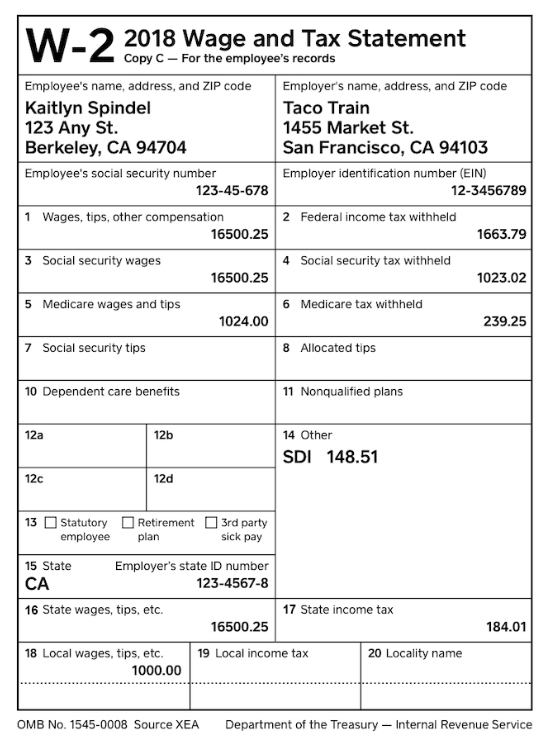

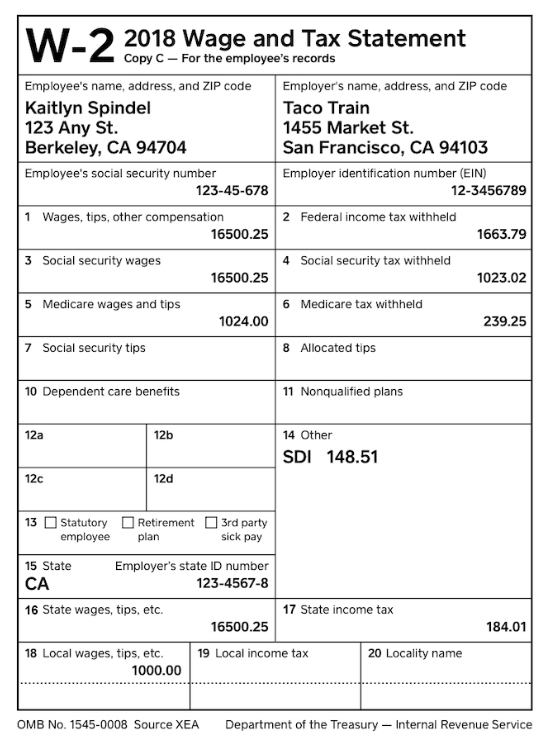

All compensation from your employer is considered income including. The Form W-2 also reports the amount.

W 2 Form Filing Deadline And Faqs Square

W 2 Form Filing Deadline And Faqs Square

The undersigned certify that as of June 22 2019 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 22 2019 published by the Web Accessibility Initiative of the World Wide Web.

Employer file w2 california. A W-2C is a form used to make corrections on previously issued wagetax information W-2s from current or prior years. The federal Internal Revenue Service IRS requires employers to report employees wage and salary information on Form W-2. Returns that are paper-filed with the IRS will be forwarded to the CA Franchise Tax Board FTB so theres no need for you to also file with the FTB.

To obtain a refund of the withheld CA taxes the taxpayer must file a non-resident CA tax return on which she allocates zero income to CA. The employers responsibility is the same in both types of cases except on one point. When some or all of a California employees compensation is based on commissions California law requires the compensation agreement to be in writing14 The agreement must specify the way the commissions will be computed and paid15.

Your W-2 also reports the amount of federal state and other taxes withheld from your paycheck. For starters filing W-2s electronically is free fast and secure. A Pay Data Report covers only a single employer.

With at least one employee in California and that is required to file an Employer Information Report EEO-1 Report pursuant to federal law. File Form W2 Now with TaxBandits an IRS-Authorized e-file provider. Even though the State of California does not require W2 Form the IRSSSA still requires you to file Form W2 to report wages and the taxes withheld for each of your employees for the year.

You also receive an acknowledgement receipt. If this date falls on a Saturday Sunday or legal holiday the. Your employer is required to report wage and salary information on the Wage and Tax Statement IRS Form W-2.

All employers are required by law to report all newly hired or rehired employees to the NER within 20 days of their start-of-work date. As the chief fiscal officer of California the State Controller is responsible for mailing all Form W-2s to civil service and California State University employees paid by the states Uniform State Payroll System. Download and print your W-2 statements online.

Also the copy of Form W2 must be furnished to the employees. Are you a California employer who must file state copies of W2s and 1099s. If a worker is classified as an employee for example their employer will usually be required to provide them with a completed copy of IRS Form W-2.

And the employer must ask the employee to sign a receipt as proof that the employee. Verify Employees Social Security Numbers. Access to password protected andor secure areas of this portal is restricted to authorized users only.

Form W-2 is a wage tax form to report the wages paid to employees and the taxes social security income and Medicare tax withheld from the employees to the SSA Social Security Administration. The employee must be provided with a copy of the written commission agreement. Like Form W-2 it is a multi-use form used to report corrected wages to the IRS Internal Revenue Service FTB Franchise Tax.

Independent Contractors on the other hand are usually provided with a completed copy of IRS Form 1099-MISC. Access your paycheck and other earnings statements online. 1 maintain a copy of each employees personnel records for a period of not less than three years after termination of employment 2 make a current employees personnel records available for inspection and if requested by the employee or representative provide a copy at the place where the employee reports to work or at another location agreeable to the employer.

The IWO form is in the Employer Forms box to. Opens in new window. New Employee Registry NER.

It offers secure and accurate e-filing with the IRS. This is a secure web-based employee self-service portal available to California State Employees. The state of California does not require you to file Form W2.

Wages are earnings from your employer. January 31st is the filing deadline for BOTH electronic and paper forms W-2. File W-2sW-2Cs Online This service offers fast free and secure online W-2 filing options to CPAs accountants enrolled agents and individuals who process W-2s the Wage and Tax Statement and W-2Cs Statement of Corrected Income and Tax Amounts.

For the purposes of California Pay Data Reporting an employer means any private employer of 100 or more employees anywhere in the US. Since Non-4-D orders do not originate within the child support system the California State Disbursement Unit which processes all child support payments needs additional information to assure the payment is processed accurately. Assuming the taxpayers income from CA consisted solely of W2 wages or salary and the taxpayer did not live in or physically work in CA her remote income is not taxable by CA.

To facilitate the inspection employers shall do all of the following.