All good business ideas do not require spending of greater funds but surely need thorough research before you take a plunge. Sit down with each of them to hash out the pros and cons of health insurance so they know what they want to do this year.

As a small-business owner benefits planning communication and employee engagement are just a few of the obstacles that can hold you back from a successful open enrollment season.

Small business open enrollment. There are three things you should know about enrolling in small business health insurance. Small business entrepreneurs have many opportunities that they can explore successfully. Too many employees arent aware of the nuances of the ACA.

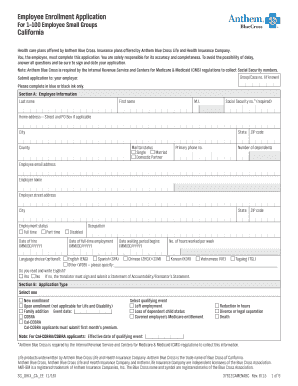

Open enrollment can be hectic for small business owners who often handle human resources on their own and sometimes offer enrollment for employment-sponsored benefits in the same calendar window. If you or your employees need to enroll in or renew your health insurance plans for 2021 through the Affordable Care Act ACA individual. When you can apply for a new plan.

For many small businesses open enrollment comes at a tough time. ACA Open Enrollment 2019 Marcie ODwyer VP of Strategic Relationships at SyncStream Solutions filled us in on what small business needs to know. During this time employees receive plan materials have a chance to ask questions about plan choices and enroll in a plan.

For many small businesses and their employees one of the biggest benefits-related challenges is getting prepared for open enrollment. For small businesses open enrollment is critical because it helps them to put together their budgets and incentivize prospects and existing employees with health care. How to Offer Coverage Open enrollment isnt just about buying new health insurance or changing your health insurance plan.

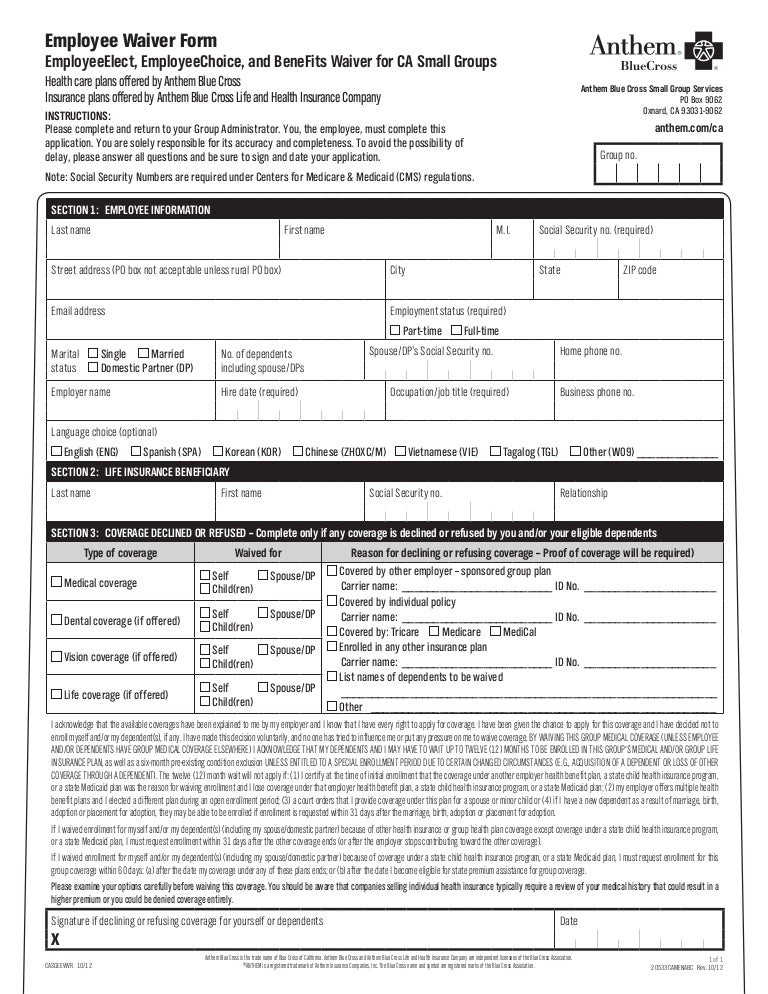

While there is no open enrollment or annual period that employers are limited to like on the individual side where you can only sign up during open enrollment or a qualifying life event there is a once-a-year window when its easier for small businesses to offer group health insurance to employees. Open enrollment will continue until December 15 with coverage starting on January 1 2021. Its open enrollment time.

When can you apply for a new plan. This year weve seen how important it is for small business owners their employees and their families to have access to health coverage. This year for coverage in 2019 and beyond open enrollment will begin on November 1st and ends on December 15th.

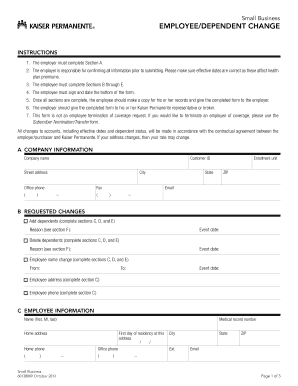

Announcing a Special Open Enrollment period for small groups with 2 50 employees which allows you the business owner to offer group health even if you cannot meet either or both the participation and the financial commitment. 4 open enrollment pain points--and how small businesses can avoid them. Determine how many employees will receive coverage through a new or renewed health plan Provide employees with health plan information prior to Open Enrollment to give them enough time to review and compare.

As someone with health insurance andor looking to get health insurance for your small business you have likely heard the term open enrollment This refers to a period of time in the late fall during which individuals can choose their health insurance plan for the upcoming year. Healthcare small business and open enrollment. A lack of communication can be a serious problem during the open enrollment period.

Open enrollment is underway. Open Enrollment for Small Business Owners. If you miss the deadline for 2021 youll have to wait until the enrollment period begins for 2022 unless you qualify for a Special Enrollment Period.

To streamline the enrollment process small business owners should. Instead make sure you talk it out with your staff ahead of time. Small businesses owners can also take advantage of the changing prices and plans available during this open enrollment period.

Small businesses dont have to wait until Open Enrollment to offer benefits to their employees While employees wont be able to enroll in health insurance plans until November comes along small business owners dont have to wait at. Lets look at each of these enrollment questions in more detail. All they need is a great small business idea.

You dont have to go it alone. Open enrollment for small employers usually is the month prior to renewal date of the policy and lasts about one or two weeks. Open enrollment ends on December 15.

Its a quick six weeks. As you likely know open enrollment is that time of year when you can shop and switch plans. Entrepreneurs and small business owners.

And how you can add and remove new employees and dependents from your plan. When you can make changes to an existing plan. Year-end is approaching fast and you may want to focus on holiday sales tax strategies and business planning for the coming year instead of how to get your employees excited about and enrolled in a new employee.