The Plan only allows for Medicare Part A and B before the January 2020 rule was rolled out. When you add these 80 days thats a 14840 benefit.

Important Information About Medigap Plan F The Med Sup Store

Important Information About Medigap Plan F The Med Sup Store

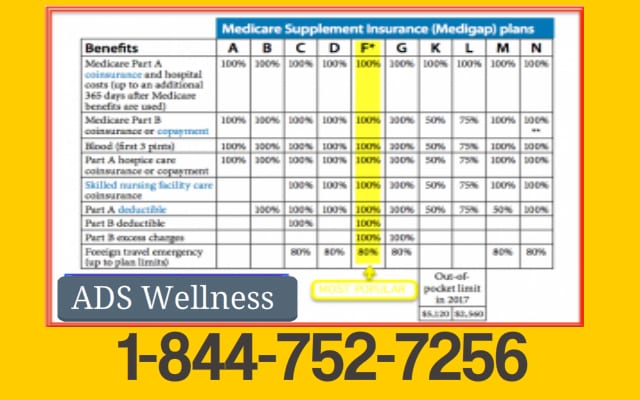

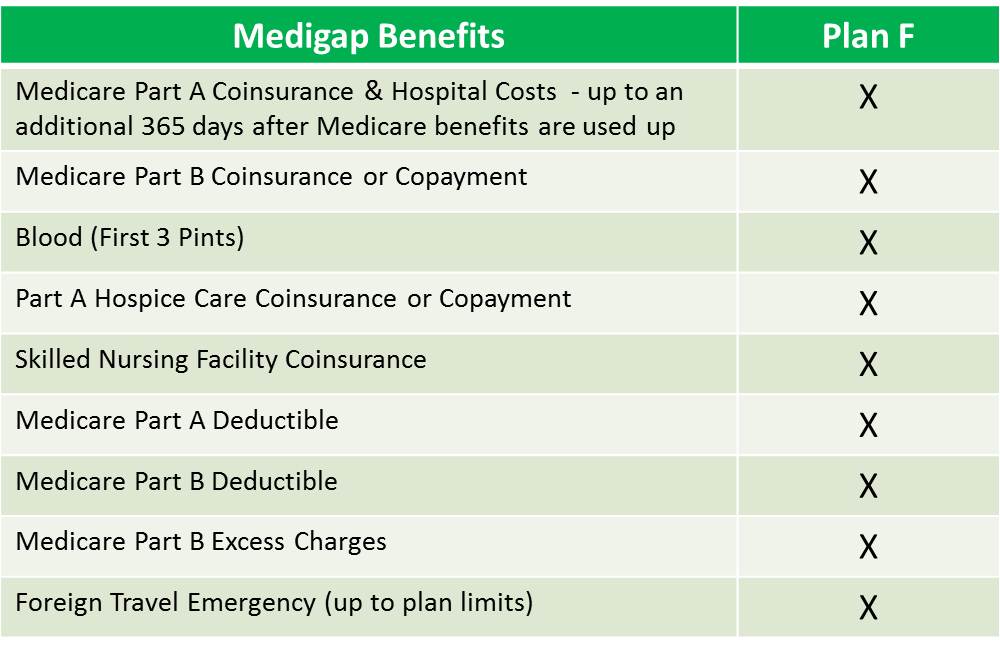

Out of all the available Medigap plans Medigap Plan F is the biggest and offers the most benefits.

Medigap part f. Medicare part B coinsurance or co-payment is at 100 in Plan F the same to skilled nursing facility care coinsurance. Medigap Plan F pays your 1484 Part A deductible every 60 day hospital benefit period. Best Medicare Part F Rates Benefits.

The Plan is expensive and the benefits associated with it are little. Your coverage is guaranteed renewable. So three insurance companies may all offer Plan F and each Plan F will have the exact same benefits to the insured person.

If you have been shopping for a Medicare Supplement also known as Medigap insurance plan you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs. Medicare Supplement Insurance Plan F also offers a high-deductible option and is the only Medigap plan to do so. What Does Medigap Plan F Cover.

You must have coverage under Medicare Parts A and B before you can enroll in Part F. Beginning in 2020 Plans F and C which cover the Part B deductible are no longer available to people newly eligible to Medicare after January 1 2020. 12 Zeilen As of January 1 2020 Medigap plans sold to new people with Medicare arent.

As a result of MACRA anybody who becomes eligible for Medicare in 2020 will not be able to purchase Plan F. Now available on all Priority Health Medigap plans. Many different companies offer Medicare Supplement plans.

Medigap Plan F gives you the most coverage of all the Priority Health Medicare supplement insurance plans. Then there are Parts C D which are optional and you can read about these parts and what they cover on this website. This cost would now be 64 for the United American High Deductible Plan F.

It is typically purchased for its affordability versus the excellent benefits it offers. According to CSG Actuarial 40 percent of the people who have Part F. For some people just having all supplementary expenses covered means they get to enjoy peace of mind about their healthcare.

Plan F is for beneficiaries looking for full coverage for all out-of-pocket costs including deductibles coinsurance and copayments. Well help you understand when Plan F. Medigap Plan F is the most comprehensive Medigap plan covering 100 of your cost-sharing.

Like Part A Part B only covers 80 of the Medicare-approved expenses. Plan F is one Medigap option. The high deductible Plan F comes with an annual deductible of 2300 in 2019.

Now lets take a closer look at the Medigap High Deductible Plan F which pays full benefits after you meet the annual deductible of 2340 in 2020. Medicare Supplement Plan F covers. It has a Part B deductible of 198 in 2020 for outpatient care.

After the first 20 days of skilled nursing Plan F pays 18550 coinsurance in 2021 up to 100 days. Medicare supplement insurance Medigap is a type of Medicare insurance policy that can help pay for some costs that original Medicare parts A and B doesnt cover. However it is not available to everyone who is eligible for Medicare.

It covers your Medicare Part A and Part B deductibles your daily copays for hospitalization and skilled nursing facility care excess charges and emergencies wherever you travel worldwide. You may have also heard of something called Medicare Supplement Plan F. Part B covers doctor visits and related charges covered under Medicare for providers.

Medigap Plan F sometimes mistakenly called Medicare Part F is the most comprehensive Medicare supplement plan available. Also known as Medicare Supplement Plan F this plan covers all Original Medicare deductibles coinsurance and copayments leaving you with no out-of-pocket costs on all Medicare-approved services. Medicare Supplement Plan F is being phased out as a result of The Medicare Access and CHIP Reauthorization Act of 2015 also known as MACRA.

Medigap Part F Costs First only Original Medicare itself has Parts. It leaves the remaining 20 on the Part B participant. Medigap Plan F will have limited availability.

This particular example from United American a High Deductible Medigap Plan F. So lets dissect this phrase. Medicare Plan F isnt a part of Medicare.

You can never lose. Medicare Part F is the most comprehensive plan offered and the most popular among the 10 Medicare Supplement plans. Part B excess charges are also at 100.

This means you must spend 2300 out of pocket on covered services before the plan coverage kicks in. It is very popular for this same reason and seniors love how much coverage it provides them. Moreover it covers the following.

Plan F might be able to do the same for you. Its actually one of several Medicare supplement insurance Medigap plans. Plan F also covers the Medicare Part B expenses.

Its the most comprehensive Medicare Supplement insurance plan among the 10 standardized plans available in most states. There is Part A Part B which are your basic benefits for hospital and outpatient coverage. If you became eligible for Medicare in 2019 or earlier however you can still enroll in Plan F in 2020 and beyond.

Due to federal legislation all plans must offer the same coverage within their Medigap Plan F.

Medigap Plan F The Most Common And Comprehensive Plan

Medicare Supplement Plan F Quote Senior Healthcare Direct

Medicare Supplement Plan F Quote Senior Healthcare Direct

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan F Call 1 844 752 7256 Ads Lifestyle

Medicare Supplement Plan F Call 1 844 752 7256 Ads Lifestyle

Medigap Plan F Vs Plan N Medicare Supplement Medicare Medicare Supplement Plans

Medigap Plan F Vs Plan N Medicare Supplement Medicare Medicare Supplement Plans

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plan Comparison Medicare Nationwide

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medicare Supplement Plans Ohio Ohio Medigap Plans

Medicare Supplement Plans Ohio Ohio Medigap Plans

Medicare Supplement Medigap Plan F What Is Medicare Plan F

Medicare Supplement Medigap Plan F What Is Medicare Plan F

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.