You may also face the LEP if at any time after your initial enrollment period is over theres a period of 63 or more days in a row when you dont have Part D or other creditable prescription drug coverage. So instead of paying the base rate of 3319 per month for Medicare Part D in 2019 your monthly costs with the late enrollment penalty would be 3719.

Medicare Part D Senior Plan Advisors

Medicare Part D Senior Plan Advisors

If you decide to get this coverage.

Is there a cap on medicare part d penalty. For each month you delay enrollment in Medicare Part D you will have to pay a 1 Part D late enrollment penalty LEP unless you. Unfortunately if these patients did miss the Medicare Open Enrollment sign up window which runs from October 15th to December 7th they will have to wait until next year to change plans or enroll in a Part D plan in most cases. However you could find a Part D plan that is less.

In 2019 this premium is 3319. If youre eligible for a special enrollment period and sign up for Medicare Part D during this time you will not incur a penalty. Medicare rules require you to enroll in Medicare Part B during your Initial Enrollment Period to avoid paying a late enrollment penalty that will be added to your Medicare Part B premiums.

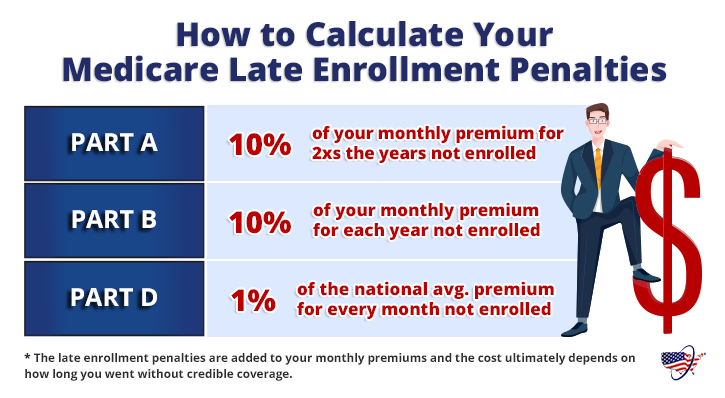

You will also not incur a penalty. Have creditable drug coverage. The Part D penalty is 1 of the average premium for every month you went without coverage.

The monthly premium is rounded to the nearest 10 and added to your monthly Part D. When calculated this penalty is rounded to the nearest 010 and added to the base monthly premium youre required to pay. 2021 Medicare Part B monthly premium 2021 Medicare Part D monthly premium.

Hi Lindsay if a person is eligible for Medicare prior to 65 and they didnt enroll in Part D I do know that if they enroll in Part D within their 2nd ICEP at 65 they get a clean slate and dont have to pay the penalty. The math I did was based on the. Medicare calculates the penalty by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage.

You pay the penalty for as long as youre enrolled in a Medicare Part D plan. Just your plans premium 8800111000 176000222000. Creditable prescription drug coverage is coverage that is expected to pay at least as much as standard Medicare.

Unfortunately there is a Medicare Part B late enrollment penalty. Your plans premium 1230. First lets start by understanding how this Late Enrollment Penalty is calculated.

The penalty is rounded to 970 which youll pay along with your premium each month. Although your Part B premium amount is based on your income your penalty is calculated based on the base Part B premium. As you could have enrolled then but didnt you can sign up only during the annual open enrollment period which runs from October 15 to December 7 each year with coverage beginning January 1just like anybody who misses their enrollment deadline.

The penalty for late enrollment in a Part D plan is 1 of the average Part D premium for each month you delay enrollment. In your case if you sign up with a Part D drug. People who qualify for Extra Help under Part D wont be charged a late enrollment penalty when they enroll in a Medicare drug plan.

You must pay for it out of your own pocket. If you have creditable prescription drug coverage when you first become eligible for Medicare generally you can keep it without paying the late enrollment penalty if you sign up for Part D later. The late enrollment penalty is added to your monthly Part D premium for as long as you have Medicare.

Prove that you received inadequate information about. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. You may have to pay a higher monthly premium for your Medicare Part D Prescription Drug Plan if you go 63 or more consecutive days without creditable prescription drug coverage after your Initial Enrollment Period IEP.

However if someone is on Medicare disability and doesnt enroll in Part D and also chooses not to enroll in Part D at 65 would the penalty start when they first became eligible for Medicare or would the penalty. Medicare rounds this amount up to the nearest 010 then adds it to your monthly Part D. If you do not enroll in Part D when you are first eligible for Medicare you may have to pay the Medicare Part D late enrollment penalty Part D LEP or LEP.

In general youll have to pay this penalty for as long as you have a Medicare drug. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. If you multiply 132 x the current average premium that would give you an additional 44 to pay on top of the 3306.

You may delay enrolling in Medicare Part D without penalty if you qualify for Extra Help or have creditable drug coverage. If its been more than 63 days since youve had creditable coverage then the penalty. The penalty is then added to your actual premium amount.

Your penalty for 2021 would be 33 cents x 12 for the 12 months of 2020 you werent covered or 396. Moreover a penalty will be added onto their monthly premium for years to come. When the Part D program began in 2006 people already in Medicare could sign up until May 15 of that year without incurring a late penalty.

The late enrollment penalty is an amount added to your Medicare Part D. If you went 11 years without coverage that equates to 132 months. As a reminder unlike Medicare Part A Medicare Part B isnt free.

You may owe a late enrollment penalty if at any time after your initial enrollment period is over theres a period of 63 or more days in a row when you dont have Part D or other creditable prescription drug coverage. Since the base Part B premium in 2021 is 14850 your monthly premium with the penalty will be 25245 14850 x 07 14850. Qualify for the Extra Help program.

The late enrollment penaltyLEP is an amount added to your Medicare Part D. If you dont sign up for Part D when youre first eligible you may have to pay a Part D late enrollment penalty. If an individual disenrolls from his or her Medicare drug plan and goes 63 days or more in a row without other creditable coverage Medicare may charge a late enrollment penalty if he or she later.

Medicare prescription drug coverage Medicare Part D is optional.

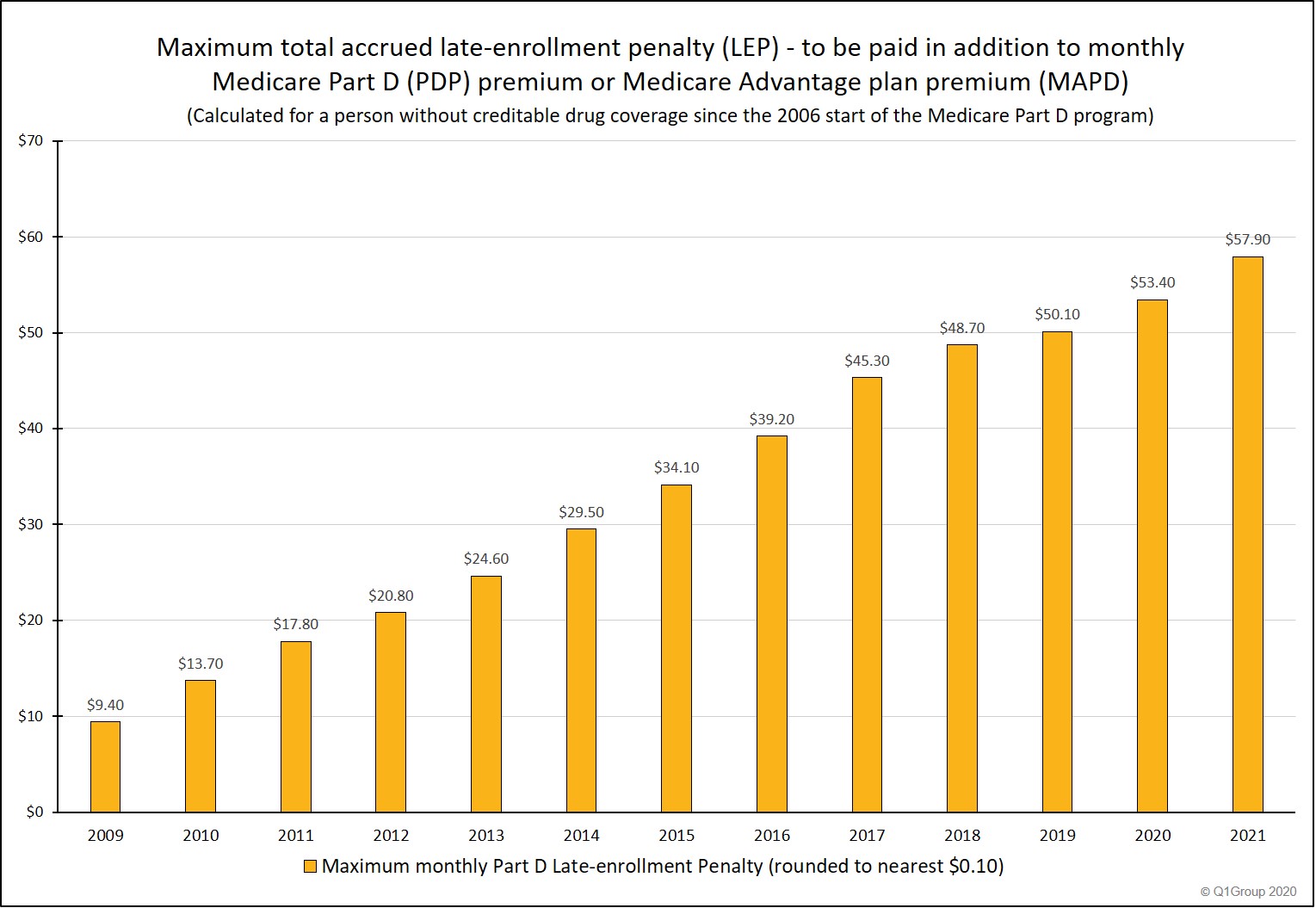

2021 Medicare Part D Late Enrollment Penalties Will Increase Slightly Maximum Penalties Can Reach Up To 695 For The Year

2021 Medicare Part D Late Enrollment Penalties Will Increase Slightly Maximum Penalties Can Reach Up To 695 For The Year

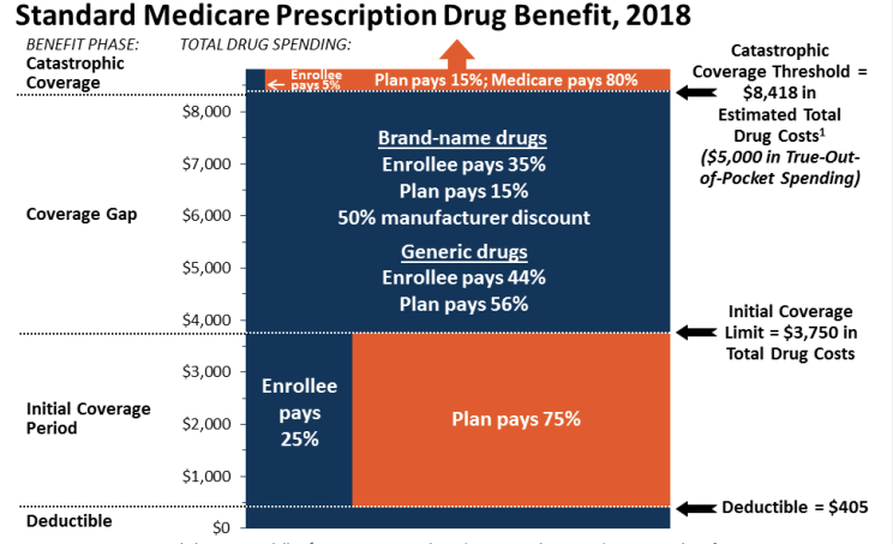

Medicare Part D In A Nutshell 2018 Steinlage Insurance Agency

Medicare Part D In A Nutshell 2018 Steinlage Insurance Agency

2021 Medicare Part D Late Enrollment Penalties Will Increase Slightly Maximum Penalties Can Reach Up To 695 For The Year

2021 Medicare Part D Late Enrollment Penalties Will Increase Slightly Maximum Penalties Can Reach Up To 695 For The Year

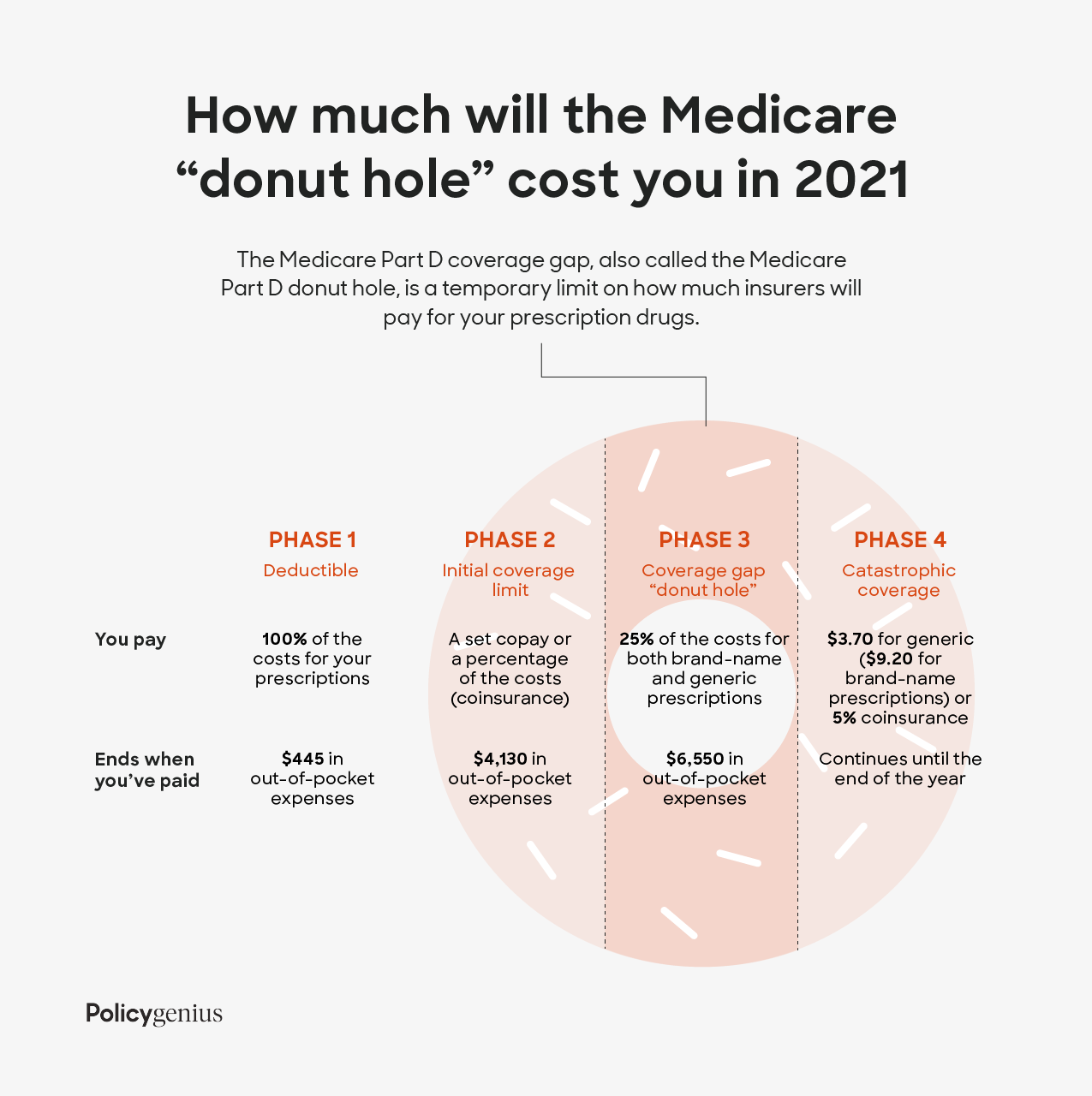

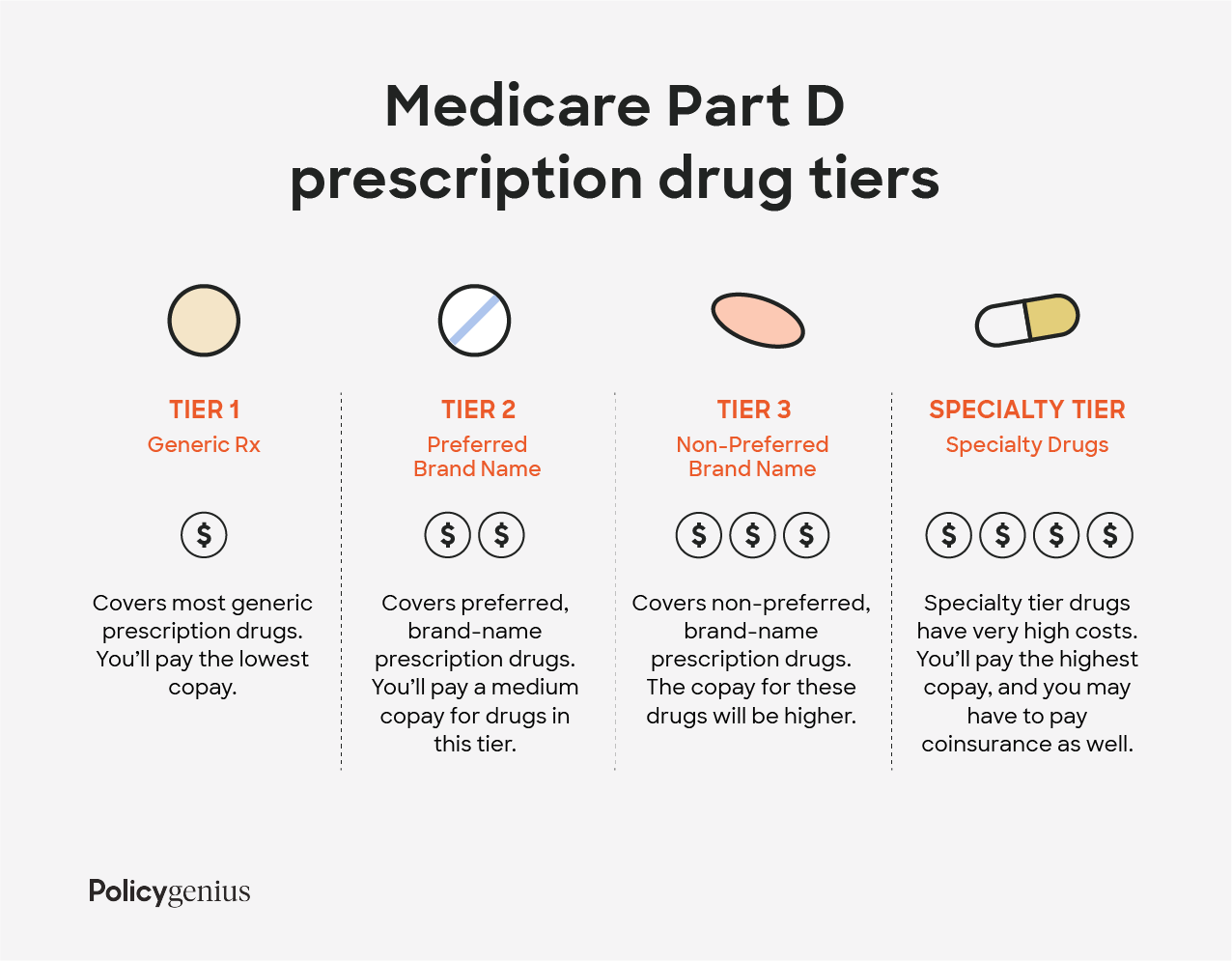

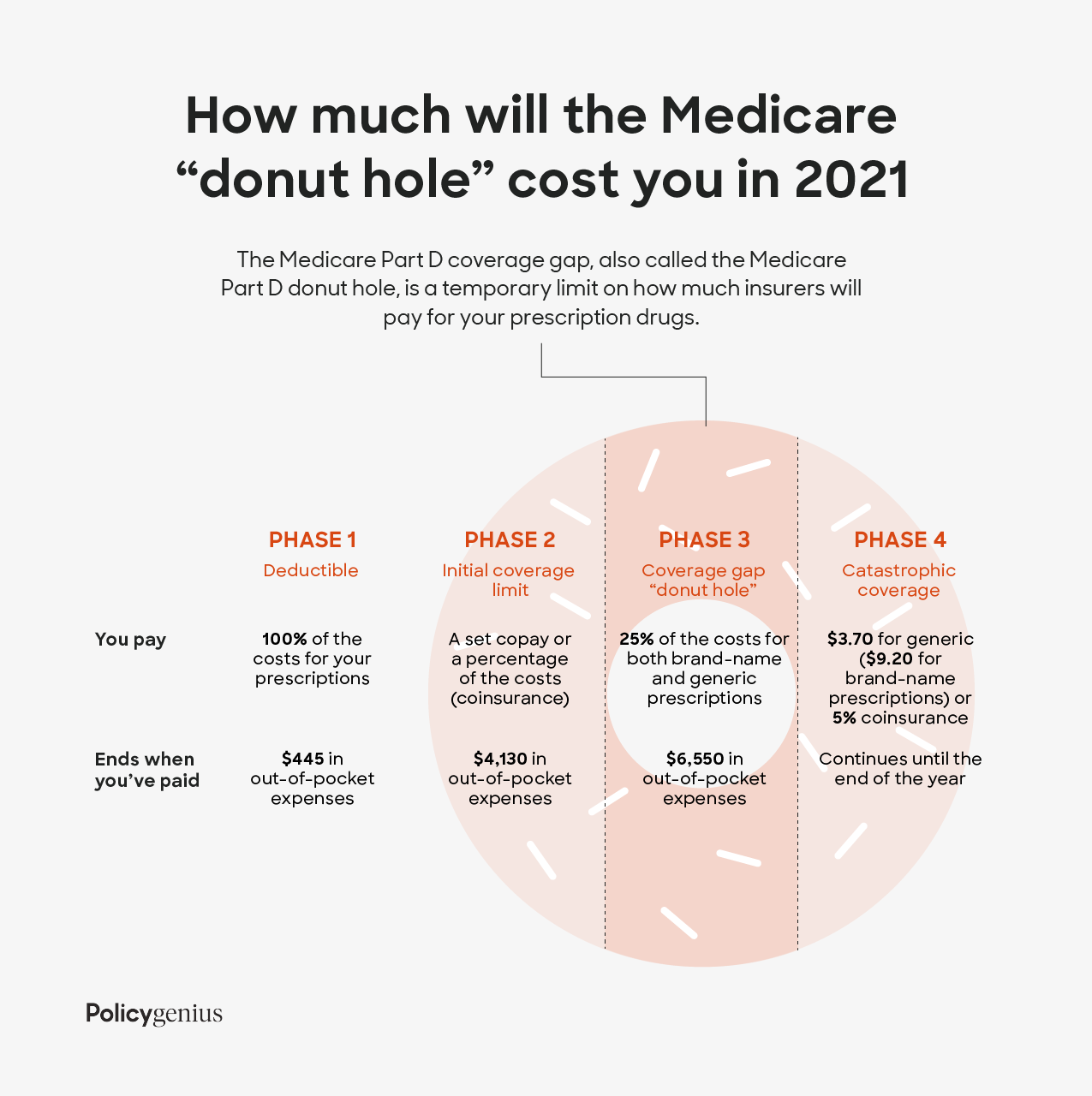

Your Guide To Medicare Part D For 2021 Policygenius

Your Guide To Medicare Part D For 2021 Policygenius

:max_bytes(150000):strip_icc()/medicare-part-d-costs-4589863_FINAL-a334073127ad461fbd5457a7d74d1e6c.png) How Much Does Medicare Part D Cost

How Much Does Medicare Part D Cost

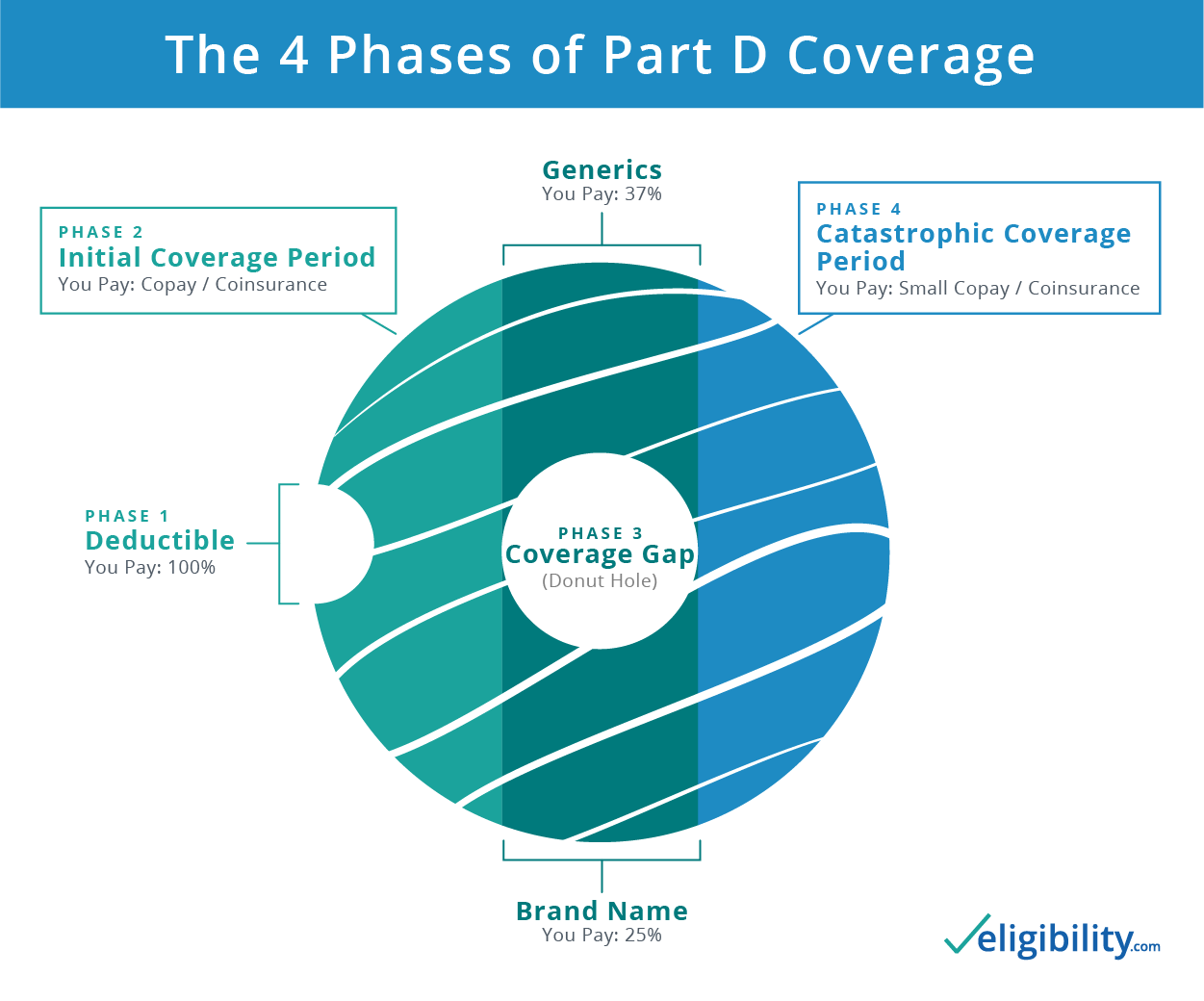

Medicare Part D Premium And Deductible Costs For 2020 Eligibility

Medicare Part D Premium And Deductible Costs For 2020 Eligibility

Your Guide To Medicare Part D For 2021 Policygenius

Your Guide To Medicare Part D For 2021 Policygenius

Find Medicare Part D Prescription Drug Plan Coverage

Find Medicare Part D Prescription Drug Plan Coverage

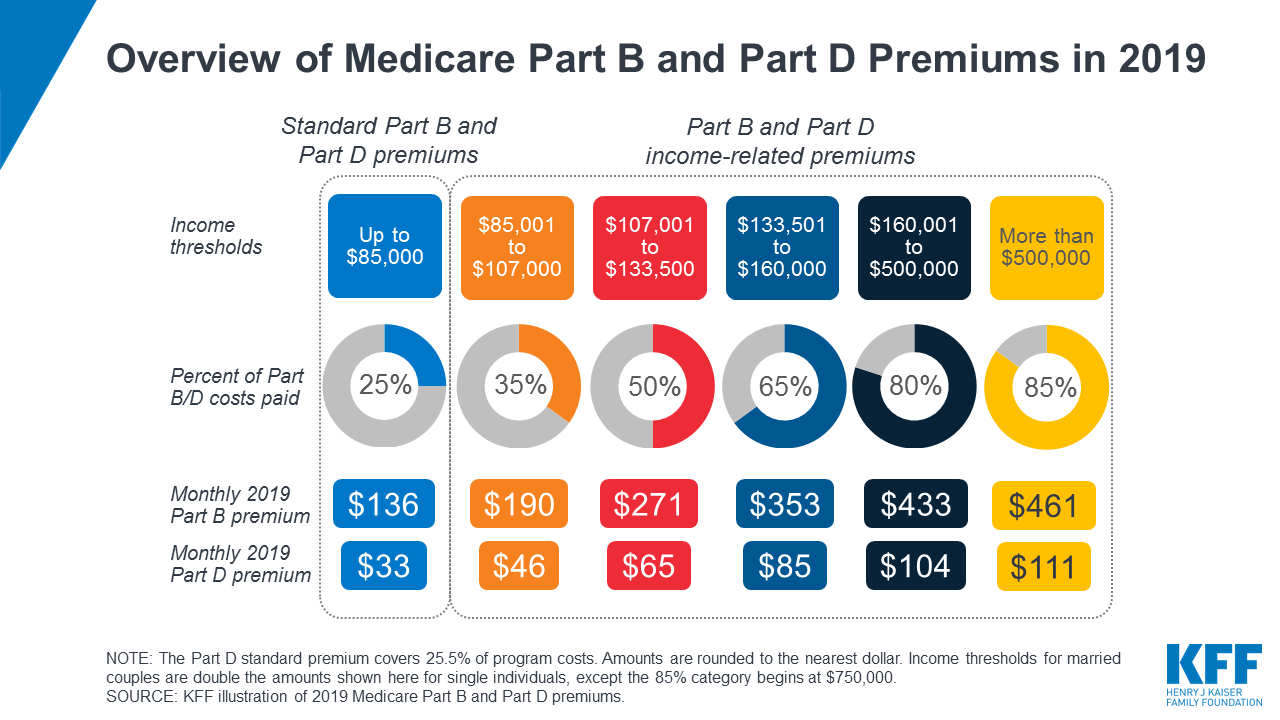

Medicare S Income Related Premiums Under Current Law And Changes For 2019 Kff

Medicare S Income Related Premiums Under Current Law And Changes For 2019 Kff

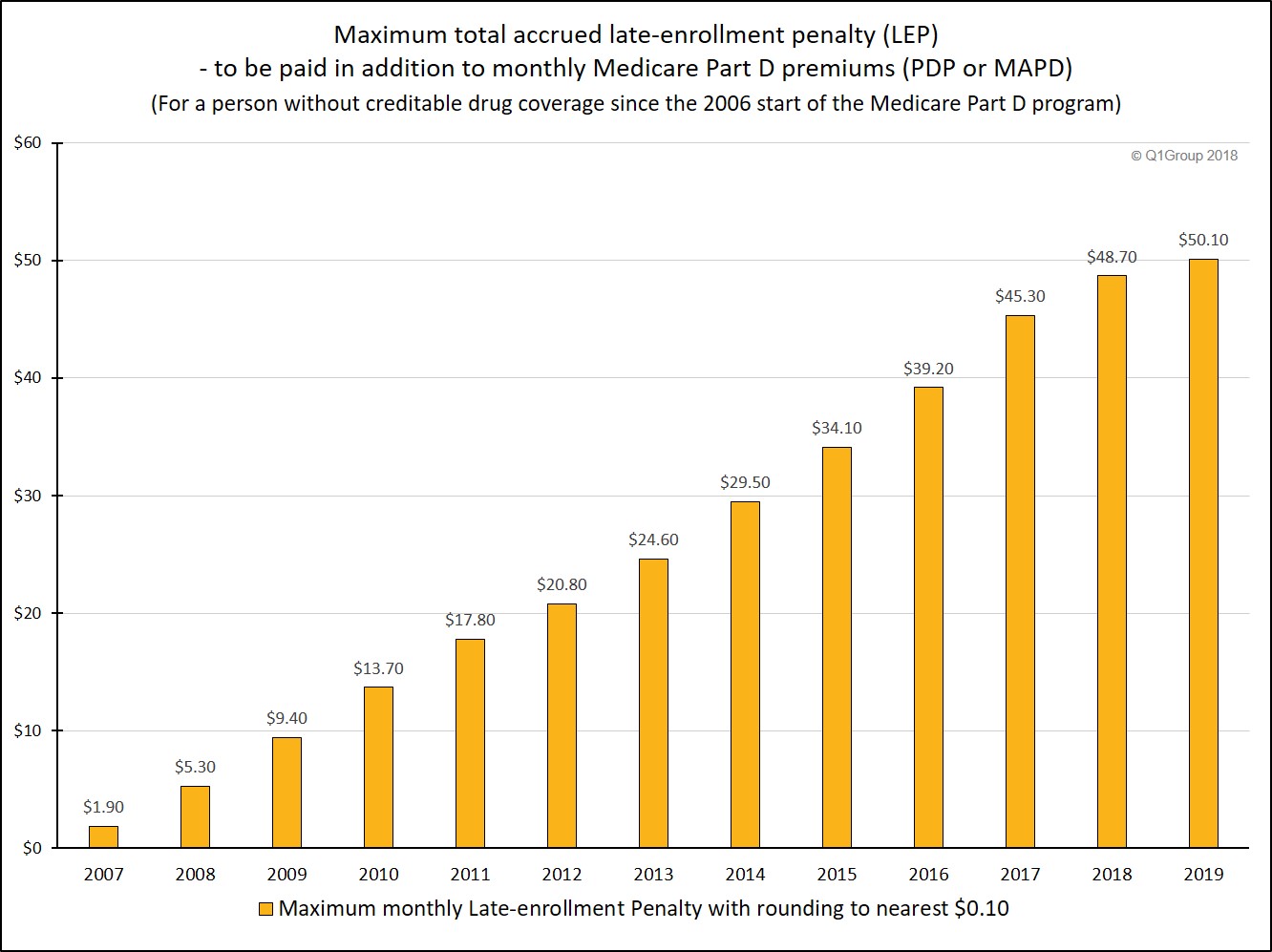

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part D Plans 2022 Medicare Part D Enrollment

Medicare Part D Plans 2022 Medicare Part D Enrollment

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.