Yorba Linda CA 92887. If you lose health benefits under those circumstances you have the right to choose to continue group health benefits.

California Timely Access To Care

California Timely Access To Care

Luckily Dale and Debra can both remain on their employer-sponsored health insurance under COBRA also known as the Consolidated Omnibus Reconciliation Act.

Cobra insurance california phone number. What Is The Phone Number For COBRA Insurance. If you would like to contact one of our consultants please call 877-262-7241. HelpI lost my jobShould I take COBRA or Covered California Exchange.

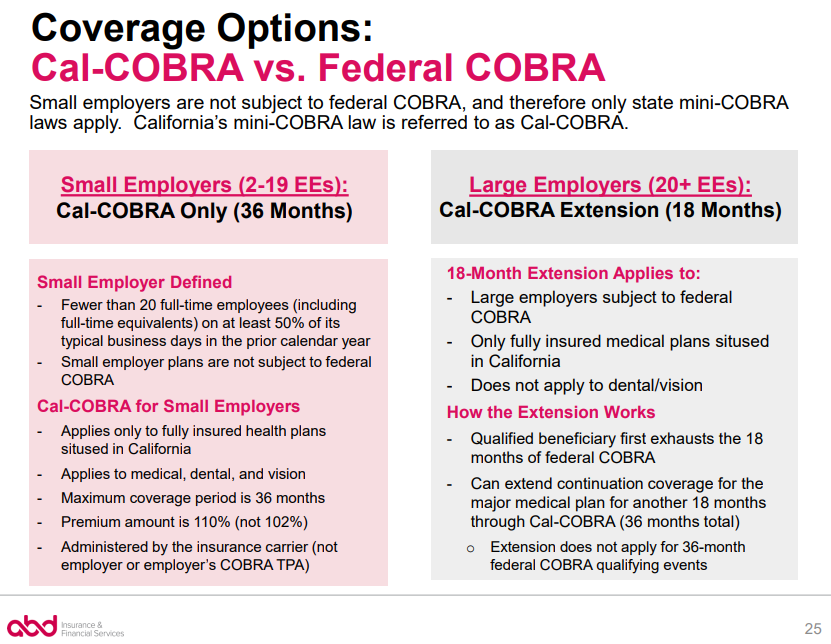

The California Continuation Benefits Replacement Act of 1997 Cal-COBRA requires insurance carriers and HMOs to provide COBRA-like coverage for employees of smaller employers two to 19 employees not covered by COBRA. To be covered by Cal-COBRA you must have employed two to 19 eligible employees on at least 50 percent of working days during the preceding. COBRA insurance may provide you with temporary health coverage after you leave a job or due to another event that qualifies you.

Groups have the option to self-administer their federal COBRA benefits or choose a third-party COBRA administrator including Blue Shields preferred COBRA administrator CONEXIS. Box 833 Belmont CA 94002-0833 888 837-7511 Premier Access Attn. Its a federal law that was created in 1985.

What is COBRA insurance. If you get COBRA you must pay for the entire premium including any portion. 1-877-262-7241 Since COBRA is the name of a federal law and not a company with benefits specialists each employer hires a COBRA Administrator.

Its available if youre already enrolled in an employer-sponsored medical dental or vision plan and your company has 20 or more employees. If the group master policy is not issued in California. What can I do when my Federal COBRA or Cal-COBRA options have been exhausted.

You can enroll in a temporary health insurance program at any time. Electing COBRA Coverage. Your COBRA benefits are the same as those you had in the employer plan.

For more information please do not hesitate to contact MNJ Insurance Solutions at 714 716-4303. See blog post. Awards Amounts for Employee Suggestions.

Your spousepartner and dependents can also be included on your COBRA. You may be eligible to apply for individual coverage through Covered California the States Health Benefit Exchange. The beneficiary must contact Cal-COBRA 800 228-9476 to request the extension and ensure they meet the requirements.

Request for Reinstatement After Automatic AWOL Resignation. CalHR Case Number 14-B-0132. Dont forget to speak to an insurance agent and get the best possible deal it could save your life.

If you elect to receive COBRA. Wolfpack Insurance Services Inc. COBRA stands for the Consolidated Omnibus Budget Reconciliation Act.

Each qualified beneficiary can decide independently to elect COBRA coverage or to waive. COBRA Unit 8890 Cal Center Drive Sacramento CA 95826 888 534-3466. Continuation coverage falls into four categories.

How do I reach COBRAs customer service. Understanding what COBRA insurance is and how it works can help you better decide if its right for you. Anyone who waives COBRA coverage can revoke their waiver and elect COBRA.

Get a Cobra Insurance Plan Today. COBRA is a federal law passed three decades ago to give families an insurance safety net between jobs. After exhausting 18 months of Federal COBRA benefits a beneficiary may be eligible for an 18-month extension through Cal-COBRA.

25-Year Service and Retirement Awards. Employers must notify qualified beneficiaries about COBRA eligibility within 14 days of a qualifying event. COBRA stands for Consolidated Omnibus Budget Reconciliation Act.

Petition to Set Aside Resignation. We are here to answer all your questions and needs regarding COBRA Insurance. Final Decisions on Request for Reinstatement After Automatic AWOL Resignation.

California Insurance Code CIC Section 1012859 provides extension under Cal-COBRA for those who have exhausted their 18 months on federal COBRA or longer in special circumstances for a total extension that cannot exceed 36 months. See reviews photos directions phone numbers and more for Cobra Insurance locations in Los Angeles CA. For the special Cal-COBRA extension to apply you must have become eligible for COBRA after January 1 2003 and the employers master policy must be issued in California.

There is no waiting for an open enrollment period and it wont be too long before youre covered for the worst events that life has to throw at you. COBRA Cal-COBRA Conversion and HIPAA. The Consolidated Omnibus Budget Reconciliation Act COBRA provides a continuation of group health coverage to workers affected by voluntary or involuntary job loss a reduction in hours and certain major life events.

Employers are required to notify you when you are eligible for these benefits. CalHR Case Number 14-G-0055. Qualified beneficiaries then have 60 days to elect coverage.

The Consolidated Omnibus Budget Reconciliation Act better known as COBRA gives you the legal right to continue group health benefits when they might otherwise end due to job loss divorce or death. If you would like to contact one of our consultants please call 877-262-7241. COBRA allows former employees retirees and their dependents to temporarily keep their health coverage.

COBRA applies only to companies with at least 20 employees.

/GettyImages-478439270-ac3965e5103b400aab53ef30a4dfe8b4.jpg)