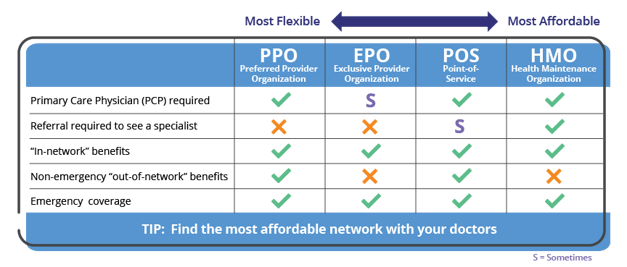

Health maintenance organization HMO preferred provider organization PPO point of service POS and exclusive provider organization EPO plans are all types of managed healthcare. HMOs and POS plans require a primary care physician and referrals while PPO plans do not.

Both Medicare Advantage HMO and PPO plans have networks.

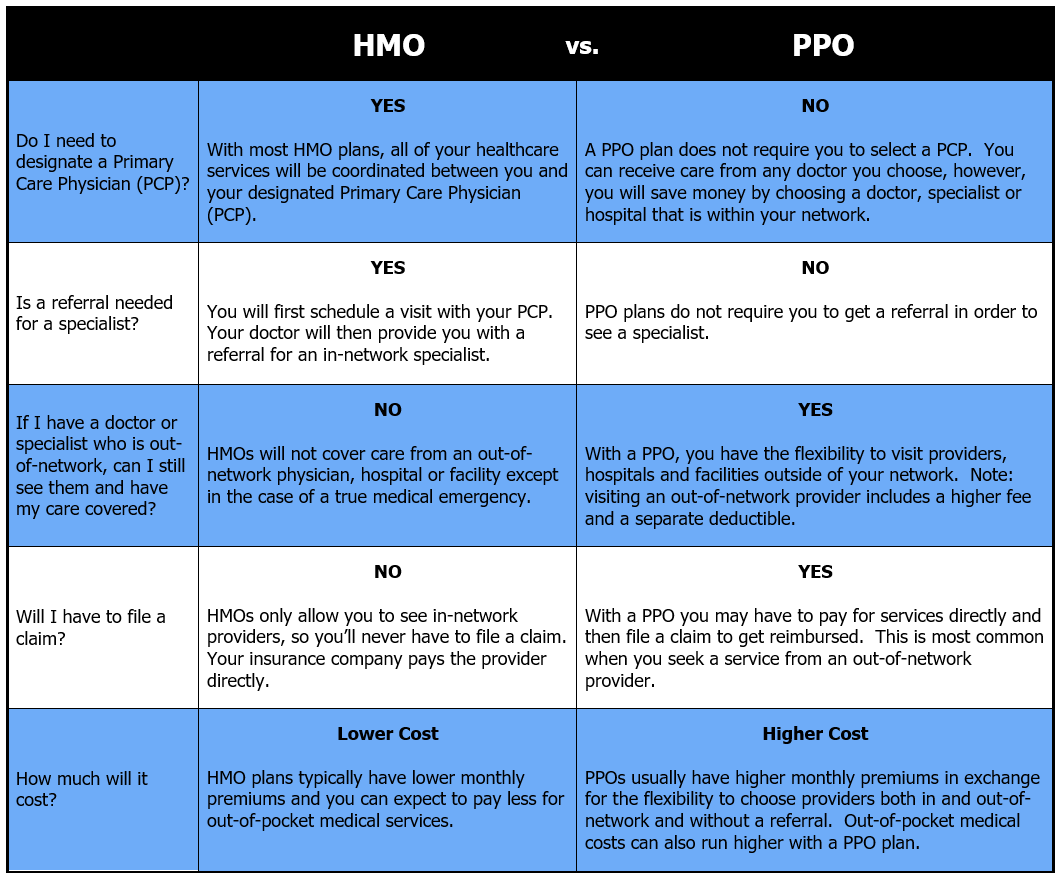

Understanding the difference between hmos and ppos. Which health insurance plan is best for you. Based on your health care needs and the information above come up with a list of questions for the employer or their human resources representative. Premiums are typically lower for HMO plans than PPO plans.

Preferred Provider Organizations PPOs also offer access to a network of doctors and providers who accept payment at a certain rate for members. POS plans generally have lower deductibles and co-pays compared to both HMOs and PPOs. PPO plans are often have higher premiums than their HMO counterparts.

Understanding the differences between Medicare Advantage HMOs and PPOs Single source of coverage. HMOs and PPOs. Updated September 30 2020 The differences between health care plans can be confusing when choices include HMO PPO POS and EPO plans.

The average total cost per individual new specialty visit was 1229 lower for HMO versus PPO patients a relative difference of 61 mean cost 18905. An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization. The purpose of managed care is to provide members with access to a comprehensive system of medical care that offers savings and encourages quality service.

But the major differences between the two plans. As youre changing jobs and deciding between HMO PPO EPO or POS health plans your first step is to ask questions. Unlike HMOs users of PPOs are required to pay for services at the time rather than on a prepaid fixed-rate basis and are reimbursed at a later date.

Costs and Spending on New Specialty Care. Understanding the difference between HMO PPO and POS. Deciding between an HMO and PPO depends on your individual situation.

Carriers build different levels of flexibility into their HMO plans. The concept of a Host-n-Post offer is to send the user directly to the Buyers website straight after they submit the form. Now that you understand the difference between in-network and out-of-network it is important to understand what HMOs are versus a PPO.

While larger companies can afford to offer a choice of health plans. HMOs usually provide lower premium payments and copays. The difference is that POS plans also require the insured to have a primary care doctor who helps manage the overall care plan of their patients.

HMO plans typically require patients to have referrals from a primary care physician and wont cover out-of-network care. Here re some quick facts about HMOs. HMOs are often more affordable but come with less coverage and more restrictions.

The purpose of managed care is to. You should consider things like deductibles and out-of-pocket costs and whether you want to. However POS plans do have a network of care providers including physicians and hospital just like an HMO plan does.

Therefore we have to assess the lead communicate with the potentially multiple Buyers and sell the lead with a few seconds of the submit limiting functionality that happens at point of submission but potentially increasing the value of the user. These costs are typically capped at specific price points for individuals and. Health maintenance organizations HMOs preferred provider organizations PPOs and point-of-service plans POS are all types of managed health care.

Network of participating health-care providers. The differences besides acronyms are distinct. Health maintenance organizations HMOs preferred provider organizations PPOs and point-of-service plans POS are all types of managed health care.

HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs. Since the cost is arranged by the sponsor and healthcare provider ahead of time patients are able to know what they will be expected to pay. Whether or not you have to select a primary care physician who refers you to specialists.

This is because the insurance company has to factor in a cost for unknown future bills with outside providers. HMO is an acronym for Health Maintenance Organization. How much you have to pay if you see a provider who is out of network.

Comparing an HMO vs PPO vs POS. Members of an HMO Health Maintenance Organization receive coverage only for care received from in-network providers. The central differences in HMO vs PPO vs POS plans are.

PPOs offer more flexibility and greater coverage but they cost more and usually have a deductible. As is true of all Medicare Advantage plans Medicare Advantage HMOs and PPOs combine coverage. You are required to choose a primary care.

Carefully compare the long term cost differences if you are thinking about a Medicare PPO plan VS an HMO.