For 2021 assistance youll use the 2020 poverty levels. Employers with nongrandfathered plans will need to update their maximum annual OOP limit for 2020 to 8150 self and 16300 other.

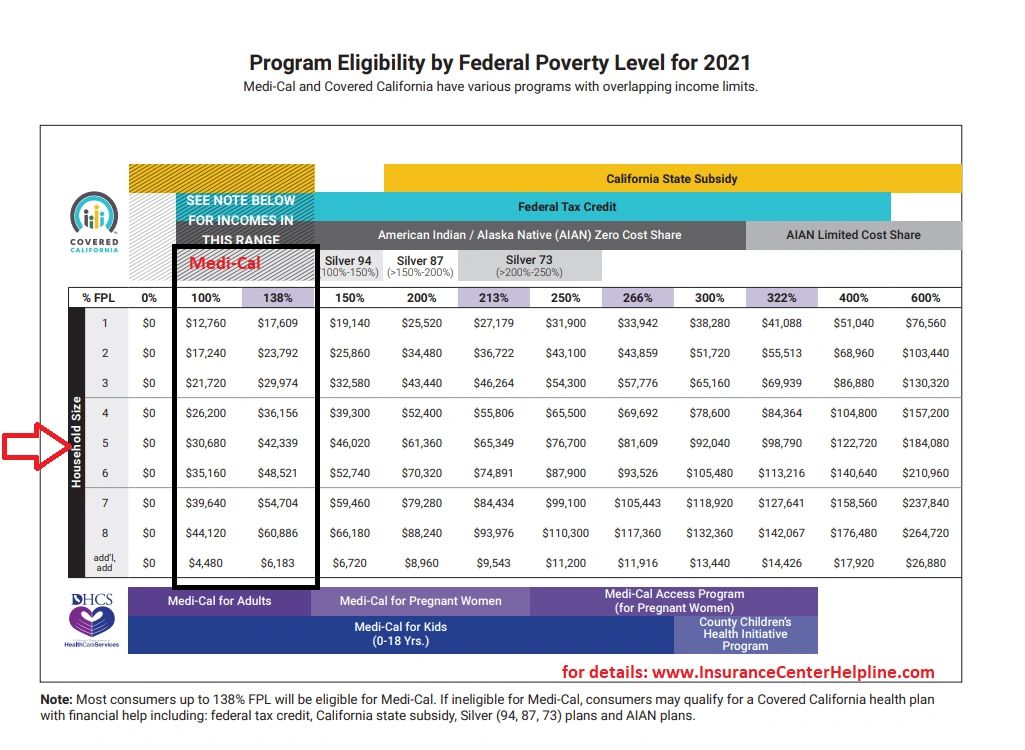

2021 Health Insurance Federal Poverty Level Chart

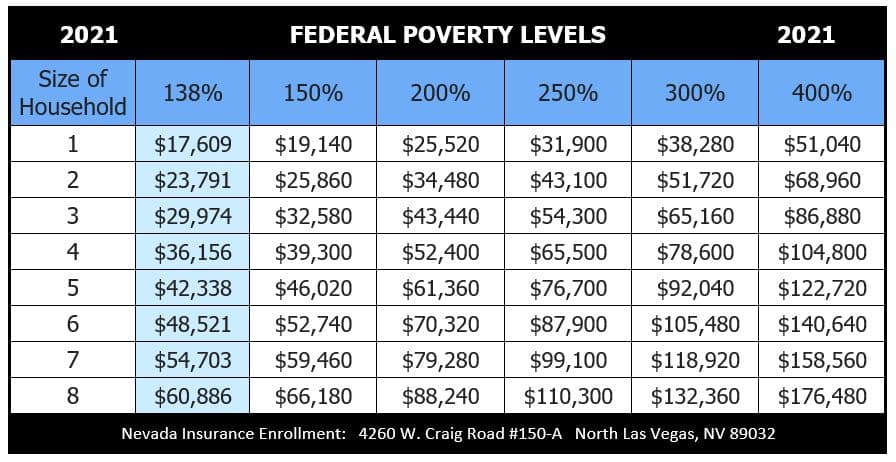

2021 Health Insurance Federal Poverty Level Chart

Analysis Of Income Limits For Subsidies Poverty levels are dependent on FPL.

2020 aca income limits. Learn more about who to include in your household. You simply wont qualify for monthly premium assistance if you make more than the income limit. If your household makes.

Remember the federally facilitated Affordable Care Act Marketplace savings are based on your expected household income for 2021 not last years income. 1 Find out how to estimate your expected income Healthcaregov. In this case you would multiply the monthly salary by 978.

With passage of the American rescue plan 10200 of my unemployment pay in 2020. Each year the ACA sets new limits for out-of-pocket maximums and deductibles. In general you may be eligible for tax credits to lower your premium if you are single and your annual 2020 income is between 12490 to 49960 or if.

For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. Here are the limits for 2018 plans for individuals and families. Glad for so many who were paid unemployment in 2020 that 10200 of unemployment is tax exempt but it appears to create a problem or at least confusion with 2020 ACA while doing 2020 taxes.

The American Rescue Plan Act of 2021 lowered the applicable percentages significantly in 2021 and 2022 from previous years. The caps are printed each year on form 8962 at tax time and earlier in the year in federal register. Out-of-Pocket Maximums and Deductible Limits For 2020 For 2020 your out-of-pocket maximum can be no more than 8150 for an individual plan and 16300 for a family plan.

For example an employee earning 17 per hour at the beginning of the 2020 plan year cannot be charged more than 21614 per month for the lowest-priced self-only coverage. Thus if you make between 12760 51040 as an individual or 26200 104800 for a family in 2021 youll qualify for cost assistance. For example in 2020 people with income between 250 and 300 of the Federal Poverty Level were expected to pay between 829 and 978 of their income toward a second lowest-cost Silver plan in their area.

2021 Total Household Income for Minimum ACA Subsidy. Healthcare Cost Assistance. Out-of-Pocket Maximums and Deductible Limits For 2020.

If You Dont Qualify. Employers should also note the slight increase in ESR assessments for 2020 as IRS continues to actively enforce these penalties. Prior to passage of the American Rescue Plan in March 2021 I was at 166 of the FPL.

9 Zeilen With the recent passage of the ARPA there is now NO INCOME LIMIT for ACA tax credits. Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those who dont need coverage. 1 For 2020 your out-of-pocket maximum can be no more than 8150 for an individual plan and 16300 for a family plan before marketplace subsidies.

What is the maximum income for ObamaCare. Understanding MAGI and AGI can save you lots of money. Please note marketplace cost assistance can be taken in advance based on income.

They will be looking at your 2020 income when determining whether youre eligible for a subsidy for 2020 so it will only be based on your own income if youre going to be single and filing your own tax return for 2020 the premium subsidy is a tax credit that has to be reconciled when you file your 2020 tax return. Including the right people in your household. As requirements vary by state reach out to your states Medicaid office or insurance office with eligibility questions.

This tool provides a quick view of income levels that qualify for savings. IRS Notice 2019-29 states that beginning January 1 2020 the affordability threshold for determining whether or not employer sponsored healthcare is affordable as required by the ACAs Employer Mandate will be 978 of the Federal Poverty Level. For 2020 your maximum deductible is the same as the out-of-pocket maximum.

17 x 130 x 978 For salaried employees affordability is based on the monthly salary. The premium tax credit caps below are an example see the premium tax credit caps for 2020 to see the most recent premium tax credit caps. You may qualify for marketplace cost assistance based on income and family size each year if you make between 100 400 of the federal poverty level.

Subsidy eligibility is normally based on income ACA-specific MAGI. Income under 25100 to be exact for a family of four two adults two children 20780 for a family of three and 12140 for an individual are considered poverty levels in the United States. For 2021 those making between 12760-51040 as an individual or 26200-104800.

Income Level Premium as a Percent of Income these amounts adjust upward slightly each year. The calculator spits out 0 subsidies which is a glitch implying such applicants pay 0 to next to nothing for annual health care. I had significant income from unemployment in 2020.