If you have Medicare coverage youre not eligible to use the Marketplace to buy a health or dental plan. In this case affordable insurance means at least 60 percent of covered benefits or the premiums would cost you no more than 95 percent of your annual household income after tax credits are applied.

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

The subsidy goes to your health insurance company so your monthly insurance bill is lower.

Do i qualify for subsidy for health care. Premiums will drop on average about 50 per person per month or 85 per policy per month. 20 rows Marketplace savings are based on your expected household income for the year you. In Florida as in other states if you qualify the government will help you pay a part of the cost for your health plan through the Marketplace.

They expect earned income over 12400. The main factor is your income. Learn more about who to include in your household.

Must live in the United States. The majority of the states have expanded. The amount of assistance you get is.

Your employer doesnt offer affordable health insurance to you. In order to be eligible for healthcare subsidies under the Affordable Care Act you must earn no more than 400 of the Federal Poverty Limit FPL by household size. Citizen or national or be lawfully present.

Learn about eligible immigration statuses. ACA-specific MAGI is used to determine eligibility for premium subsidies the subsidy is actually a tax credit thats available upfront or on your tax return and cost-sharing reductions when people shop for coverage in their states health insurance exchange. A single person earning about 51520 or a family of four with a household income of 10600 which is four times the federal poverty level will.

If you already enrolled in an ACA plan and got a subsidy you can change your plan and get the added savings. These lower costs are handled with a tax credit or subsidy. You must include the income of any dependent required to file a federal income tax return for the year you want coverage.

Those who qualify for government subsidies in the form of premium tax credits or extra savings typically have a household income between 100 and. You qualify for subsidies if pay more than 85 of your household income toward health insurance. To be eligible to enroll in health coverage through the Marketplace you.

Subsidies are financial assistance from the Federal government to help you pay for health coverage or care. Must be a US. On the lower end subsidies are available in most states if your income is at least 139 of the poverty level with Medicaid available below that.

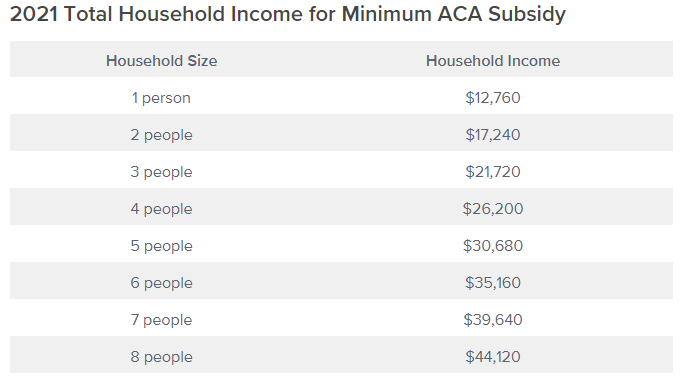

Its also used to determine eligibility for CHIP and Medicaid. Thats about 47000 for an individual and 97000 for a family of four. Prior to 2021 the rule was that households earning between 100 and 400 of the federal poverty level could qualify for the premium tax credit health insurance subsidy the lower threshold is 139 of the poverty level if youre in a state that has expanded Medicaid as Medicaid coverage is available below that level.

In all states your household income must be between 100 and 400 FPL to qualify for a premium tax credit that can lower your insurance costs. To qualify for a subsidy your household income must be between 100 and 400 of the FPL. You may qualify for a subsidy if all of the following are true.

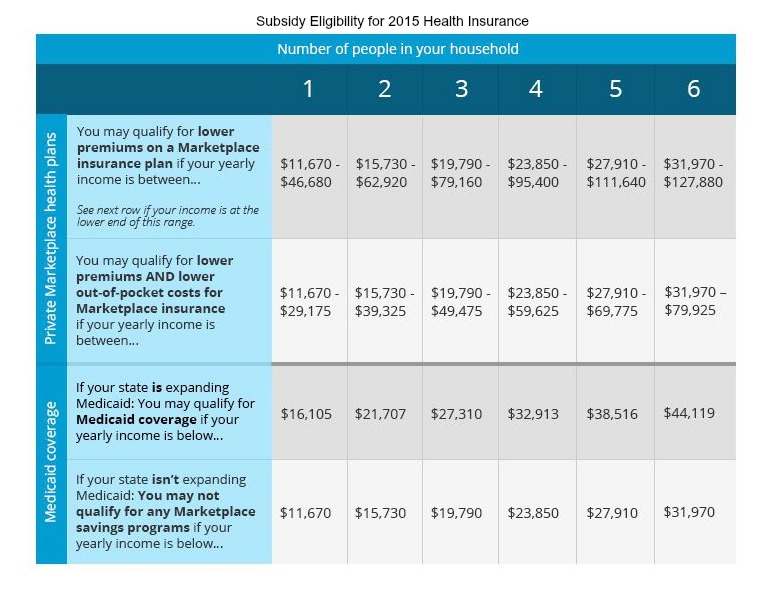

In states that have expanded Medicaid coverage your household income must be below 138 of the federal poverty level FPL to qualify. If you meet these criteria youll be eligible for a subsidy on a sliding scale based on your income. This tool provides a quick view of income levels that qualify for savings.

In the chart below you will see the latest FPL limits under the 100 column. But you must also not have access to Medicaid or qualified employer-based health coverage. If youre an individual who makes about 29000 or less or a family of four that makes about 60000 or less you may qualify for both subsidies.

Includes salaries wages tips and taxable scholarships and fellowships. You can qualify for a subsidy if you make up to four times the Federal Poverty Level. Certain individuals may qualify at different levels.

Single dependents under 65 are required to file if any of the following applies. Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those who dont need coverage. But in the states that havent yet expanded Medicaid premium subsidies are available if your income is at least equal to the poverty level.

Each year these limits will go up by 2 to account for inflation.