It is your responsibility to report this change to Covered California. Can anyone get Covered California.

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

If someones Medi-Cal coverage is cancelled due to increased income or decreased household size does that person qualify for special enrollment into Covered California.

Income change covered california. Now if your income increase and youre getting financial assistance. You can start by using your adjusted gross income AGI from your most recent federal income tax return located on line 8b on the Form 1040. Covered Californias answer is Generally no.

In 2020 California is offering tax credits for households of two making between about 67000 and about 101000. If you make 601 of the FPL you will be ineligible for any subsidies. If you have health insurance through Covered California you must report changes within 30 days.

Get married or divorced. If your income decreases and youre currently not receiving financial assistance you may want to report the change because you may qualify to receive help paying for your coverage. Have a child adopt a child or place a child for adoption.

The good news is that California is offering additional subsidies for those that purchased coverage through Covered California also known as the Exchange. Californians earning up to 150 of the Federal Poverty Line 19140 for a single person in 2021 qualify for an Enhanced Silver 94 Plan for 1 per month. Call Covered CA at 1-800-300-1506.

Add any foreign income Social Security benefits and interest that are tax-exempt. Through Covered California now because you will be moved to Medi-Cal automatically. This helps everybody individuals older folks early retirees small business owners.

If your income is in that. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. You must report a change if you.

It is important to report income changes to Covered California that impact the amount of premium assistance or tax credits that you receive. The money raised from the penalties which is expected to be about 1 billion. These amounts are adjusted annually but for the 2020 tax year the repayment caps would have ranged from 325 to 2700 depending on your income and whether your tax filing status is single filer versus any other filing status as noted above however people do not have to repay excess premium subsidies for 2020.

Expected contributions vary by income but are significantly lower for families at every income level. However if your income changes during the year or at your annual renewal you may qualify for other health insurance and premium assistance through Covered California. As a Covered California member its important for you to know which changes must be reported as they can affect your coverage.

If your income is verified as eligible for premium assistance and then later you become Medi-Cal eligible you do not have to repay the premium assistance you received as long as you report the income change within 30 days. Call your insurance agent for free assistance. Because income determines eligibility for Medi-Cal and Covered California tax credits your eligibility can change if your income changesAs a result some people move between the two and as Obamacare debuted state officials promised that the transition from one to the other would be seamlessIt hasnt been for many.

Medi-Cal and Covered California work together to make sure Californians. Keep in mind that Tax deductions can. You can report your changes to Covered CA in one of the three ways below.

Then add or subtract any income changes. In order to be eligible for assistance through Covered California you must meet an income requirement. For example if your income decreases and youre receiving financial assistance you may qualify to receive more.

According to the California Franchise Tax Board FTB the penalty for not having health insurance is the greater of either 25 of the household annual income or a flat dollar amount of 750 per adult and 375 per child these number will rise every year with inflation in the household. People with Medi-Cal must report changes to their local county office within 10 days of the change. If your income decreases you may qualify to receive a higher amount of premium assistance and reduce your out-of-pocket expenses even more.

Under Federal rules the subsidies drop. However if your income increases you may receive too much premium assistance and may. Have a change in income.

Lee believes Covered California especially with the changes coming in 2020 is a model for the nation.

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

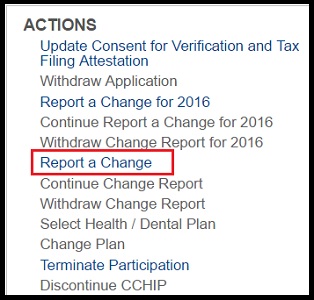

Reporting Changes Yourself Health For California Insurance Center

Reporting Changes Yourself Health For California Insurance Center

Reporting Changes Yourself Health For California Insurance Center

Reporting Changes Yourself Health For California Insurance Center

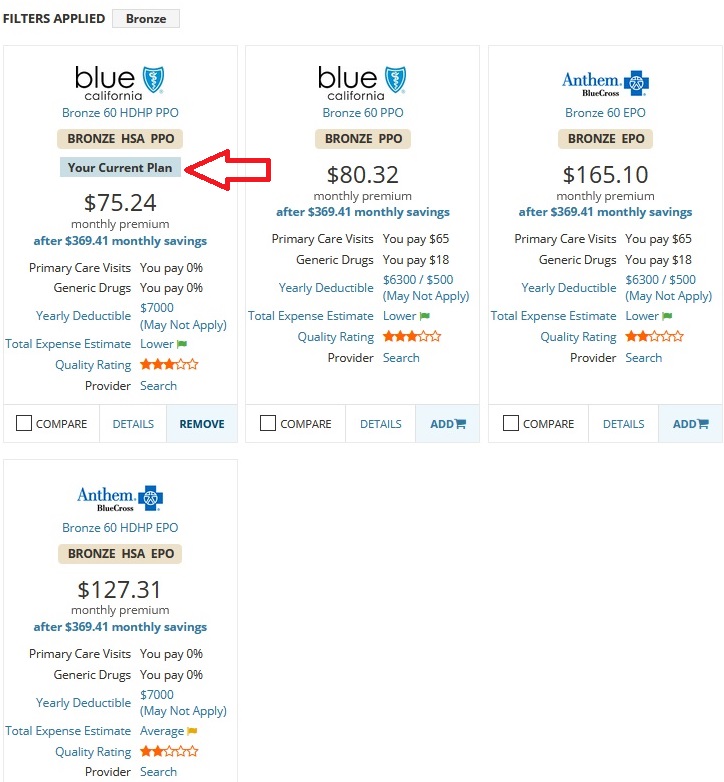

Renew Covered California For 2017 To Avoid Medi Cal Eligibility Errors

Renew Covered California For 2017 To Avoid Medi Cal Eligibility Errors

Reporting Changes Yourself Health For California Insurance Center

Reporting Changes Yourself Health For California Insurance Center

Covered California Coveredca Twitter

Covered California Coveredca Twitter

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

Reporting Changes Yourself Health For California Insurance Center

Reporting Changes Yourself Health For California Insurance Center

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

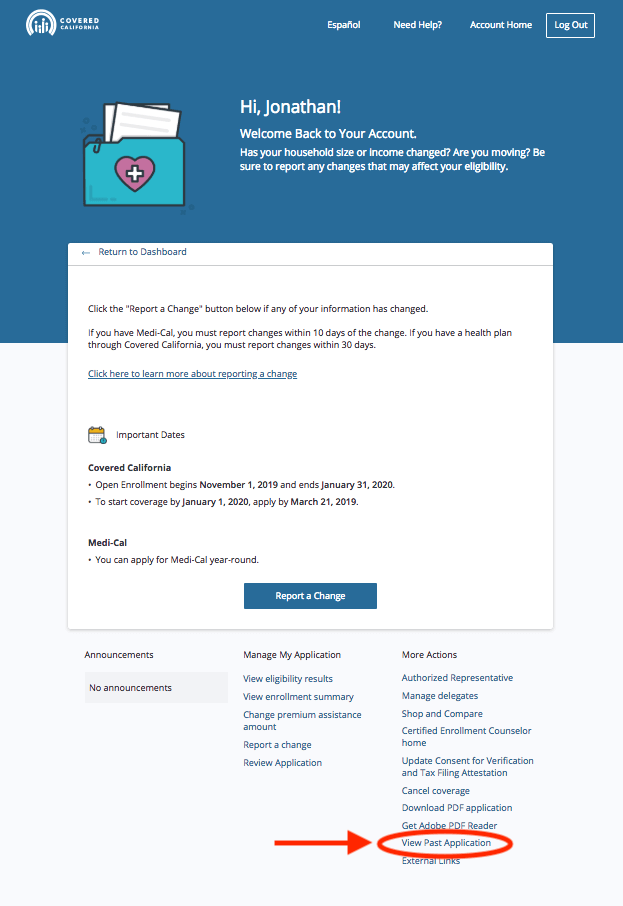

How To Find Your 1095 A On Covered California Rockridge Health Benefits

How To Find Your 1095 A On Covered California Rockridge Health Benefits

2021 Covered California Renewal And Open Enrollment Changes

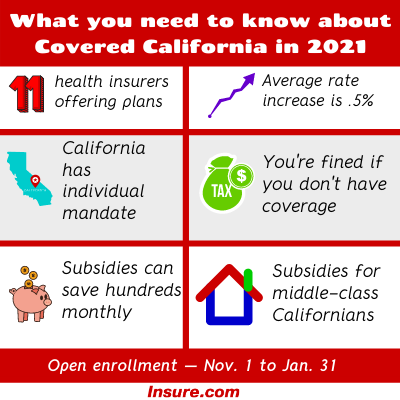

Covered California Open Enrollment 2021 A Complete Guide Insure Com

Covered California Open Enrollment 2021 A Complete Guide Insure Com

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.