Unlike an HMO PPO plans give participants the freedom to seek care from any in- or out-of-network provider. Its not a form of health insurance.

Comparing Health Plan Types Kaiser Permanente

An HSA is a savings account you use for medical expenses in conjunction with your insurance.

Difference between hsa and ppo health insurance. 8 rows Read more about the differences between PPOs and other plan types here. With money from this account you pay for health care expenses until your deductible is met. The tax difference is the real focus between PPO and HSA plans.

The difference between HSA and PPO health insurance is a distinct one where HSA reimburse for qualified medical expenses while PPO health insurance builds a network of medical service providers to choose from without the need for referrals. An HSA Health Savings Account is a savings account you can use with a high-deductible health plan HDHP. A PPO Preferred Provider Organization refers to the network coverage your health plan gives you access to.

HSA is a health savings account while PPO or Preferred Provider Organization is a group consisting of doctors. Log in or sign up to leave a comment Log. You will pay the full cost of items such as prescription drugs and office visits until the plans deductible amount is met.

Employers should note that there are some key differences between HSAs and PPOs. A Preferred Provider Organization or PPO is a type of health insurance plan that provides a network of healthcare providers much like a Health Maintenance Organization. And theyre both intended to be used for qualified medical expenses.

What is an HMO Plan. But thats about where the similarities end. There are some differences in how the plans work for smaller bills subject to HSA deductible but they generally treat the large bill the same.

A Preferred Provider Organization PPO has pricier premiums than an HMO or POS. The key difference between HSA and PPO health insurance is that HSA is a tax-advantaged health benefit plan exclusively available to taxpayers in the United States who are enrolled in a High-Deductible Health Plan HDHP whereas PPO is a cost sharing health plan that collaborates with medical services providers such as hospitals doctors and other medical specialists to create a. And which one is best.

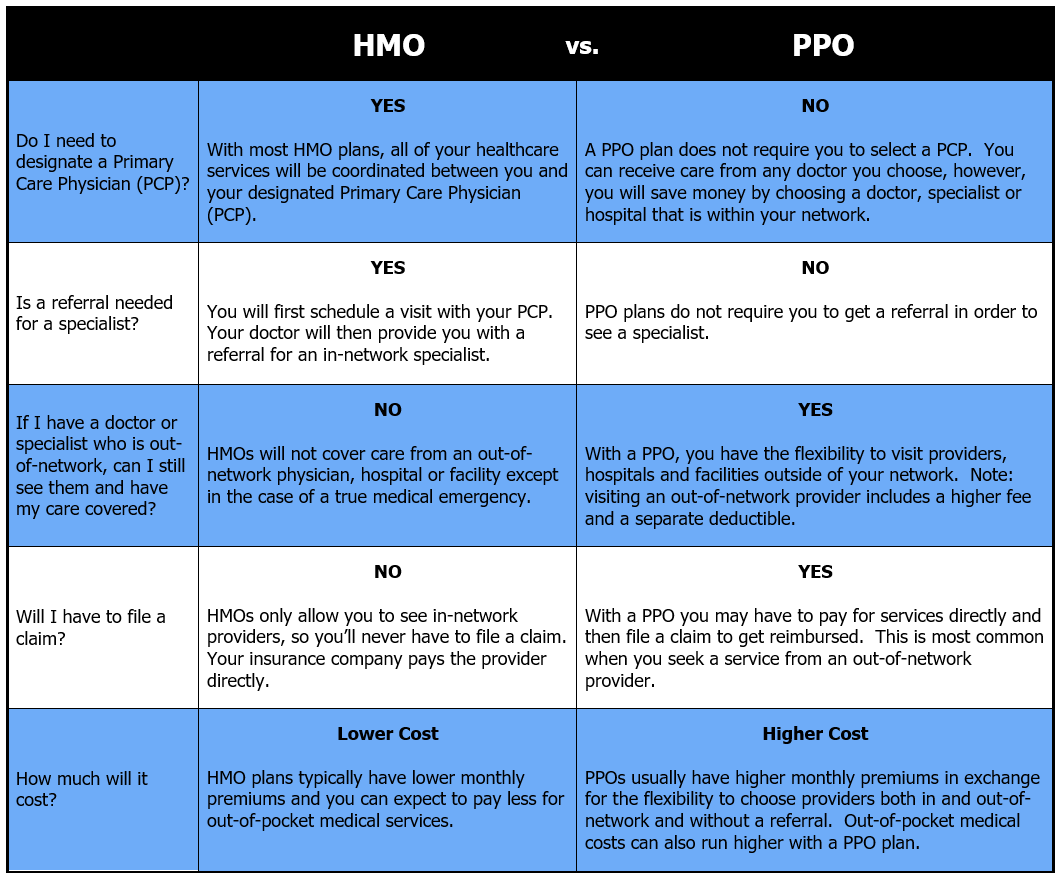

Yes Im a 28yoF millennial who just cant comprehend 0 comments. ELI5 whats the difference between HMO PPO and HSA health insurance. A PPO is a type of health insurance plan that gives you access to a network of providers.

A PPO is a great option for many people especially for larger families or those who have high annual medical expenses on a regular basis. HSA offers tax deductions while PPOs do not. If you know youll need more health care in the coming year and you can afford higher premiums a PPO is a good choice.

HSA can be fully or partially paid for by your employer while PPO is usually self-funded. If you dont have an HDHP you cant have an HSA. Both HRAs and HSAs are designed to give you more control of the money you spend on your health care.

Any unused funds are yours to retain in your HSA and accumulate towards your future health care expenses or your. ELI5 whats the difference between HMO PPO and HSA health insurance. The HSA-HDHP connection results in lower health insurance premiums than a typical PPO plan with a 500 or 1000 deductible.

While not every PPO plan offers eligibility for HSAs there are many PPO networks that offer comprehensive coverage and are compatible with HSAs as long as the member uses in-network providers. Health Savings Account HSA An HSA is a tax-advantaged account established to pay for qualified medical expenses of an account holder who is covered under a high-deductible health plan. 6 Differences Between an HRA vs HSA.

An HSA account helps you save for medical expenses. But with an HSA many of those costs can be planned for or offset by the opportunity to take an employer match invest and roll funds over. But this plan allows you to see specialists and out-of-network doctors without a referral.

But one crucial thing to remember is that unlike a PPO plan an HSA is not a health insurance plan. For most services youll have to meet a higher deductible before the HSA Plan pays its share of the cost of services than you would in the EPO or PPO Plans. Which Is Right for You.

Copays and coinsurance for in-network doctors are low. The networks are generally the same most HSA plans are PPO plans after all. Apply For A PPO or.

The IRS defines a high deductible health plan HDHP as any plan with a deductible of at least 1350 for an individual or 2700 for a family. And in order to open an HSA you need to be covered by an eligible high deductible health plan.