The poverty guidelines are sometimes loosely referred to as the federal poverty level FPL but that phrase is ambiguous and should be avoided especially in situations eg legislative or administrative where. Medicaid Marketplace Tax Subsidies SNAP energy assistance and other subsidies.

Https Board Coveredca Com Meetings 2019 05 16 20meeting Ppt Policy 20and 20action May 202019 5 16 Pdf

If you want to know if you qualify for Covered California or m.

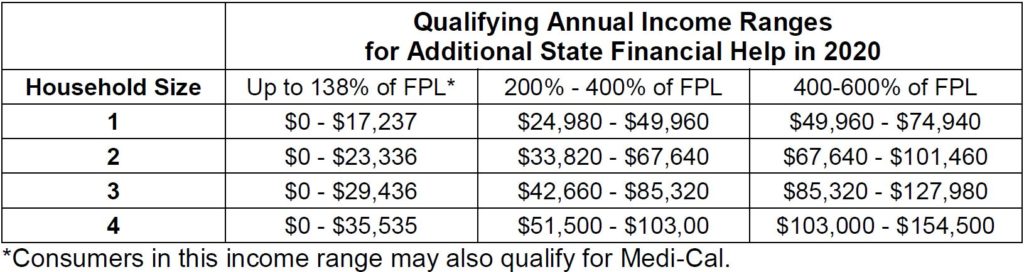

Federal poverty level 2020 covered ca. The thresholds vary by state. The threshold for Medi-Cal 138 FPL jumped from 17237 on the September chart up to 17609 on the new revised income table. The federal poverty level FPL.

This is the Federal Poverty Level for the 50 core States and most importantly to us California. Finance has reviewed the. FPL is based on income and family size.

Use this free tool to calculate 2020 California Poverty Levels including monthly totals annual income amounts and percentages of California Poverty Levels like 133 138 150 200 and more. The DHCS 2020 FPL income chart lists a higher amount of 17609 for a single adult and 23792 for two adults. This video will help you understand the income levels between medi-cal and Covered California.

Covered California uses FPL limits from the prior year to determine eligibility for its programs as required by regulation. C-CHIP is available in San Francisco Santa Clara and San Mateo counties only. If ineligible for Medi-Cal consumers may qualify for a Covered California health plan.

This number is used to determine eligibility for different federal state benefit programs. Covered California listed the single adult Medi-Cal annual income level 138 of FPL at 17237 and for a two-adult household at 23226. S tarting November 1 2020 the Health Insurance Marketplace 2.

All the the important numbers are multiples of this key rate. In 2020 that number will be 49460 for an individual 67640 for a couple and 103000 for a family of four. Most consumers up to 138 FPL will be eligible for Medi-Cal.

The guidelines are a simplification of the poverty thresholds for use for administrative purposes for instance determining financial eligibility for certain federal programs. On June 25 2020 the Covered California Board adopted resolution number 2020-41 adopting the proposed program design see Attachment 1. Federal Tax Credit 100600 FPL Silver 94 100150 FPL Silver 87 over 150200 FPL Silver 73 over 200250 FPL.

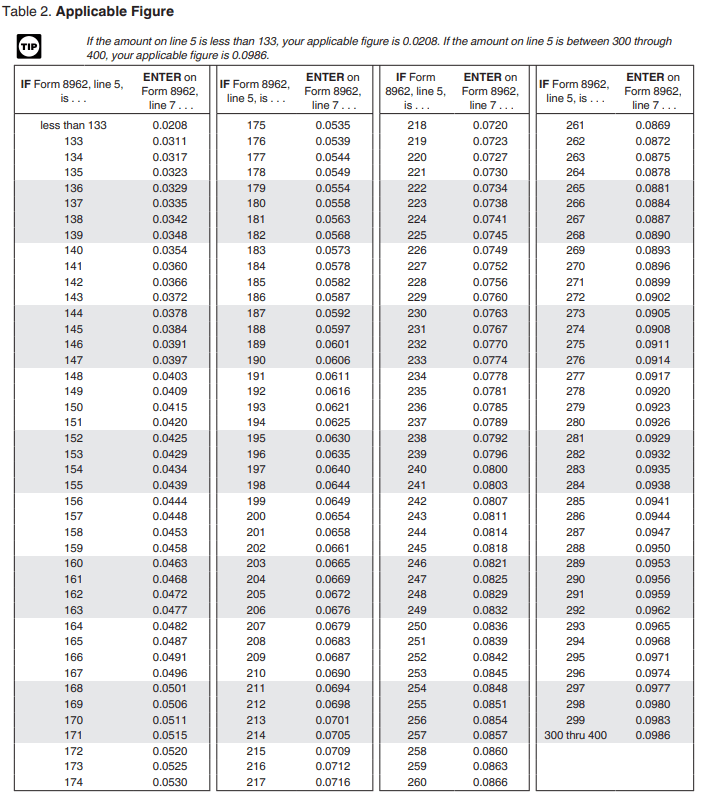

These ceilings are derived from the annual Federal Poverty Level FPL. Revised Covered California 2020 Income Table with. The federal threshold is 400 percent of the federal poverty level FPL.

Individuals who make above 400 of the Federal Poverty Level are still eligible to enroll in a health plan through CoveredCA but they will not be eligible for Subsidy. The enclosed charts provide the 2020 poverty level ceilings for Medi-Cal Medi-Cal Access Program MCAP MCAP-Linked Infants and County Childrens Health Initiative Program C-CHIP. The 2020 Poverty Guidelines commonly referred to as the Federal Poverty Level FPL follow in the tables below.

The unshaded columns are associated with Covered California eligibility ranges. Will use the 2020 guidelines when making calculations for advance payments of the premium tax credit and income-based cost-sharing reductions for coverage year 2021. What Programs Use FPL.

Federal Poverty Levels are used by many assistance programs including some states Medicaid programs as a way. At the end of the year if their income is below the 400 FPL then any amount of subsidy that should have been received will be paid back on the years tax return. To qualify for a subsidy from the government families must purchase their coverage through Covered California and have a gross income no more than 400 of the federal poverty level.

FPL is used to determine eligibility for. California will pick up where the federal government leaves off. Federal poverty level and to individuals with household incomes at or below 138 percent of the federal poverty level.

Use this poverty level calculator to get 2021 annual and monthly federal poverty income levels and percentages for your household size in California. To also qualify for cost sharing reductions your family gross income must be more than 138 and less than 250 of the federal poverty level. The new higher income amount concurs with the issued Medi-Cal income table for 2020.

This form does not incorporate the federal guidance for Alaska and Hawaii Use this calculator to get. This is the California adjusted number which acts as a dividing line between Medi-cal eligibility and the standard plans for adults 19 and over. 2020 FEDERAL POVERTY LEVELS.

News media such as Los Angeles Times reported this in California. California passed a law in 2019 that extends the premium subsidy to 600 Federal Poverty Level FPL for three years starting in 2020. Note that these amounts change based on the number of individuals in the household and the state in which one resides.

Program Eligibility by Federal Poverty Level for 2020 Medi-Cal and Covered California have various programs with overlapping income limits.