The Countdown Is On. Before the stimulus bill passed Obamacare subsidies were available only to those who earned less than 400 of the federal poverty level.

What Are The 2021 Federal Poverty Levels Independent Health Agents

What Are The 2021 Federal Poverty Levels Independent Health Agents

Obamacare Rolls Tick Higher For 2016 individuals with annual taxable income between 11770 and 47070 qualify for such aid.

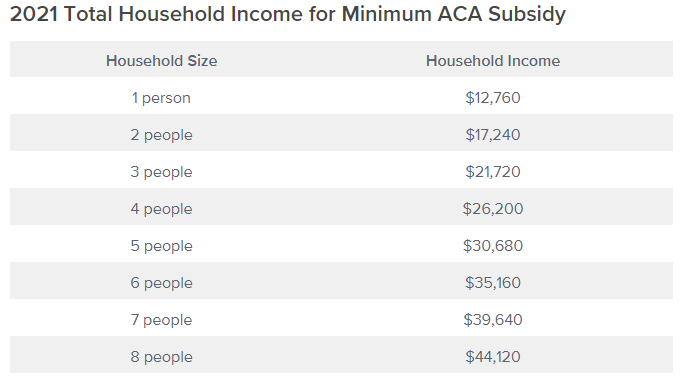

Obamacare subsidy income levels. The minimum income for ObamaCare is 100 of the federal poverty level. But you must also not have access to Medicaid or qualified employer-based health coverage. Obamacare Subsidy Eligibility Obamacare offers subsidies also known as tax credits that work on a sliding scale.

The 2021 income cutoffs for the different levels of what are called cost sharing subsidies CSS are for a single person 19140 150 of poverty 25520 200 and 31900 250. The Maximum Income You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below. To qualify for a subsidy your household income must be between 100 and 400 of the FPL.

McClanahans Obamacare customer clients were all. If you meet these criteria youll be eligible for a subsidy on a. If you earned more than that at tax time you had to pay.

A family of four making the current 400 of poverty level annual income of 106000 would pay no more than 9010 in annual premiums 85 of their income under the new rules. And although there is normally an income cap of 400 of the poverty level discussed in more detail below that does not apply in 2021 or 2022. Income under 25100 to be exact for a family of four two adults two children 20780 for a family of three and 12140 for an individual are considered poverty levels in the United States.

9 rows With the recent passage of the ARPA there is now NO INCOME LIMIT for ACA tax. You can check the federal poverty level guidelines each year to figure out what the minimum income level is. Those earning below 150 of poverty will.

For income-based subsidy eligibility a household must have an income of at least 100 of the federal poverty level 139 percent of the federal poverty level in states that have expanded Medicaid. Ever since the health insurance marketplacesexchanges debuted for 2014 coverage the premium subsidy premium tax credit eligibility range has been capped at household incomes of 400 of the federal poverty level FPL. You can base this amount on your most recently filed tax return taking into account any changes you expect for the following year.

Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate. 104800 family of four the mid-level plan cost drops from a maximum of 983 to 85. You can probably start with your households adjusted gross income and update it for expected changes.

The dollar amount of this changes every year but for 2020 it is 12490 for an individual and 25750 for a family of four. But it varies widely by income with those between 400 and 600 of the poverty level saving an average of 213 a month or 39 of their current premiums. Most people are eligible for subsidies when they earn 400 or less of the federal poverty level.

If your MAGI goes above 400 FPL even by 1 you lose all the subsidy. See Stay Off the ACA Premium Subsidy Cliff. Select your income range.

People with incomes above 400 of FPL have been on their own when it comes to paying for health insurance. At 400 of the poverty level 51040 individuals. Please note that in states that expanded Medicaid those making under 138.

The calculator spits out 0 subsidies which is a glitch implying such applicants pay 0 to next to nothing for annual health care premiums. They limit the amount you pay in monthly premiums to a percentage of your annual income. The American Rescue Plan enhanced premium tax subsidies to help earners at every income level pay for coverage and for the first time made those with incomes greater than four times the federal.

So for instance a 21-year-old with an income of 19320 who was eligible for a subsidy of about 3500 under the Affordable Care Act would get 4300 under the new plan assuming the cost of his. Estimating your expected household income for 2021. To qualify for an Obamacare tax credit you have to estimate your household income for the following year in your application.

Above 400 of the poverty level people previously. And prior to. 8 rows Prior to 2021 you were expected to chip in anywhere from 2 to 983 of your income.