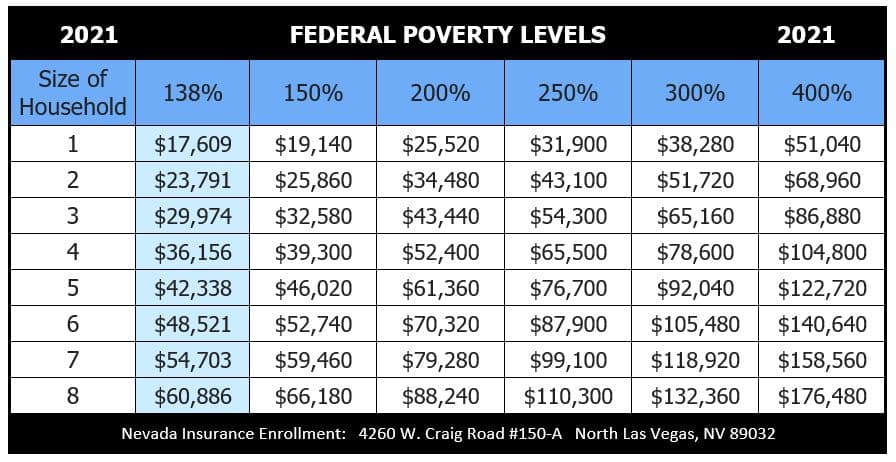

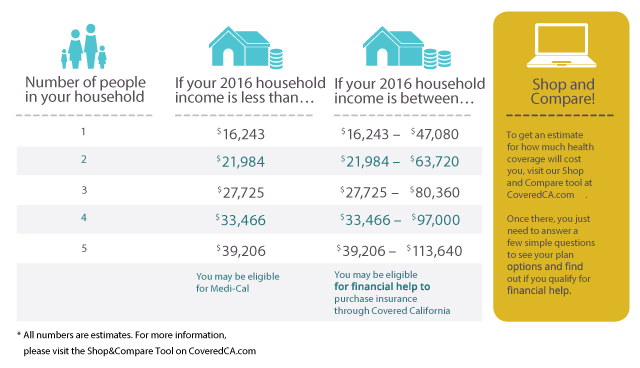

136B-1 household income for Covered California eligibility determinations includes. Add 100 S15930 S20090 S24250 S32570 96730 S4160 MAGI Medi- Cal 13800 S16394 S22107 S27820 93534 99247 S56428 Program Eligibility by Federal Poverty Level FPL for 2016 Coverage Year Eligible for Premium Tax Credit PTC 2100 to. When you applied for Covered California healthcare you estimated that your family income would be 25000 a year.

Can I get health insurance through Covered California. If it says counted in either one of the columns you should put it on your application. 70000 Annual Income x 966 _____ 6762 This is the premium threshold that Covered California considers as affordable for Susans family.

Everyone in CC wAPTC After MediCal income thresholds are updated. The unshaded columns are associated with Covered California eligibility ranges. Even an individual earning close to 75000 may qualify for financial help.

If you make 601 of the FPL you will be ineligible for any subsidies. Can anyone get Covered California. On January 1 2014 California expanded Medi-Cal eligibility to include low-income adults.

Income as Percent of Federal Poverty Level FPL Income for Single Person Household. Medi-Cal has always covered low-income children pregnant women and families. You can start by using your adjusted gross income AGI from your most.

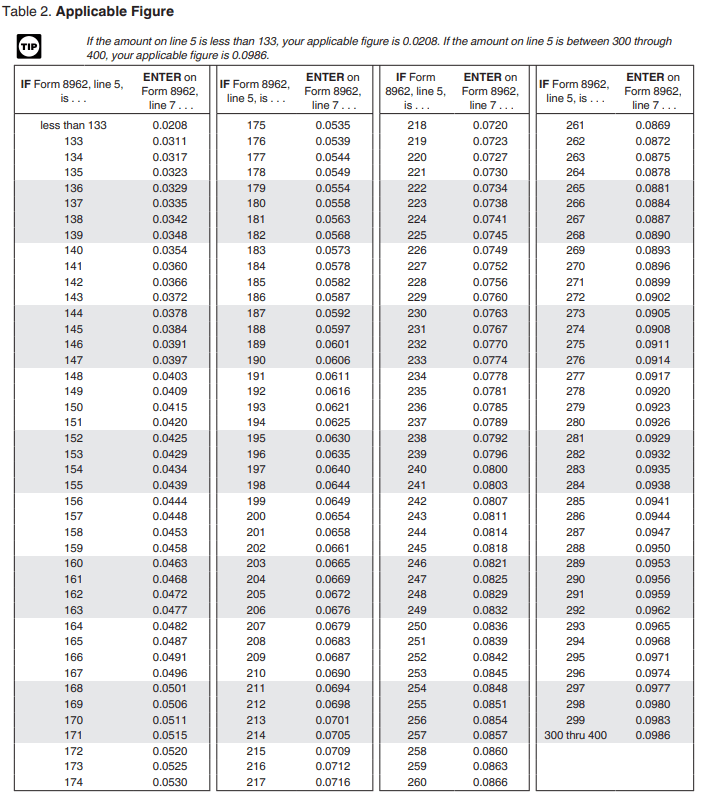

In order to be eligible for assistance through Covered California you must meet an income requirement. The tax household s income based on their reported modified adjusted gross income and family size. Income Range Required Contribution as Share of Income.

Child goes to MediCalif application is updated and family size and income aka FPL stay the same. ACA California requires US citizens US nationals and permanent residents to have health coverage that meets the minimum requirements. Federal Tax Credit 100600 FPL Silver 94 100150 FPL Silver 87 over 150200 FPL Silver 73 over 200250 FPL AIAN Zero Cost Share 100300 FPL AIAN Limited Cost Share all income levels.

When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. You will see that for almost all income types the answer is the same in both columns. If you do not find an answer to your question please contact your local county office from our County Listings page or email us at.

Eligibility for Covered California programs is determined. Both Covered California and Medi-Cal have plans from well-known companies. Eligibility for its programs as required by regulation.

Medi-Cal has free or low-cost coverage if you qualify. Covered California will accept a clear legible copy from the allowable document proof list from the following categories which you can click on for more details. 2 parents 1 child55000.

Heres how Covered California will determine if they qualify for a subsidized Covered California plan. Applicants may qualify for a free or low-cost health plan or for financial help that can lower the cost of premiums and co-pays. Back to Medi-Cal Eligibility.

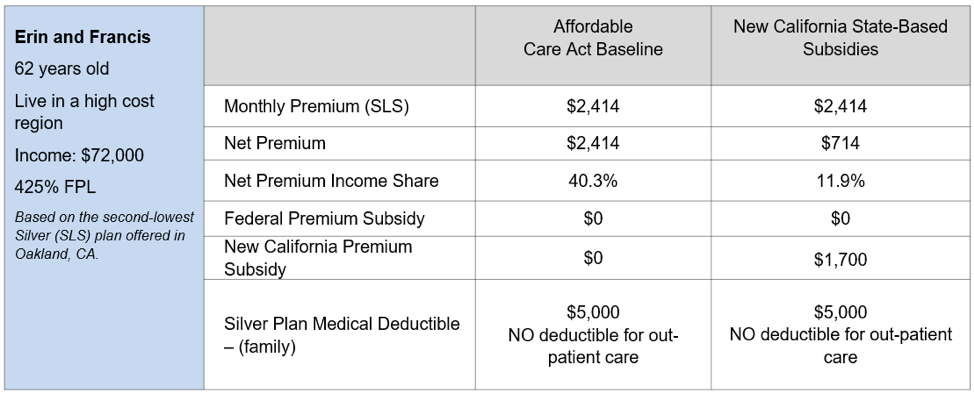

California State Subsidy Program. Keep in mind that Tax deductions can. COVERED Household Size For each additional person.

However when you do your taxes in April you discover your household income was actually 35000 year. How do I know if I qualify. Proof of Income Proof of Citizenship or Lawful Presence Proof of California Residency and Proof of Minimum Essential Coverage.

150 Susans share of the work premium for herself only x 12 Twelve months in a year _____. All plans cover treatment and vaccines for COVID-19. You can apply for Medi-Cal benefits regardless of your sex race religion color.

Its the only place to get financial help to pay for your health insurance. As defined in 26 CFR. Whose Income Counts for Covered California.

The persons first and last name and company name. The amount of financial help is based. Medi-Cal Eligibility and Covered California - Frequently Asked Questions.

Self-Employment includes farm income Self-employment Profit and Loss Statement or Ledger documentation the most recent quarterly or year-to-date profit and loss statement or a self-employment ledger. 2021 Coverage Year Percent of Household Income Paid for Covered California Benchmark Silver Premium. Covered California will let you know which categories they need documentation.

Any Californian can get health insurance through Covered California if he or she is a state resident and cannot get affordable health insurance through a job. When you complete a Covered California application your eligibility for Medi-Cal will automatically be determined. For more information about the new state subsidies please review the design documents which have more details about the program.