A supplement plan with drug coverage you have from before 2006 might not meet current health care standards. Medicare Part A Prescription Requirements Part A covers your inpatient hospital stays.

What Is Medicare Advantage Physicians Medical Group Of San Jose

What Is Medicare Advantage Physicians Medical Group Of San Jose

Medicare Prescription Drug Plans Medicare Prescription Drug Plans provide drug coverage with a monthly premium.

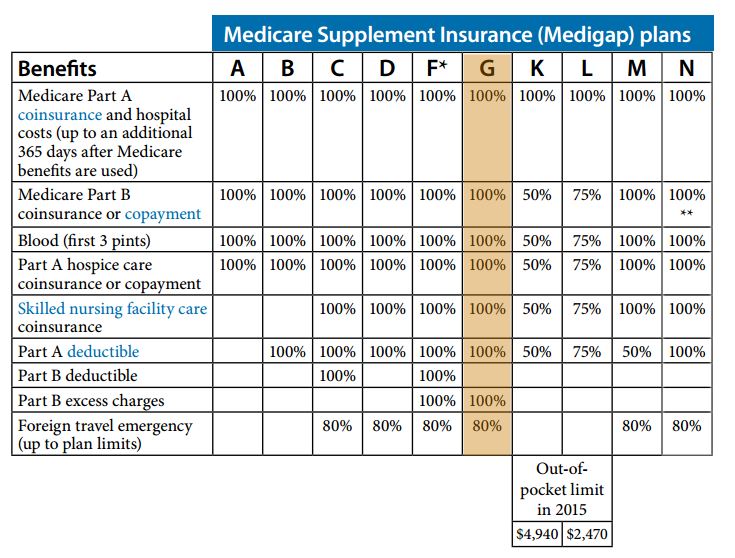

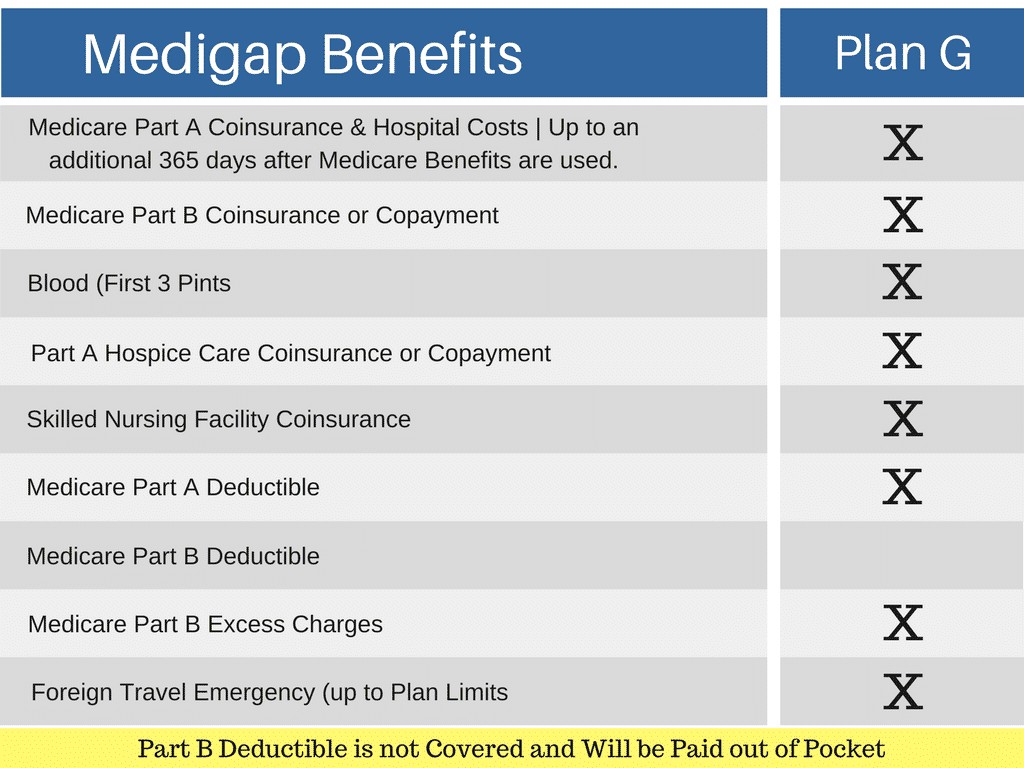

Does medigap cover prescriptions. While Medicare Supplement Insurance Medigap plans do not provide prescription drug coverage you may be able to get prescription drug coverage through a Medicare Part D prescription drug plan. All plans sold after that year dont cover prescription drugs. A B C D F G K L M and N do not cover prescription drugs.

Before January 1 2006 prescription drugs were covered in three plan packages plans H I and J. They generally do not cover long-term care vision or dental care hearing aids eyeglasses or private-duty nursing. Does Medigap Plan G Cover Prescriptions.

During an inpatient stay Medicare Part A will generally cover any medications that are given to you as part of your overall treatment in the hospital. Medigap also does not cover vision care eyeglasses hearing aids or dental care unless such treatment or equipment is needed as the result of an injury. Read on to learn more about Medigap Plan A including what it does and doesnt cover and how it may help you save on out-of-pocket expenses.

You have to be enrolled in either Part A or Part B before you can enroll in a Medicare Prescription Drug Plan In case you have Prescription Drug Coverage through a. Medigap plans can help cover the costs that Original Medicare does not including coinsurance copayments deductibles and medical care outside of the United States. The premiums for Medigap policies that never included prescription drug coverage could increase more slowly than a.

In 2021 the annual deductible to pay for Medigap Plan J is 2370. If your plan covers prescription drugs it also has a separate prescription drug deductible of 250 to cover each year. You can enroll in a separate Part D plan like a Prescription Blue SM PDP.

In addition Medigap plans do not cover prescription drugs. Through the use of prescription medications patients may avoid more serious or invasive treatments. Medigap plans purchased after that date do not cover any prescription drugs.

If you enroll in a Medicare prescription drug plan byMay 15 2006 you can switch from the Medigap policy that you have now to a Medigap policy that doesnt include prescription drug coverage. Medicare Supplement insurance plans sold today usually dont cover prescription drugs and you cant use them with Medicare Advantage plans. If your Medigap policy covers prescription drugs youll need to tell your Medigap insurance company if you join a Medicare Prescription Drug Plan.

You can read more about how supplement and Medigap plans work in our help section. Modern Medigap plans do not include prescription drug benefits. At one time some Medicare supplement plans included prescription drug coverage.

However your Medigap Plan will cover drugs while an inpatient in a hospital under Part A. The Medigap insurance company will remove the prescription drug coverage from your Medigap policy and adjust your premium. A Medicare supplement plan might be a good choice for you if you already have prescription coverage through an employer or military benefits.

All lettered Medigap Plans. Prior to January 1 2006 some Medigap plans included prescription drug coverage. In addition these plans do not cover prescription drugs see Part D below.

So for example anesthesia medication administered during a surgery will be paid for by Part A. Medicare Supplement Medigap insurance plans also offered by private companies can work alongside Original Medicare to cover out-of-pocket costs such as copayments coinsurance and deductibles. Prescription medications can improve quality of life treat illness and disease assist in rehabilitation and prevent the onset of certain medical conditions.

Medigap plans do not cover maintenance medications aka drugs that treat chronic health conditions. Medigap plans work in conjunction with your Medicare Parts A and B coverage to pay for additional expenses that dont fall under Medicares purview. If Medicare Part A or Part B covers a medicine you need a Medicare Supplement Medigap plan can help pay for your medicine by covering some of your out-of-pocket Medicare costs like deductibles copays coinsurance and more.

That ended in 2006. You can have a Part D plan and a Medigap plan at the same time. Medigap policies do not cover everything.