AARP members can receive discounts from Philips Lifeline and veterans may be eligible. Overall we found plenty to appreciate about Life Alert.

Does Medicare Cover The Cost Of Medical Alert Systems 2021

Does Medicare Cover The Cost Of Medical Alert Systems 2021

Life Alert systems arent covered by original Medicare parts A and B.

Life alert cost covered by medicare. Medicaid recipients on the other hand may be eligible for funding that can pay for a medical alert service. Their campaigns were so popular that the Life Alert brand is used to describe the entire industry much like Kleenex and Chapstick. Does Medicare Pay for Medical Alert Systems.

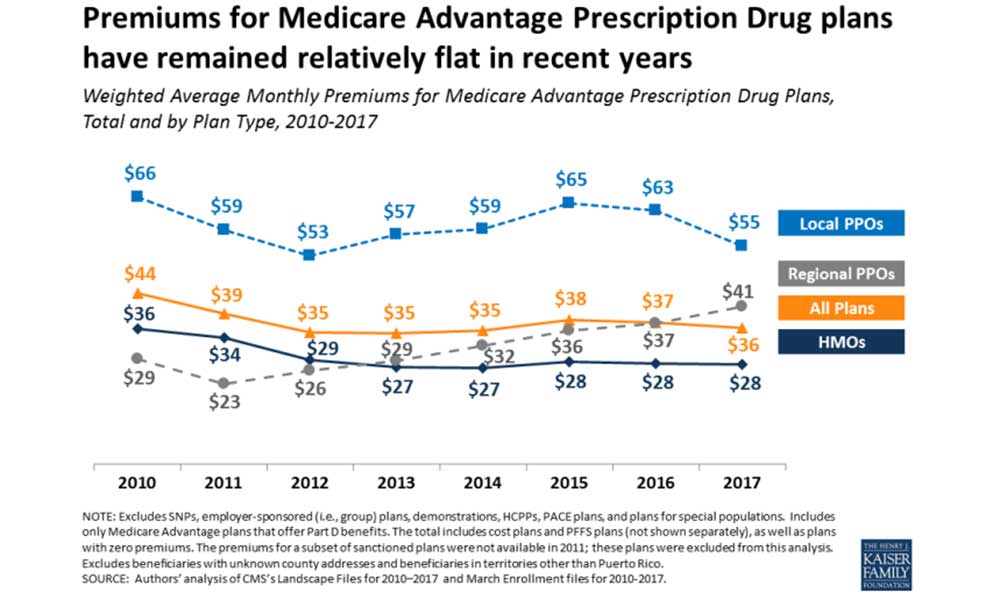

The features of Medicare Advantage plans depend on. Private insurance and Medicare Part C may help cover the cost of a medical alert device or assist with defraying the monthly fees for a personal emergency response system. Depending on the system and company you choose monthly monitoring fees for life alert devices range from 26 for traditional pendant models to 38 for a mobile GPS-enabled device.

Youll need to talk with your insurance provider to find out how much they cover and for what medical reasons and for how long. Pricing for Life Alert starts at 4995mo which also requires a. What Will Medical Alert Systems Cost You.

Although Life Alert costs are among the highest there is one nice perk. Members must pay a 149 cost for the device. The Classic Guardian Medical Guardians most affordable option comes with a landline base unit with a 1300-foot range and 32-hour backup battery.

4 Bay Alarm Medical starts at 1995 per month. Seniors who need a medical alert system for medical reasons might be able to get it covered by a Medicare Advantage Plan2 Some Medicare Part C plans cover 100 percent of the cost while others only cover a portion. We share details from our research below to explain how Medicare Advantage plans discounts from medical alert system sellers and manufacturers long-term care insurance and the Medicaid program can help you pay for a medical alert system.

GoSafe is about 60 a month. Life Alert and other PERS allow a person at home to push a button to call for help when in trouble. However a Medicare Advantage Part C plan might cover some of the cost.

Some agencies are run by the state or local entities and may provide a discount. The cost ranges from 4995 to 8995 per month based on the services and equipment you select. As long as youre covered by your Life Alert service contract your.

Although Medicare does not cover the cost of a medical alert system other programs do cover these life-saving systems. If you have coverage for medical alert systems through Medicare Advantage or Medigap you could receive partial or full coverage of Life Alerts monthly fee. Life Alert is an advanced medical emergency response system which is designed to dispatch immediate help to seniors in situations such as a fire breakout poisoning or any other medical emergency.

Most insurance companies wont cover them either. 2 The Life Fone Medical Alarm is 3095 per month. Those interested will need to find out if their insurance or Medicare Part C in their state covers a medical alert device.

Your monthly monitoring fees are locked for life. But in most cases medical alert systems like Life Alert arent covered by Medicare. If neither your Original Medicare nor Medicare Advantage plans cover the cost of Life Alert there are other options that may help with the cost of these devices and the associated medical services.

The price of this service can vary but often ranges from between 20 and 40 per month. Original Medicare does not cover them. Unfortunately they are not considered a medical necessity by Medicare.

1 The Belle Medical Alert Device from Family1st is 3295 per month. This is something we disagree with as. If you or a loved one needs a medical alert system your device may be covered by a private insurer or Medicare Part C.

Cost of the equipment itself averages about 50. Life Alert like most other emergency response providers can help elders live an independent life so that retirement homes are not the only option for them especially when they do not. But we would have liked to see greater transparency in their pricing and better at-home coverage 800-ft range isnt great compared to other brands like Medical Guardian which offers 1300 ft.

3 The Medical Guardian medical alert device ONLY works with ATTs cellular service but it runs 2995 per month. There may be initial setup or. In-home range for only 2995 per month.

Youre usually paying for a life alert system out of pocket. Medical Guardian offers a wide variety of medical alert systems with monthly prices starting at 2995 per month. A mobile device with a fall detection alert averages 44 monthly.

In-home Lifeline costs about 30 monthly for the 247 monitoring an initial 50 is for the equipment. Typically medical alert systems or PERS are not covered under Medicare Parts A and B. However whether or not one of these devices is covered will vary by insurance provider.

While Medicare does not cover life alert you can purchase a lifeline alert system at an affordable rate. Life alert is not covered by Medicare.