New employers in California pay 34 of the first 7000 in wages per employee for Unemployment Insurance UI tax and 01 also of the first 7000 in wages for Employment Training Tax ETT. Heres a breakdown of who pays which tax and what the rates are.

California Tax Changes Single Screen

Des lois constructives en matière de licenciement sappliquent.

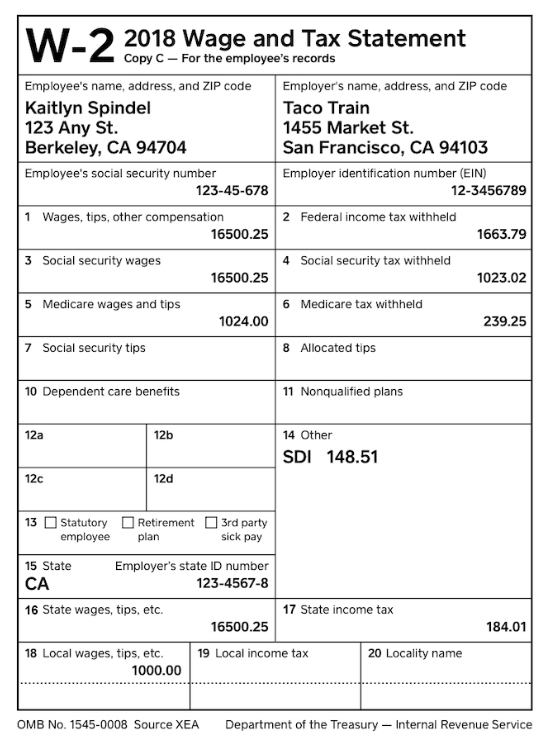

Employer taxes california. Unemployment Insurance Tax is paid by the employer. Combined the FICA tax rate is 153 of the employees wages. What are Californias payroll taxes and who pays them.

The program consists of Unemployment Insurance and Employment Training Tax which are employer contributions and Disability Insurance and Personal Income Tax which are withheld from employees wages. Le California Employment Development Department de la Californie envoie un avis de contribution - le formulaire DE 2088 - aux employeurs chaque mois de. Replaces all other types of withholding.

Withhold 145 of each employees taxable wages up until they have reached total earnings of 200000 for the year. En Californie les employeurs qui obligent leurs employés à démissionner en les discriminant injustement peuvent se rendre coupables dune violation des lois de lÉtat interdisant les licenciements constructifs. California Personal Income Tax PIT Withholding California PIT withholding is based on the amount of wages paid the number of withholding allowances claimed by the employee and the payroll period.

You as the employer will also need to match this tax. If you are an employer in California you may be confused about how much in taxes should be withheld from an employees paycheck. La Californie exige le paiement dune taxe de séjour transitoire dans de telles circonstances.

Some taxes are deducted from the employees paycheck and some are paid by you the employer based on the employees wages. Unemployment Insurance UI is paid by employers. Provides an overview of California Payroll Taxes.

As an employer you will need to match this tax one-for-one. Your payer must take 7 from your California income. Nine states dont collect individual income tax at all although there may be alternate taxes your employees will need to account for.

Medicare is a federal system of health insurance for people over 65 and younger people with disabilities. This tax is calculated as a certain percentage of the first 7000. UI provides temporary payments to individuals who are unemployed.

Does not apply to California real estate withholding. Employment Training Tax ETT is paid by employers. Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that varies by income level reaching rates as high as 133 in California.

Only the employee is responsible for paying the Additional Medicare Tax. Les exceptions au Règlement 1603 concernent les produits de cuisson chauds et les boissons telles. The main taxes employers have to pay in California.

However for earnings above 200000 employees need to pay whats called an Additional Medicare Tax of 09 along with the 145. Please refer to page 13 for additional information on PIT withholding or refer to the PIT withholding schedules available on page 17. Le California Board of Equalization BOE est lorgane directeur chargé de faire appliquer et de gérer les taxes de vente sur les aliments.

Le règlement 1603 du BOE stipule quen général la taxe sapplique à la vente de repas au restaurant ou de produits alimentaires préparés à chaud. En 2003 la bande dAgua Caliente des Indiens Cahuilla a compris que même leur statut de souveraineté ne pouvait empêcher la perception de la taxe doccupation transitoire de la Californie. Social Security is a federal insurance program that provides benefits to retired employees and the.

An employer usually becomes subject to payroll taxes after they have paid more than 100 to one or more employees in a calendar quarter. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. Décharge constructive et droit du travail en Californie.

Identifiez le taux de taxe IDS correct pour lannée en cours. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Employment Training Tax is the way that California funds a program thats designed to grow the California labor.

Payroll taxes are calculated as a percentage of an employees income. Although there are books and other resources available on the topic all of the information can seem like a maze if you have. Bien que lemployeur ne soit pas légalement obligé de payer la taxe SDI la réglementation autorise un employeur californien à payer la taxe SDI au nom dun employé.

Cannot be reduced or waived. La section 7280 du code des impôts et des impôts de la Californie autorise les.