Uninsured Californians still have time to avoid a penalty for not having healthcare if they sign up through Covered California by March 31. The penalty will amount to 695 for an adult and half that much for dependent children or 25 of household income whichever is greater.

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

You can estimate the penalty you might owe by clicking Penalty Estimator.

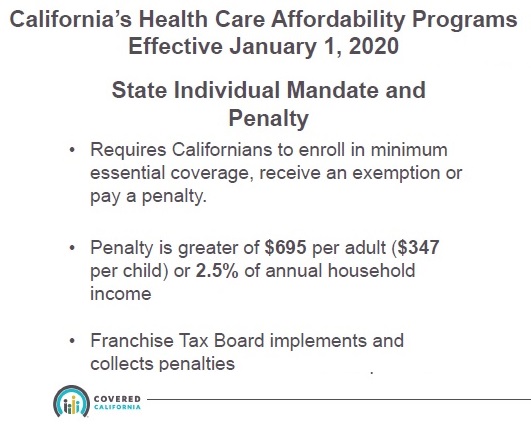

2020 california health insurance penalty. California residents who do not have health insurance in 2020 will have to pay a tax penalty in 2021. 695 per each adult in a household as well as 34750 per each child. A new California law that went into effect on Wednesday resuscitates the requirement that people obtain health coverage or face tax penalties.

Beginning January 1 2020 California residents must either. If youre a Californian who wasnt covered by employer or government health insurance in 2020 and didnt purchase it but could have your penalty will be at least 750 per adult and 375 for each dependent child in your household under 18 years old. The penalty is based on the previous federal individual mandate penalty which is 965 per uninsured adult or 25 percent of the individuals household income.

A taxpayer who fails to get health insurance that meets the states minimum requirements will be subject to a penalty. You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021. Will there be a tax penalty in California for not having health insurance in 2020.

The tax penalty was eliminated in 2017 by the Trump administration but the state of California has reinstated it for 2020. The penalty for a dependent child is half of what it would be for an adult. Everyone must have qualifying health insurance coverage or qualify for an exemption as of Jan.

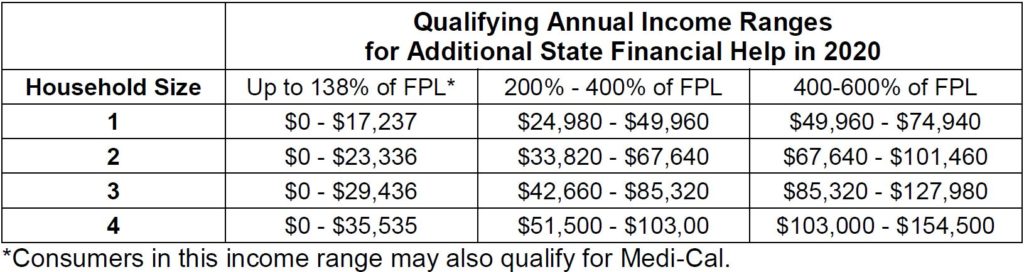

Have qualifying health insurance coverage. Household size If you make less than You may pay. Get an exemption from the requirement to have coverage.

Tax Penalty for No Health Insurance 2020. California shook things up for its residents in 2020 at least when it comes to health insurance. The penalty for a married couple without coverage can be 1390 or more and the penalty for a family of four with two dependent children could be 2085 or more.

Sample penalty amounts. The money raised from the penalties which is expected to be about 1 billion over the next three years. As of this date California has not indicated that the penalty will be rescinded for tax year 2020.

The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021. The penalty varies based on a taxpayers income level and how long they go without coverage in 2020. This requirement applies to each resident their spouse or domestic partner and their dependents.

What is the penalty for not having health insurance. California residents with qualifying health insurance and new penalty estimator. Starting in 2020 California residents must either.

Under the new California state law the failure to obtain minimal coverage before January 1 2020 will result in penalties of. An adult who is uninsured in 2020 face could be hit. Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance.

What is the Penalty for Not Having Health Insurance. An individual who makes 14600 and goes uninsured for. Obtain an exemption from the requirement to have coverage.

That could make the penalty quite a bit heftier for. Pay a penalty when they file their state tax return. Read our blog to learn more.

If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021. Effective January 1 2020 a new state law requires California residents to maintain qualifying health insurance throughout the year. Otherwise theyll face a tax penalty.

Family of 4 2 adults 2 children 142000. So many are unemployed due to COVID-19. Starting in 2020 California has enacted their own individual mandate for the state that requires residents to acquire a healthcare policy or pay a penalty.

According to the California Franchise Tax Board FTB the penalty for not having health insurance is the greater of either 25 of the household annual income or a flat dollar amount of 750 per adult and 375 per child these number will rise every year with inflation in the household.