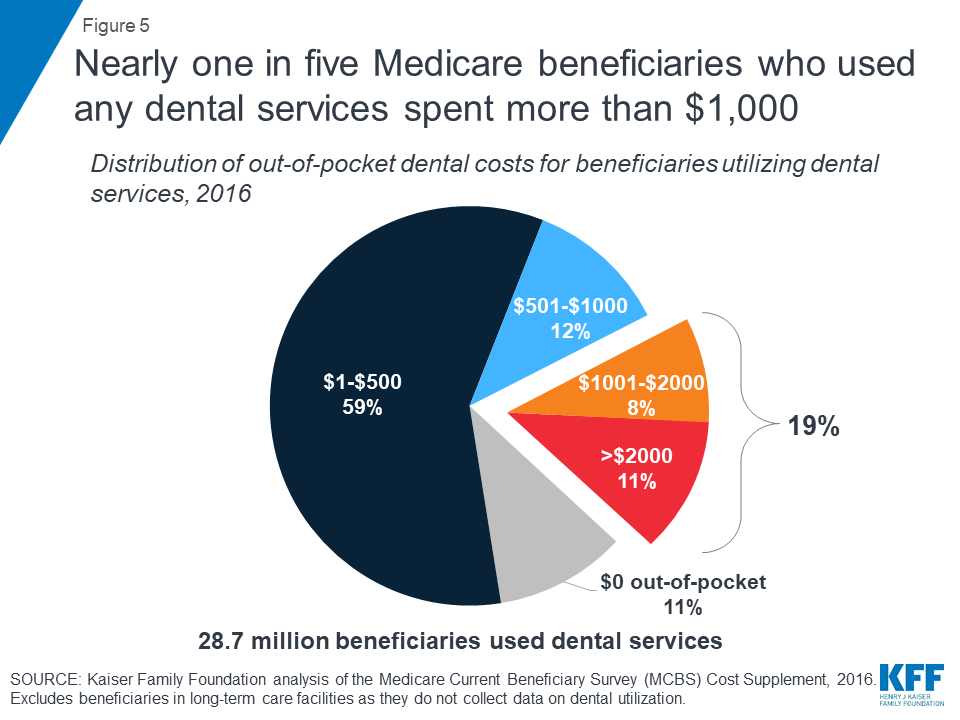

Coverage is only available once youve proven that you meet the criteria for infertility which varies according to the states law. Sixteen states have mandates requiring plans to cover certain infertility treatments.

Does Health Insurance Cover Infertility Treatments

Does Health Insurance Cover Infertility Treatments

Each state law is different.

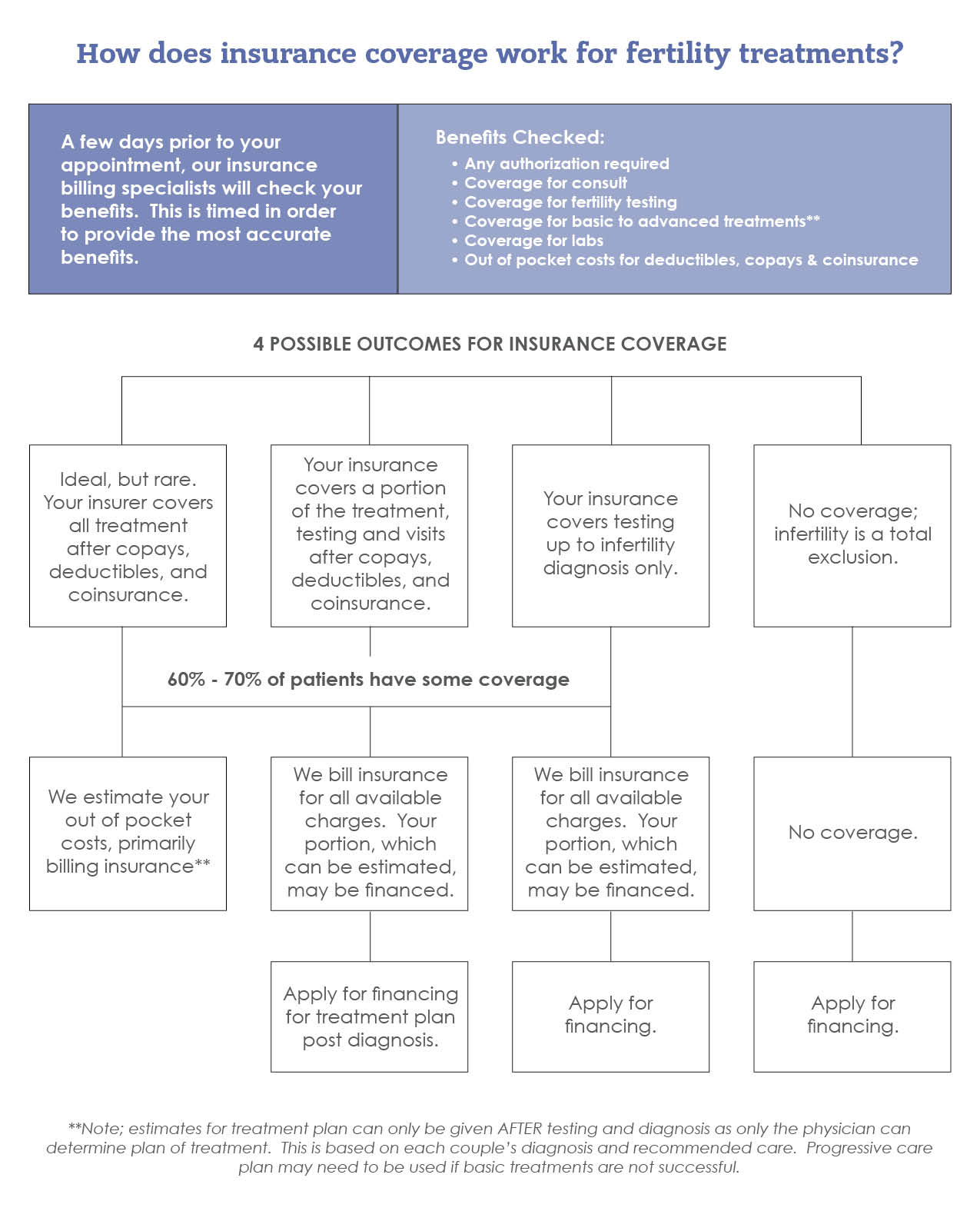

Does insurance cover artificial insemination. Our fertility specialist believed in transferring only one because complications are more likely to occur with multiples in utero. Some insurance plans will cover nothing related to infertility services some may pay for all of it and many are somewhere in between. Some insurance plans will only cover IVF if youve had a certain number of IUIs.

Infertility services covered as part of basic healthcare. The laws primarily apply to group health plans issued in the state. Sperm egg andor inseminated egg procurement and processing and banking of sperm or inseminated eggs.

The VA provides healthcare benefits for artificial insemination also known as intrauterine insemination IUI services but does not provide In Vitro Fertilization IVF or other assisted reproductive technologies due to the prohibited cost. For understanding this first we have to understand that Artificial Insemination is not covered under health insurance and must not get the benefits but in some cases it gets the benefits as aviates from company to company policy which is relative to term insurance. Covers 3 IVF cycles per live but not artificial insemination.

Some states mandate insurance coverage of infertility treatment with some restrictions. With IVF you have to determine how many embryos you want to have implanted at one time. Group insurers may be required to offer coverage but.

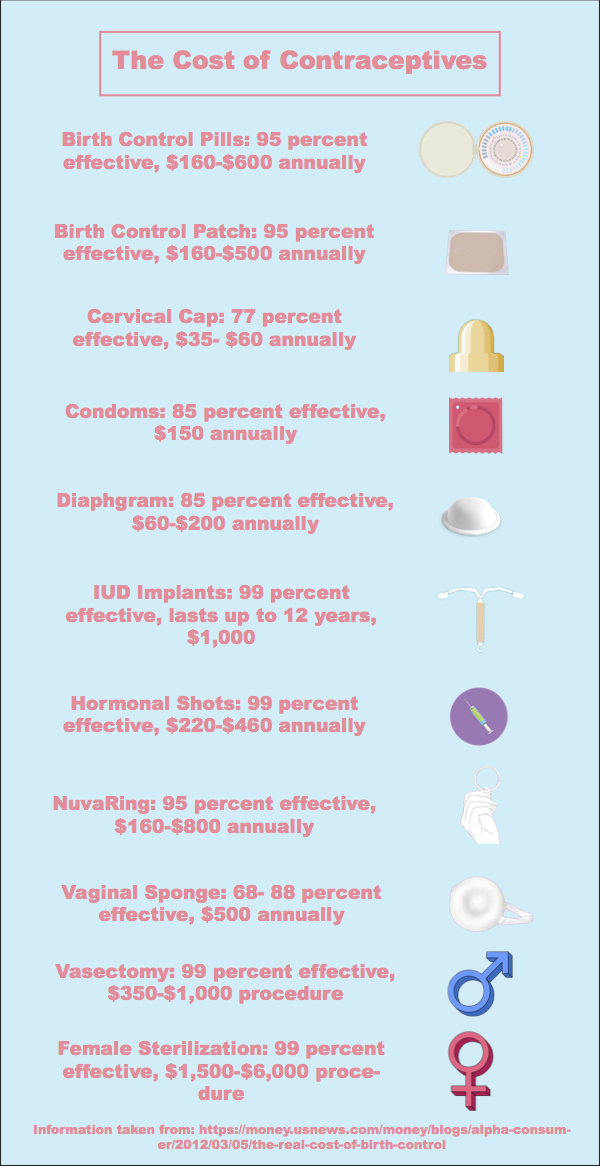

Although it is common for insurers to have exclusions for fertility treatments some insurance plans cover artificial insemination. Infertility treatment when the cause of the Infertility was a procedure that produces sterilization eg vasectomy or tubal. Therefore youll have to check policy-by-policy to see if a carrier will cover artificial insemination in your state.

20 Zeilen NJ. 1748-6x 1748A-7w 1748E-3522 and 17B27. The American Society for Reproductive Medicine 3 lists states that require coverage.

These procedures are considered elective. TRICARE may cover artificial insemination. No coverage for artificial insemination.

Many plans do not classify your desire to become pregnant by injecting sperm as a medically necessary procedure. Insurance coverage for infertility treatment including artificial insemination and in vitro fertilization varies greatly. All insurers must provide coverage for the diagnosis and treatment of infertility including artificial insemination.

Does Insurance Cover Artificial Insemination Once the tests and still be advised to encourage ovulation when insurance does not require a larger share program. If you have private insurance youre still responsible for copays. Eleven states have legal mandates requiring specific types of plans not companies to cover infertility treatments.

If you plan to start treatment for infertility and have coverage through Aetna your provider may initiate the treatment request online using our provider portal on Availity. Benefits for Wounded Ill and Injured Service Members. Your health insurance may cover artificial insemination when state law requires the benefits.

Insurers cannot decline coverage for treatable medical conditions which cause infertility. Does Insurance cover Artificial Insemination. Assisted reproductive services may be available to service members who have sustained serious or severe illness or injury while on active duty that led to the loss of their natural reproductive ability including but not.

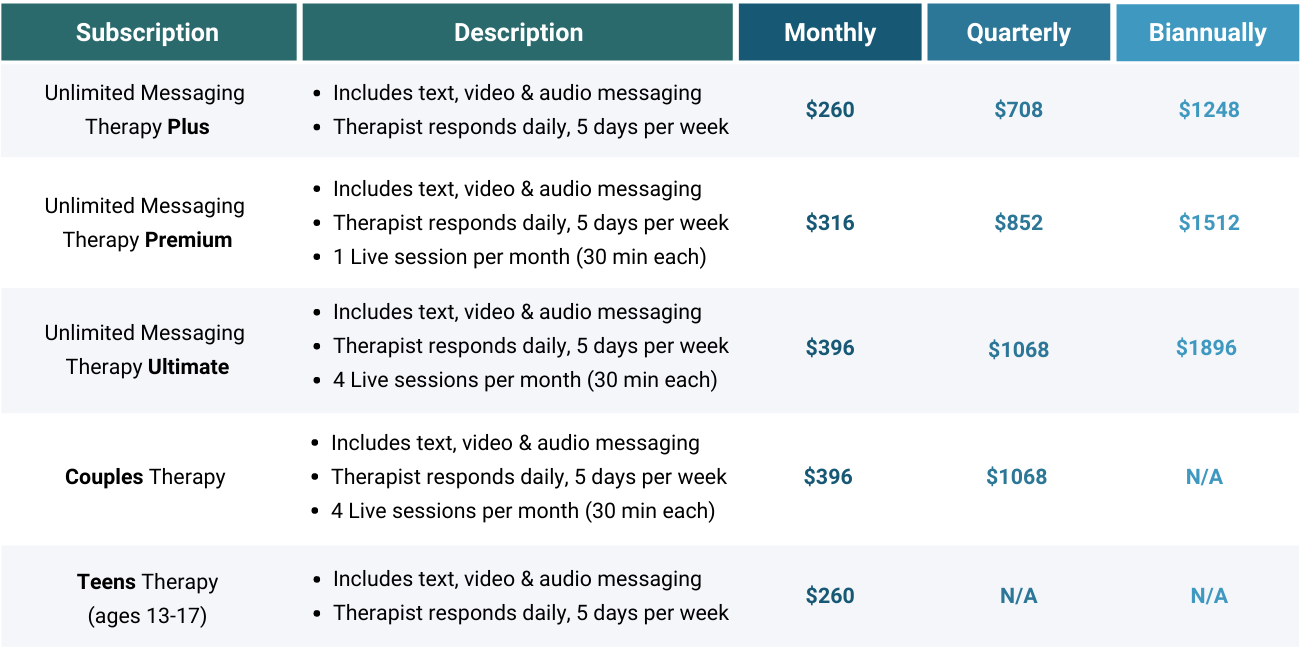

Most health insurance plans will not cover artificial insemination or any other infertility treatment. Owner Orange County Health Life Insurance The Affordable Care Act does not specifically address nor does it require artificial insemination. Infertility treatment includes ovulation induction with injectable infertility medicines artificial insemination or advanced reproductive technology ART.

Insemination are covered if the member has an Infertility benefit that allows for artificial donor insemination.

/talkspace-40e0447196a949e7b70f4a52ef69d960.png)

:max_bytes(150000):strip_icc()/hernia-surgery-in-detail-3157226_FINAL-ab113759eb27456b827498ca8db5c99b.png)

/GettyImages-107313063-75a79be6f7304f34b2c097efec7f369d.jpg)