Cobra coverage - allows continuation of employer sponsored health plans. A person on COBRA will not be eligible for coverage in Covered California unless their COBRA premium is unaffordable that is it fails the 95 of income test read Bad News.

How To Compare Cobra Versus Covered California Health Plans And Rates

How To Compare Cobra Versus Covered California Health Plans And Rates

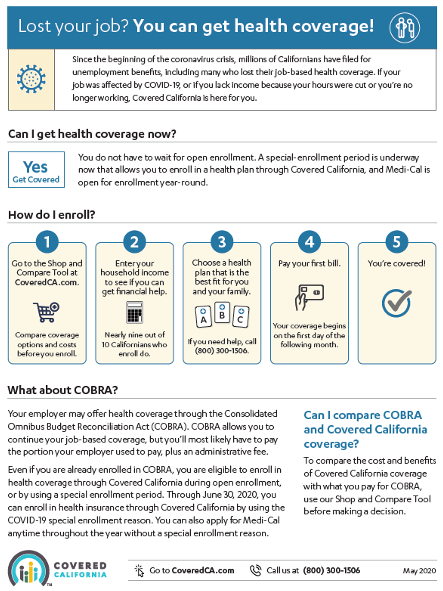

Can I drop it and enroll in Covered California now.

Covered california vs cobra. If the COBRA health plan premiums are more than 95 of the household income then his family would become eligible for premium assistance. We dont recommend choosing to remain uninsured because you could face tax penalties under the Covered California. Cal-COBRA is a California Law that lets you keep your group health plan when your job ends or your hours are cut.

Of course even without the premium assistance the family health plans through Covered California may still be less expensive that those offered through COBRA. Depending on the level of benefits previously provided by the employer the COBRA monthly premiums may be more expensive than desired coverage through Covered California ie. Instead you can focus on choosing which health insurance plan is right for you.

Each option has its own set of eligibility requirements and you will like receive confirmation of the plans and rates available to you. For individuals covered under Federal COBRA Cal-COBRA may also be used to extend health coverage for a combined period of up to 36 months. It may also be available to people who have exhausted their Federal COBRA.

In that case you are eligible for Covered California coverage and also eligible for a federal subsidy if your income qualifies you. If employee or dependents may not need the rich covered previously offered by the employer. If you choose to decline coverage your options are to enroll in the private marketplace or Covered California or to be uninsured.

What about Cobra versus Covered California for RX This is the other consideration along with doctor networks. After Open Enrollment ends January 312017 if you voluntarily drop your COBRA coverage or stop paying premiums you will not be. In both Cal-Cobra and Federal Cobra you are allowed to sign up for Cobra anytime within 60 to 90 days of the time your company-benefit plan ends.

If your former employer had 20 employees then you fall into Federal Cobra. The formulary is smaller on Covered California plans so if you have medications now check with us first. When you extend your federal COBRA coverage under state Cal-COBRA you have the opportunity to continue the same health plan as under federal COBRA.

If you have both COBRA coverage and Covered California at the same time and you receive financial help to help you pay your Covered California premium. If you use a COBRA plan to cover the one- or two-month gap that can happen when you enroll in Covered California after losing employer coverage you must cancel the COBRA coverage once the Covered California plan becomes effective. If COBRA is too expensive you can decline coverage.

The law says you have at least 60 days and some employers. Months of federal COBRA coverage you may have the opportunity to continue coverage for a maximum of 36 months through a combination of federal COBRA and Cal-COBRA. Under COBRA there are often no cost-sharingpremium assistance options available and coverage.

If you sign up for insurance through Covered California you are covered by Obamacare. Since these two options are the same you do not have to worry about choosing between the two. California State Retirement Benefits of CalPERS.

Cal-COBRA may also be able to extend your coverage if your federal COBRA. Small Employer 2 to 19 employees. Both COBRA coverage and Covered California plans qualify as sufficient coverage under the Affordable Care Act to avoid the consumer being charged the.

We typically recommend that employers with 20 or more employees outsource the COBRA administration to one of our preferred third-party administrators TPA as COBRA requires a number of plan notifications to take place at different stages in the COBRA. This is because individual plans often have different network options of providers and can offer an array of different health costs for services especially for deductibles coinsurance etc. Therefore if you like your health plan and can afford to pay the monthly premium you can choose to continue your health insurance plan by enrolling in COBRA.

The formulary list of drugs is different between group plans Cobra and individual family plans Covered Ca. Cal-COBRA applies to employers and group health plans that cover from 2 to 19 employees. If you take advantage of CalCOBRA you must pay the entire premium that both you and your employer have paid in the past plus an administrative fee.

There is nothing to stop anyone from dropping COBRA coverage and enrolling in an ACA. My COBRA coverage wont expire for another 9 months. Federal retirement coverage or FEHB.

Consider your health and what you will need to use your health coverage for when deliberating between metal tiers. Those with few health. During this segment that aired o.

If the company had 19 or fewer employees then you are subject to Cal-Cobra the California version of Cobra. ENROLLING IN COVERED CALIFORNIA OR OFF EXCHANGE PLANS WITH THE CARRIER. During Open Enrollment you can sign up for a Covered California plan even if you already have COBRA.

In California if your employer has two to 19 employees you may be covered by Cal-COBRA. Retiree Benefits from a Union or Company. Conversely continuing group coverage through COBRA is often more expensive than Individual plans via Covered California.

CalCOBRA provides the same protection as COBRA in California for small employers with 2 to 19 workers.

.png) How To Compare Cobra Versus Covered California Health Plans And Rates

How To Compare Cobra Versus Covered California Health Plans And Rates

Covered California The Cobra Glitch Kqed

Covered California The Cobra Glitch Kqed

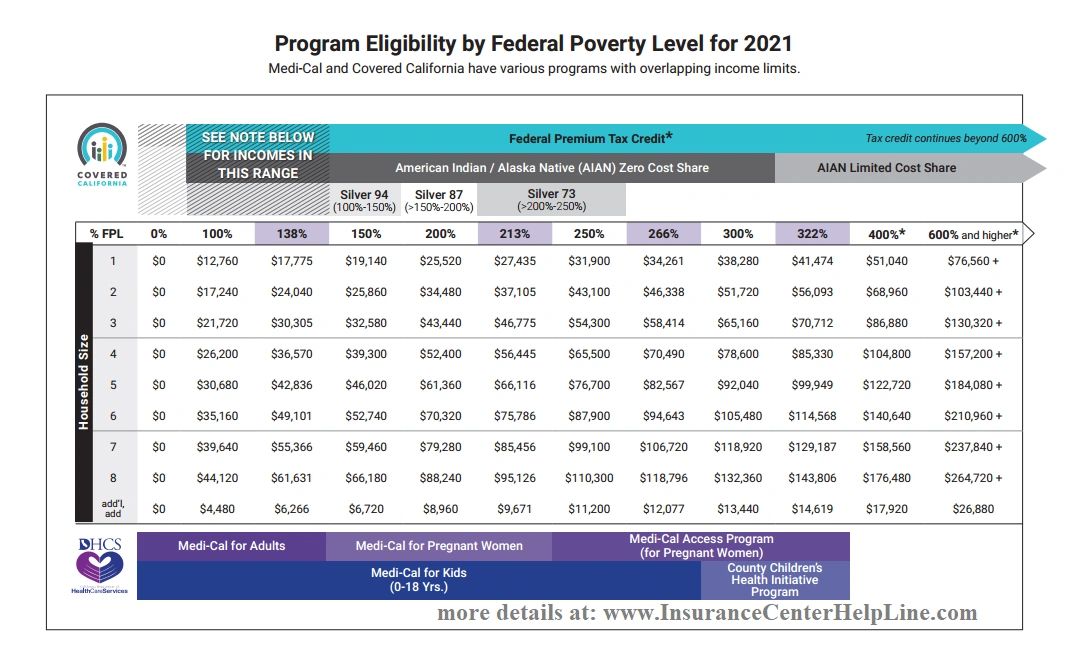

Covered California Vs Medi Cal Vs Obamacare Health For California

Covered California Vs Medi Cal Vs Obamacare Health For California

Covered California Vs Medi Cal Vs Obamacare Health For California

Covered California Vs Medi Cal Vs Obamacare Health For California

Covered California Twitterissa Recently Lost Health Coverage And Being Offered Cobra You May Be Eligible For Financial Help To Lower The Cost For A Plan Through Coveredca Weigh Your Options Https T Co Yiq25mj3lm Https T Co Gzhurjjvsj

Covered California Twitterissa Recently Lost Health Coverage And Being Offered Cobra You May Be Eligible For Financial Help To Lower The Cost For A Plan Through Coveredca Weigh Your Options Https T Co Yiq25mj3lm Https T Co Gzhurjjvsj

Covered California Vs Cobra Steve Grady Insurance Services

Health Insurance Is More Than An Insurance Card Tips For Using Your Coverage Los Angeles Sentinel Los Angeles Sentinel Black News

Health Insurance Is More Than An Insurance Card Tips For Using Your Coverage Los Angeles Sentinel Los Angeles Sentinel Black News

How To Compare Cobra Versus Covered California Health Plans And Rates

How To Compare Cobra Versus Covered California Health Plans And Rates

Covered California Sees More Than 123000 Consumers Sign Up For Coverage During The Covid 19 Pandemic

Covered California Sees More Than 123000 Consumers Sign Up For Coverage During The Covid 19 Pandemic

How To Compare Cobra Versus Covered California Health Plans And Rates

How To Compare Cobra Versus Covered California Health Plans And Rates

Health Insurance Cobra The American Rescue Plan

Health Insurance Cobra The American Rescue Plan

.jpg?width=850&height=566) Health Care Options Cobra Vs Individual Coverage On Covered California Word Brown

Health Care Options Cobra Vs Individual Coverage On Covered California Word Brown

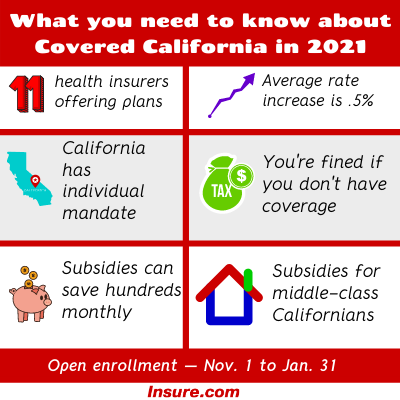

Covered California Open Enrollment 2021 A Complete Guide Insure Com

Covered California Open Enrollment 2021 A Complete Guide Insure Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.