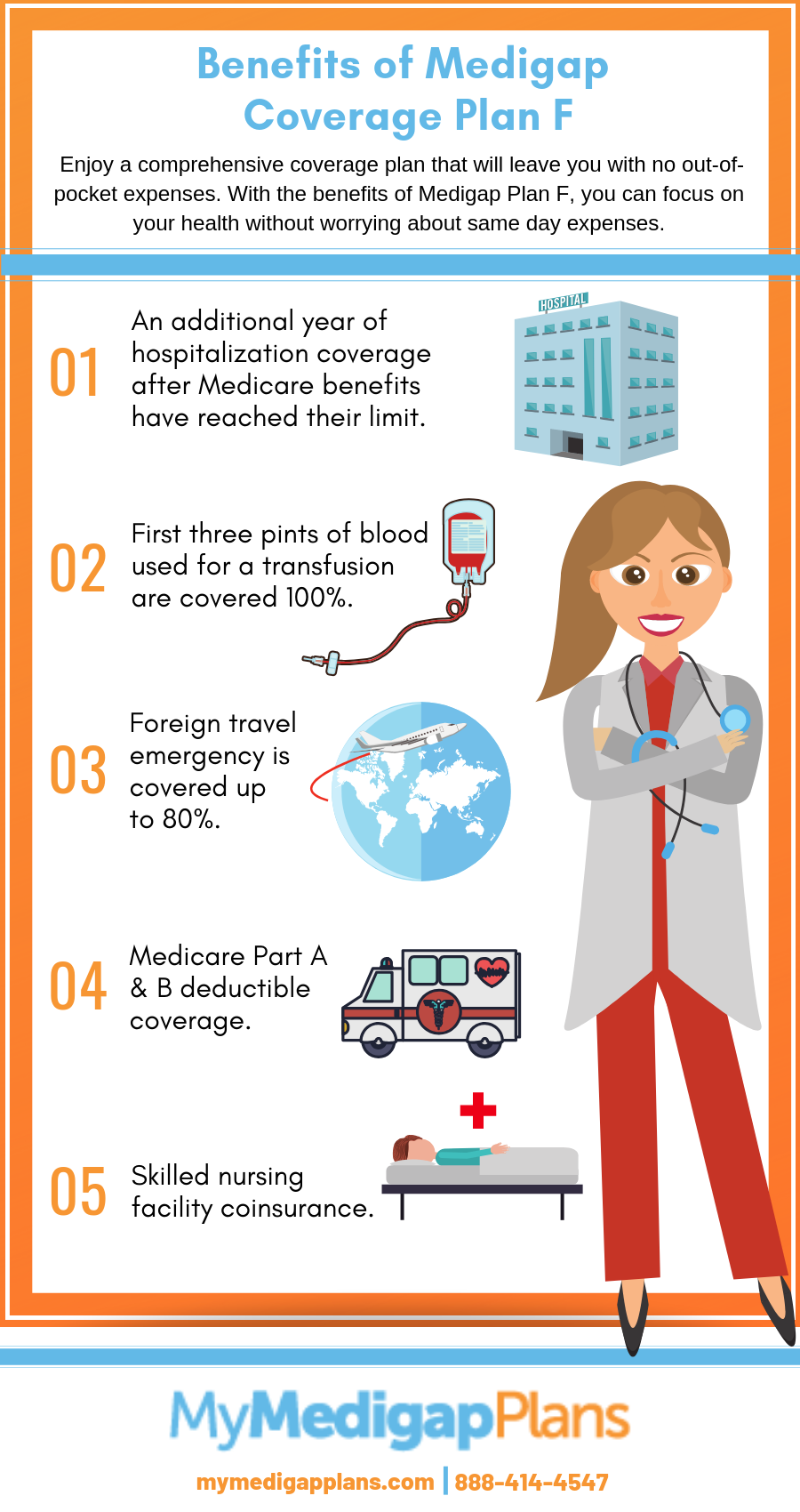

The average premium for Medicare Supplement Insurance Plan F in 2018 was 16914 per month or 2030 per year. Medigap Plan K and Plan L Have Annual Out-of-Pocket Spending Limits.

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

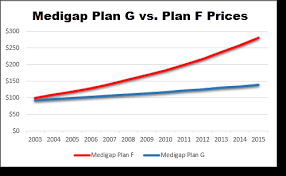

Because of the extra benefit the Plans F premium is always higher than the premium for Medicare Supplement Plan G.

Compare plan f premiums. Average monthly cost premium 39. In the medicare plan g vs f evaluation cost is offered by private insurers who have the liberty of fixing their own costs. If you choose this option you have to pay a deductible of 2240 for 2018 before the plan pays anything.

Because it offers the most benefits Plan F premiums are generally the most expensive. Based exclusively on premium if the difference between plan F and G premiums exceeds the Part B deductible it makes sense to go with Plan G. This amount can go up each year.

Additionally typical premiums for Medicare Plan F are slightly higher when compared to Plan G 140 versus 110 respectively and have a larger rate increase from year to year. Medicare Plan F is chosen by more than half 52 percent of seniors in the United States. Enrollment percentage for Plan A and Plan C were not available at the time this article was written.

High Deductible Plan F is popular as the premiums are usually very low when compared to most other supplements sold today. That means a Plan F is Plan F - no matter who you buy it from you get the exact. 2016 Plan F monthly premium rates for 65-year-old male.

The average Medicare Plan F premiums cost 169 per month in 2018 which is among the more expensive Medigap plan premiums and higher than the overall plan average of 152 per month. If you didnt become eligible for Medicare until 2020 or later Plan F wont be available to you. By comparison only about 12 percent will pick Plan G which is the second-most popular Medigap plan.

Plan F options have always been the most expensive Medigap plan with the most coverage. The premiums of the plans may differ significantly among different companies. Each Medicare Supplement plan gives you identical coverage.

As noted above Plan F including high-deductible Plan F will be gradually phased out. If you choose Plan F youll essentially only pay your monthly premium and have no out-of-pocket costs for your covered medical expenses. 1 The average cost of Plan F in 2018 was the fourth highest among the 10 Medigap plans used for analysis.

That leaves 12616 for the insurance company to keep as profit basically a convenience fee you are giving to them. 1 However its important to review the cost of a Medigap plan not only by its price tag but by its overall value. The average premium for a standard Plan F in 2018 was 16914 per month while the average premium for high-deductible Plan F was just 5716 per month.

However if you were Medicare-eligible before 2020 you can keep or pick up Medigap Plan F. Plan F also has a high-deductible option. Plan M 21875 Plan A 19233 and Plan C 18988 all had higher average premiums than Plan F in 2018.

Availability in the medigap plan f vs g comparison. How Much Does Plan F Extra Cost Compared to Standard Plan F. 52 Zeilen The average premium for high deductible Plan F in 2018 was 5716.

Plan N only has 12 percent of the total enrollment. With HD Plan F your benefits will not begin until a predetermined deductible has been reached. High-deductible policies have lower premiums but if.

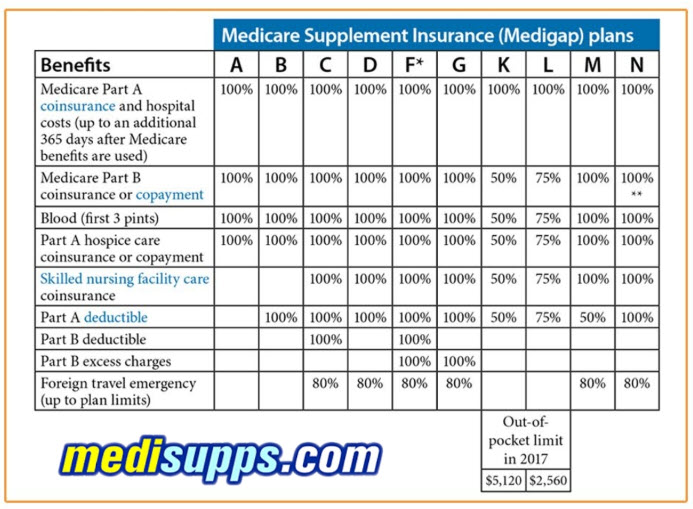

The increased premiums are because of the more comprehensive coverage that you receive through Plan F. Plan K and Plan L each have an annual out-of-pocket spending limit. Plan G has the same basic benefits as Plan F.

But you might be able to buy Medicare Supplement Plan G or high-deductible Plan G. The difference in premium is 31116 over a 12-month period. Instead the high-deductible Plan F may have lower premium costs than the standard Plan F.

So for those who choose a Plan F over a Plan G they are paying 31116 for the insurance company to pay the 185 deductible for them. For 2021 this deductible is set at 2370. Is there an alternative to Plan F.

Medicare Supplement coverage sometimes referred to as Medigap is a federally regulated health insurance plan sold by private insurers to help cover healthcare costs for Medicare-eligible individuals. Nationally monthly premiums for Plan G average about 150 compared with Plan Fs 186 according to Aon. Medicare Plan F may cost more than Plan G in some areas because plans offering more coverage often cost more than those offering less coverage.

Plan F is unique in that it is the only Medicare supplement sold today that offers a variation with a deductible. Currently the deductible for HD Plan F is. The average cost of Innovative Plan F is around 130-230 per month.

Market Percentage difference between high and low Highest premium Lowest premium. The High Deductible Plan F has a deductible of 2340 but because you have to pay more out-of-pocket the premiums for this plan tend to be significantly lower. While monthly premiums for this option may be lower you must pay a deductible before Plan F begins paying for benefits.

The monthly savings in Plan G more than cover the annual 185 deductible that people. This is offset by the fact that your out-of-pocket costs may be higher until youve reached the deductible.

Complete Medicare Supplement Plans Comparsion Chart For 2021

Complete Medicare Supplement Plans Comparsion Chart For 2021

Medicare Supplement Plans 2021 The 3 Best Plans

Medicare Supplement Plans 2021 The 3 Best Plans

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Your Guide To High Deductible Plan F Vs Medicare Supplement Plan F Medicareguide Com

Plan F Or Plan G Medigap Plans F G 65medicare Org

Plan F Or Plan G Medigap Plans F G 65medicare Org

Medigap Plan F What You Need To Know Ensurem

Medigap Plan F What You Need To Know Ensurem

Compare Plans Empower Medicare Supplements

Medicare Supplement Plans Comparison Chart Compare Medicare Plans

Medicare Supplement Plans Comparison Chart Compare Medicare Plans

Medicare Supplement Plans Comparison Chart Compare Medicare Plans

Medicare Supplement Plans Comparison Chart Compare Medicare Plans

Medicare Supplement Plans Compare The Best Plans

Medicare Supplement Plans Compare The Best Plans

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.