What is the maximum income for ObamaCare. Take the 35000 income from above not including cost basis and subtract that from the ACA income limit which is 67400 for 2020.

As requirements vary by state reach out to your states Medicaid office or insurance office with eligibility questions.

Aca maximum income 2020. The basic math is 4X the Federal Poverty Level FPL as determined by the government. Americans in this income range are caught in the trap where they make too much for Medicaid but not enough to afford private health plans. Prior to 2021 you were expected to chip in anywhere from 2 to 983 of your income.

Phaseout levels After earning an income of 100400 or higher for a family of four 83120 for a family of three 65840 for a married couple with no kids and 48560 for single individuals you will no longer receive government health care subsidies. Premium subsidies normally arent available to people with income ACA-specific MAGI above 400 of FPL although as noted above thats not the case for 2021 and 2022. Remember the federally facilitated Affordable Care Act Marketplace savings are based on your expected household income for 2021 not last years income.

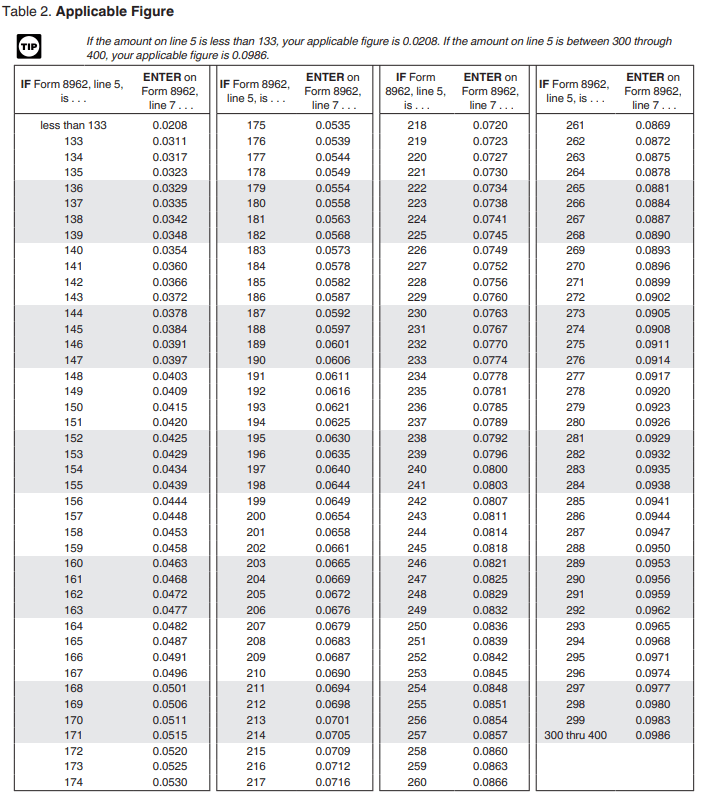

For example in 2020 people with income between 250 and 300 of the Federal Poverty Level were expected to pay between 829 and 978 of their income toward a second lowest-cost Silver plan in their area. See Stay Off the ACA Premium Subsidy Cliff. For 2021 those making between 12760-51040 as an individual or 26200-104800.

You can probably start with your households adjusted gross income and update it for expected changes. Compare changes between 2019 2020. 1 Find out how to estimate your expected income Healthcaregov.

Did you know it changes each year. The Maximum Income You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below. Here are the limits for 2020 plans for individuals and families.

When the ACA was written the expectation was that coverage would be affordable without subsidies at that income level. For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. If your MAGI goes above 400 FPL even by 1 you lose all the subsidy.

But if your household income was between 300-400 you paid a maximum of 95 of your income towards the premium. We are in the middle of the COVID Special Election Period for ACA customers and many more critical changes will be rolled out beginning 412021 due to the recently announced American Rescue Plan Act. Select your income range.

For 2020 your out-of-pocket maximum can be no more than 8150 for an individual plan and 16300 for a family plan before marketplace subsidies. Estimating your expected household income for 2021. The American Rescue Plan Act of 2021 lowered the applicable percentages significantly in 2021 and 2022 from previous years.

Before the ARPA if your household income was 400 or more of the poverty level you received no premium assistance tax credits and paid 100 of your premium. Learn about 2020 updates to The Affordable Care Act ACA IRS FSA Limits HSA Contribution Limits more. In this example the personal deduction does not fully wipe out the ordinary income as it did in Example 2.

Because employers dont usually know their employees household income the IRS created 3 safe harbors for determining affordability. Are you sure youre offering employees affordable health insurance using the correct ACA affordability percentage. Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate.

Heres more on the 2020 percentages. Therefore for 2020 plan year the most you can charge employees for the lowest-priced self-only plan is 978 of their household income. Updated ACA Changes for April 1 2021.

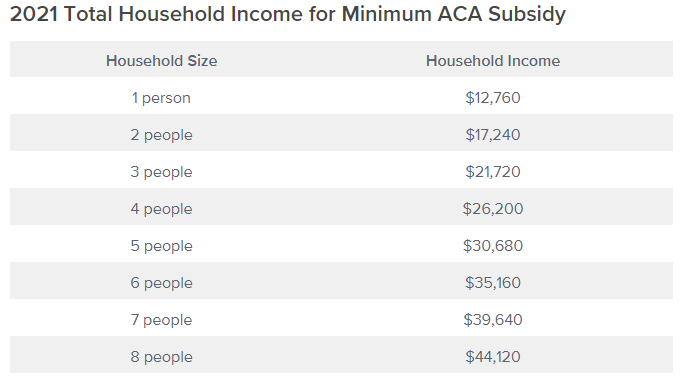

For a family of four that number equaled 104800 a year. For 2020 the maximum monthly premium contribution that meets the FPL safe harbor will be 986 percent of the prior years FPL 12490 for the mainland US divided by 12 or 10179. Previous 2021 Total Household Income for Maximum ACA Subsidy.

Each year the ACA sets new limits for out-of-pocket maximums and deductibles. The remaining 32400 is available for a Roth conversion. And prior to 2021 you could earn up to 400 of the federal poverty level to qualify for subsidies also known as the subsidy cliff.

In 2020 for example thats a family of four with an income between 26200 and 104800 a year. This is a fantastic opportunity for you to assist your existing customers and also grow your.

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

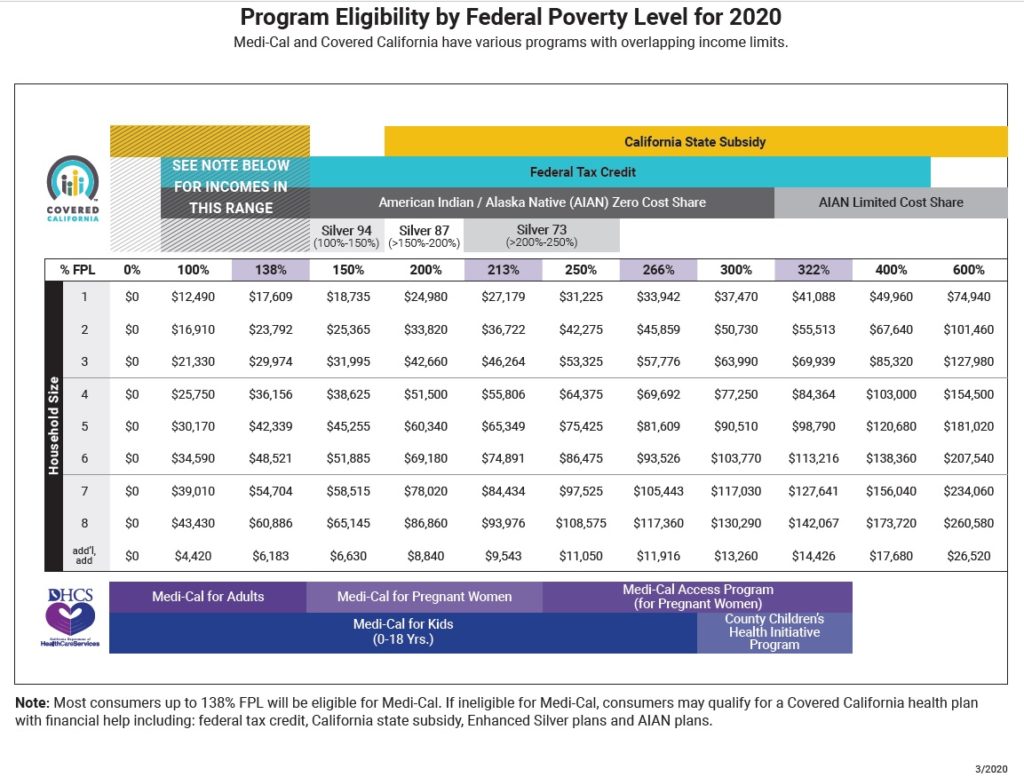

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

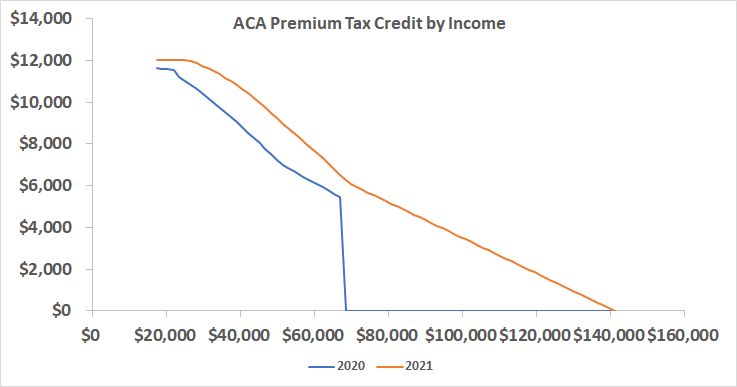

Aca Premium Subsidy Cliff Turns Into A Slope In 2021 And 2022

Aca Premium Subsidy Cliff Turns Into A Slope In 2021 And 2022

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

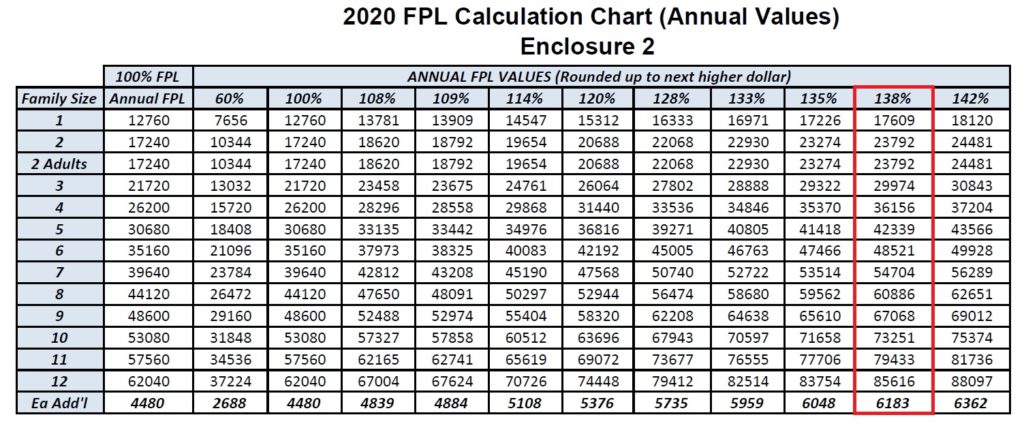

What Are The 2021 Federal Poverty Levels Independent Health Agents

What Are The 2021 Federal Poverty Levels Independent Health Agents

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.