If so look over the following scenarios carefully. You are already enrolled in a Covered California plan and you lose a dependent or lose your status as a dependent due to divorce legal separation dissolution of domestic partnership or death.

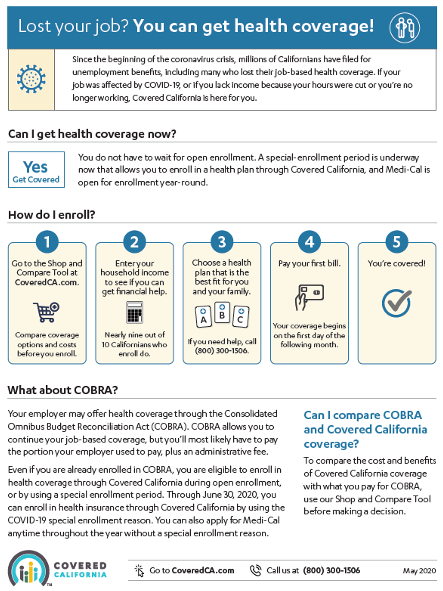

Covered California Sees More Than 123000 Consumers Sign Up For Coverage During The Covid 19 Pandemic

Covered California Sees More Than 123000 Consumers Sign Up For Coverage During The Covid 19 Pandemic

Below is a list of the qualifying life events.

Covered california qualifying events. Qualifying life event which may require review of the application for approval by Covered California for Small Business. This means you have sixty days from when you lost coverage to enroll in a new plan. Other qualifying events include.

Medi-Cal applications are accepted. There are exceptions to the annual open enrollment period. Other Covered CA Qualifying Life Events.

Lost job or income. When and where to apply for Covered California health insurance. If 60 days pass and you do not sign up for health coverage you will.

If none of the events listed above apply to you you may be able to select Other Qualifying Life Event if. You are already enrolled in a Covered California plan and become newly eligible or ineligible for tax credits or cost-sharing reductions. That means that within sixty days of being married you can apply for coverage even if we arent currently in an open enrollment period.

If you do not have one of the documents listed below Covered California accepts a written letter signed under penalty of perjury. Luckily your move may be considered a Covered California qualifying life event. Typically employees must report a QLE and select a medical or dental plan within 60 days of its occurrence.

Most special enrollment periods last 60 days from the date of the qualifying life event. These are called qualifying life events and if you experience one or more of them you can buy new coverage or change your existing coverage. If you experience a qualifying life event you can enroll in a Covered California health insurance plan outside of the normal open enrollment period.

In order for your move to qualify you it must meet one of the following criteria. Some of the most common life. In 2021 Covered California added Learned of new state penalty as a qualifying event.

Can I still apply through Covered California. A qualified life event is a circumstance that has occurred within the last 60 days. Typically in order to enroll it would have to be during an open enrollment period.

Generally if you enroll by the 15thday of the. Send us a document within 30 days from the date of this letter. The situations found in the other qualifying life event category are generally less common.

A change of income that affects your eligibility for a subsidy is considered a qualifying event that make you eligible for a special enrollment period of 60 days from the date of the change - in this case his employment termination date. Other qualifying life event You are already enrolled in a Covered California plan and become newly eligible or ineligible for tax credits or cost-sharing reductions. For all other qualifying events an application may only be submitted after the qualifying event has occurred.

Gaining a dependent or becoming a dependent through birth or adoption. However since youve recently experienced a life event you are free to buy a new plan even if were not in an open. When you applied misconduct or misinformation occurred on the part of.

An application for coverage due to a qualifying event must be received within 60 days after the qualifying event. You currently have a Covered California plan and become eligible or ineligible for cost sharing reductions or tax. Read about the documents that we accept as proof.

If you sign up during a special enrollment period when will your coverage start. This means consumers who are unaware of the potential tax penalty can still get coverage. You have 60 days from the date of your qualifying life event to enroll or change your existing Covered California health insurance plan.

Luckily as long as it wasnt voluntary your loss of coverage is a qualifying life event according to Covered California. For most qualifying life events you have 60 days from the date on which the qualifying life event happens to enroll in a Covered California health insurance plan or change their existing plan. The states open enrollment period is longer than the federal open enrollment period available to citizens in most other states.

You might be having trouble finding a qualifying life event that applies to you. Find your qualifying life event below. You are already enrolled in a Covered California plan and you lose a dependent or lose your status as a dependent due to divorce legal separation dissolution of domestic partnership or death.

In the letter you must describe your qualifying life event and why you do not have one. The ability to apply up to 60 days prior to qualifying event date is limited to loss of coverage qualifying events only. Here is a list of other qualifying events.

Permanently moved towithin California Lost or will soon lose their health insurance including Medi-Cal eligibility also known as loss of Minimal Essential Coverage MEC Had a baby or adopted a child. The 60 days are counted from the date the application is submitted. This short-term Qualifying Life Event will be in effect until April 30 2021.

Some applicants may be asked to submit verification of their qualifying life event.