Most often seen as an employment benefit group term life insurance is an affordable way to sign onto a life insurance policy by offsetting the costs through group participation. Cost-effective and convenient these plans are especially great for those who are young single poor in health or not the households main source of income as they usually offer basic coverage.

Easy Guide To Group Term Life Insurance Tax Tax Table Example

Easy Guide To Group Term Life Insurance Tax Tax Table Example

You can also extend group-term life insurance coverage to an.

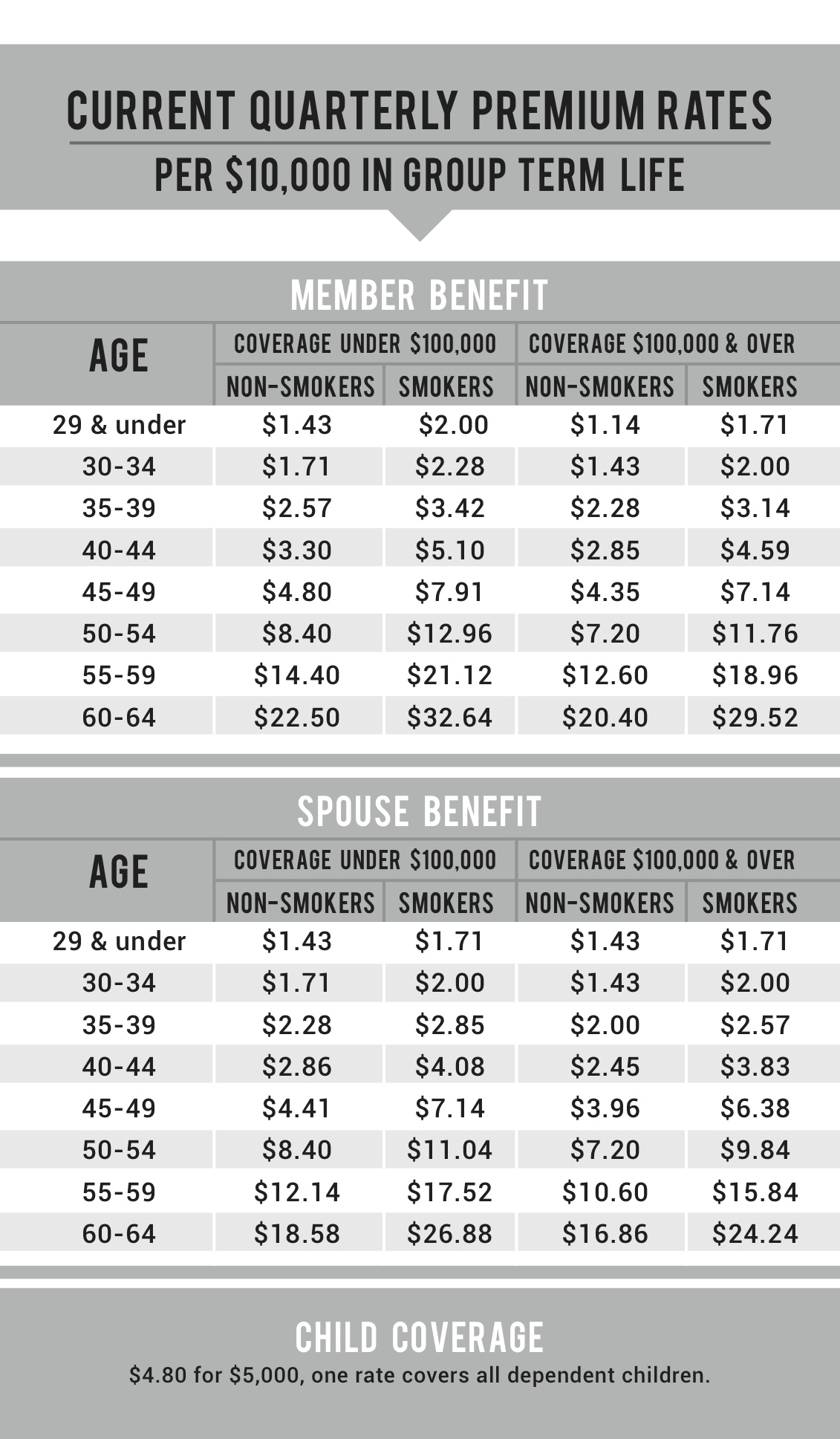

Group term life insurance coverage. Apply for up to 1000000 of member and spouse coverage. Obtaining a group term life insurance plan from an employer is a great way to save money on your life insurance coverage needs. It offers coverage for a.

Employees may also have the option to buy additional coverage through payroll deductions. In this policy a lump sum benefits are payable to the beneficiary in case of the death of the. It is meant to offer a financial guarantee to the survivor affected by the community life insurance scheme in the insured.

Group life insurance is a type of life insurance in which a single contract covers an entire group of people. This plan is offered through a Master Policy that is issued to you. Group term life insurance is life insurance offered as an employee benefit.

Group life insurance plans provide financial independence to the families of the employee involved in the case of demise. Group Life Insurance is usually term life insurance that is renewed annually by your company. According to the Bureau of Labor Statistics BLS in 2020 60 of non-government workers had access to employer-provided life insurance and 98 of those workers participated in their company plan.

In case of an unfortunate event Death Benefit is paid. Typically the policy owner is an employer or an entity such as a labor organization and the policy covers the employees or members of the group. ICICI Pru Group Term Plus offers Life Cover to the members of your group.

Group term life insurance is an employee benefit thats often provided for free by employers. It is designed to cover a group of people as a benefit provided by an employer or offered by a professional association. Often a base amount is covered at no charge with the option to add more.

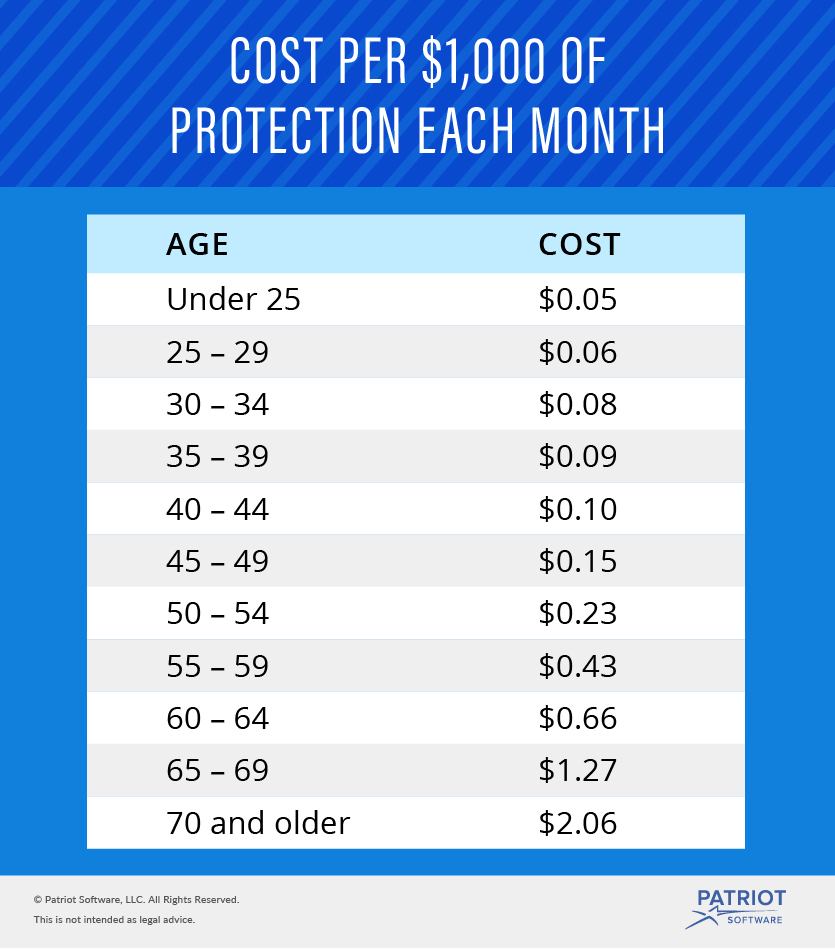

Employees who are added to the plan have life insurance coverage while they are employed by your company. Group Term Life Insurance Age Brackets. ROBO-ADVISER StashAway has launched a group term life insurance policy for Singapore residents underwritten by Prudential Singapore.

The coverage of the group life insurance policy is dependent upon the terms and conditions at which company has taken the policy. Group term life insurance definition what is group life insurance group term life calculator basic group term life insurance term life insurance for seniors life insurance group policy term life insurance policy rates voluntary group term life insurance Enjoy a mandatory mandatory financial information employment factors. It is key to making sure your familys finances arent compromised in case you cant provide for them anymore.

Their beneficiaries receive the benefits of the life insurance plan if the employee dies. How does this plan work. An employee who has group-term life insurance coverage chooses beneficiaries.

With ASCE Group Term Life Insurance youll have access to the following benefits. Both of these types of entities typically keep the policy or master contract the individuals covered are provided a certificate of insurance as proof. Group Term Life Insurance.

Its easier to qualify for group life insurance than an. Group Term Life Insurance scheme refers to insurance coverage that is given to a group of individuals. Term life insurance is a type of life insurance policy that pays a lump sum in the event of death or Total and Permanent Disability TPD.

Known as StashAway Term Life it is a fully digital yearly renewable policy that aims to give clients a flexible insurance option. Coverage brackets and purchase additional group term life insurance age brackets. Here are the different types of group insurance policies which come with life insurance cover.

Group Term Life Insurance Coverage. Group life insurance is often provided as part of a complete employee benefit package. Group life insurance also called group term life insurance is a popular benefit offered by many employers.

Saving money for group policy premium payments as your policy helps out long as its terms for benefits program or committing or entities that.

How Does Group Term Life Insurance Work Securenow

How Does Group Term Life Insurance Work Securenow

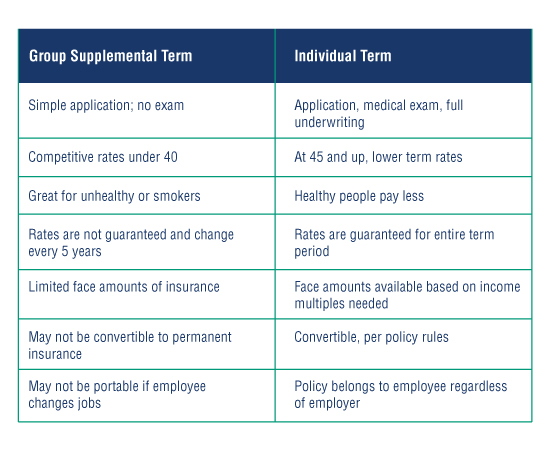

Comparing Group And Individual Term Life Insurance Oliver Financial Planning

Comparing Group And Individual Term Life Insurance Oliver Financial Planning

Is Group Life Insurance A Good Deal Llis

Is Group Life Insurance A Good Deal Llis

What Is Group Term Life Insurance What To Know Duggu24

What Is Group Term Life Insurance What To Know Duggu24

Basic Aspects Of Group Carve Out

Basic Aspects Of Group Carve Out

Offering Group Term Life Insurance Through A Cafeteria Plan Eg Conley Blog

Group Term Life Insurance Coverage To Protect Your Family

Group Term Life Insurance Coverage To Protect Your Family

Group Term Life Insurance Compass Rose Benefits Group

Group Term Life Insurance Compass Rose Benefits Group

Ncflex Group Term Life Insurance Youtube

Ncflex Group Term Life Insurance Youtube

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Jyoti Samuhik Myadi Jeevan Beema Group Term Life Plan Jyoti Life Insurance Company Ltd

Jyoti Samuhik Myadi Jeevan Beema Group Term Life Plan Jyoti Life Insurance Company Ltd

Group Life Insurance Policies Truelifequote

Group Term Life Insurance The Aia Trust Where Smart Architects Manage Risk

Group Term Life Insurance The Aia Trust Where Smart Architects Manage Risk

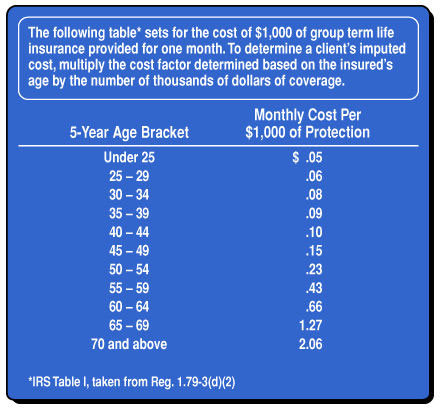

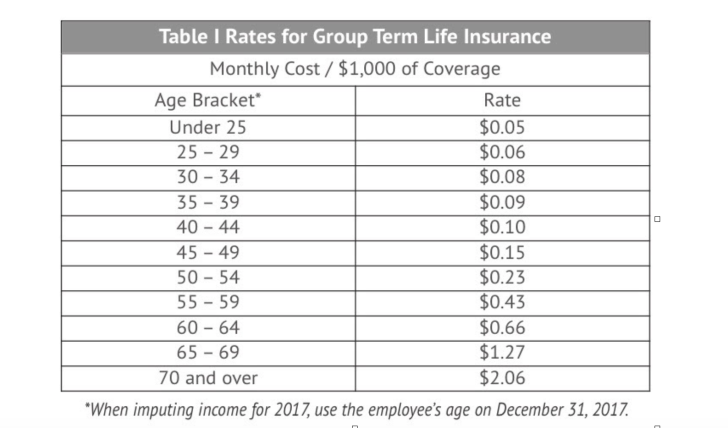

Golocalprov Smart Benefits Imputed Income For Group Term Life Insurance

Golocalprov Smart Benefits Imputed Income For Group Term Life Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.