Meet Social Securitys definition of what qualifies as a significant functional limitation. Optional Overdraft Protection for your checking account.

Wells Fargo Student Checking Account 2021 Review Should You Open Mybanktracker

Wells Fargo Student Checking Account 2021 Review Should You Open Mybanktracker

Choose between Clear Access BankingSM and Everyday Checking.

Wells fargo kids savings account. How do I know if my child is eligible for an ABLE account. Monthly automatic transfer option to reach your savings goals. Free online transfers between Wells Fargo accounts and free online statements to help teach money management There are three options.

Alliant contributes first 5. Explore Custodial Accounts offered by Wells Fargo Advisors. The Alliant Credit Union Kids Savings account is available for children 12 and under.

Other national banks like Wells Fargo and Bank of America offer childrens savings accounts but the APY rates are quite low almost zero. A Wells Fargo Way2Save Savings account only requires a 25 minimum opening deposit and has no monthly service fees for account holders under 18 19 in Alabama. Heres a quick look at the various account types each bank offers so you can compare.

With no maintenance fee for younger account holders and low balance requirements its a great general-purpose checking account for kids learning to budget. Good morning Sign on to manage your accounts. Joint management with parents.

Save As You Go transfer option. Custodial Accounts from Wells Fargo Advisors. In your online banking settings you might consider creating a nickname for the account with the name of your child children or grandchildren.

To be eligible for an ABLE account your child must. Have experienced the onset of your disability before age 26. Even young children can understand basic investing.

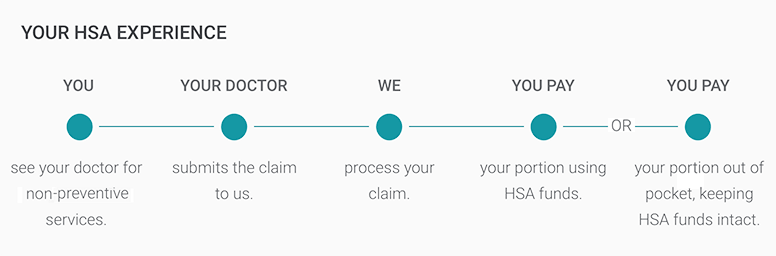

Well automatically transfer 1 of your funds from your linked Wells Fargo checking account to your Way2Save Savings account for each qualifying transaction. Offers multiple options for setting up your Kids Savings accounts. Remember that money in an UTMA account belongs to the child and will ultimately be under his or her control at your states age of majority typically 18.

Create a new password or find your username. The Wells Fargo Clear Access Banking suite is a teen-friendly product available to kids ages 13 to 17 though kids 16 and under require an adult co-owner. At the age of 13 the account converts to a Teen Savings account for teens ages 1317.

A convenient non tax-deferred way to invest money for a child thats not limited to educational expenses. Bank of America and Wells Fargo provide multiple options for checking savings certificates of deposit and accounts for children. Its an easy no-fee account with a high APY and parental control.

At that point the child is legally able to use the money however he or she wishes. 1 Both come with the Wells Fargo Mobile app check your account balances set up alerts. This serves as a helpful way to organize your online banking as well as provide a regular reminder of what you are saving for and for whom.

The Teen Checking account from Wells Fargo is best for teenagers who want to start managing their own money. Also checking and savings accounts come with monthly maintenance fees in most cases. Kidz Savings is for children ages 812 and the account requires 1 to open.

Provide a letter of certification from a licensed physician. It comes with basic parental controls that let you check your teens account activity and move money into their account as needed. No fees or minimums.

Dont expect to get a high-yielding account for your. Account options ideal for teens and students that waive the monthly service fee when the primary account owner is 24 years old or under. The Wells Fargo Kids Savings Account only requires a.

At the age of 18 the account converts to a regular savings account. You can open a joint ownership minor by or UTMAUGMA account.