You can still use out-of-network providers but you will almost always have to pay more though not necessarily 100 like with an HMO. However the cons of having an HMO health insurance plan during pregnancy is that you are restricted to your primary care physician.

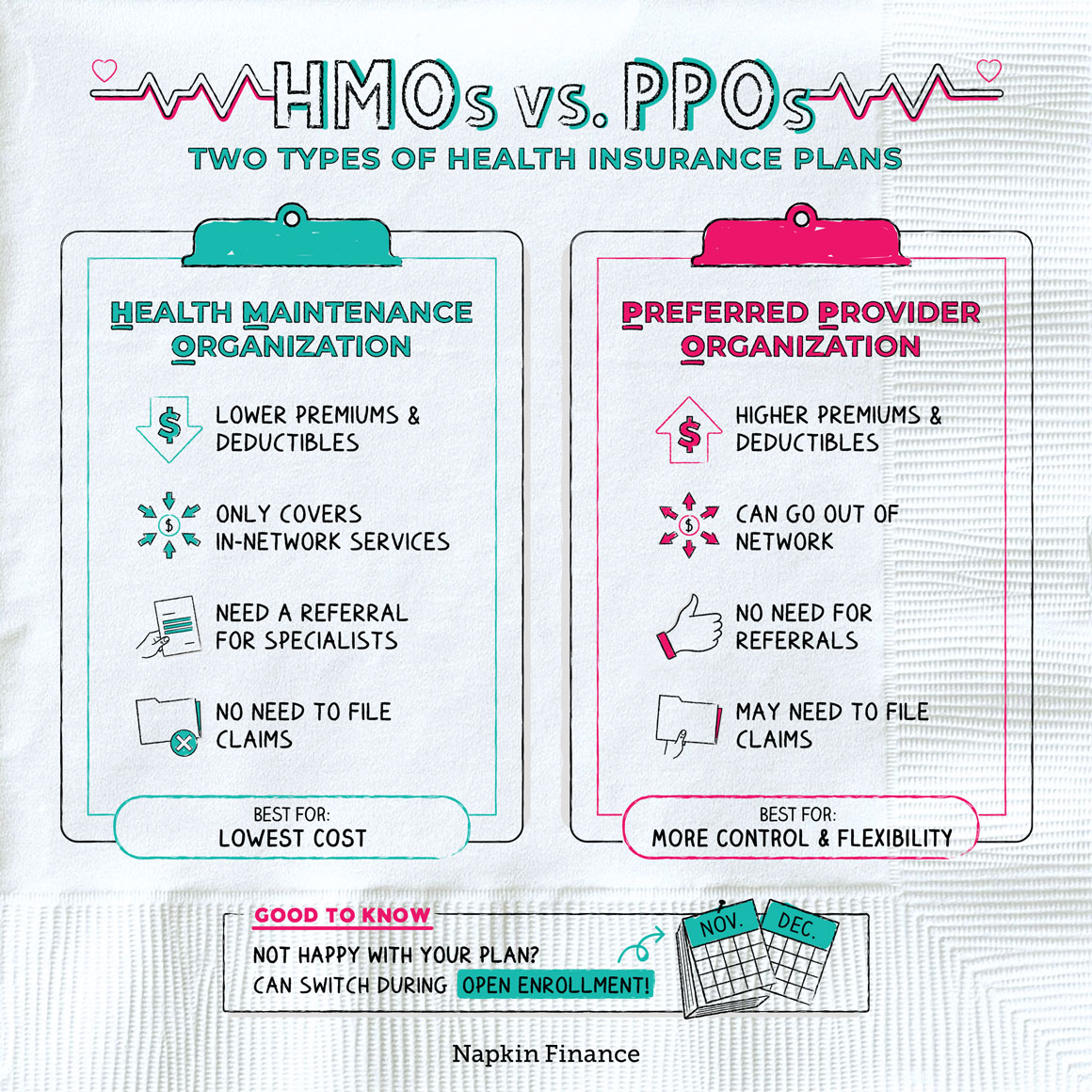

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Making a decision about the best health insurance plan for you or your family is a difficult choice.

Should i get hmo or ppo insurance. However if you choose to see an out-of-network provider then your HMO. Medicare also has both PPO and HMO options. A Preferred Provider Organization or PPO allows you to go to any health care professional without a referral.

You need to have your PCP put in an authorization. Also many HMO plans completely cover the cost of maternity care or a large portion of it. Currently on my parents dental insurance Humana.

To me a PPO costs more a month and covers less - all for the price of. Going out of network to get skin treatment from your best friend Larrys favorite dermatologist might seem like an obvious way to help your complexion. The biggest difference between a PPO and HMO is the pre-authorizations required for specialist care.

If you have diabetes you should always have a PPO. HMO plans also give members access to in-network doctors and hospitals. HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs.

HMO which literally does not cover any percentage of root canals or crowns. So obviously this is where I need your help. This network is comprised of providers who offer lower rates to plan members while still meeting set quality standards.

Now with having a spouse on the plan it more than triples the monthly cost of the insurance premium approx. Overall the differences between the two plans will sway your decision on which one you would prefer to get. A decision between an HMO and a PPO should be based on whats most important to you.

HMO costs are prepaid PPO costs are not. A PPO may be better if you already have a doctor or medical team that you want to keep but who dont belong to your plan network. Certain services and medications must be.

The additional coverage and flexibility you get from a PPO means that PPO plans will generally cost more than HMO plans. A PPO or Preferred Provider Organization is typically the most popular type of plan for anyone getting their insurance through their employer. To get the best rate on your care you have to be sure youre sticking to that list.

I had to dish out 2000 for one recently and cant afford to keep that up. PPOs mean you pay less for covered services when you use providers in your plans network aka preferred providers. Generally speaking an HMO might make sense if lower costs are most important and if you dont mind using a PCP to manage your care.

The monthly payment for an HMO plan is lower than for a PPO plan with. Choosing between an HMO or a PPO health plan doesnt have to be complicated. Think lower cost with less flexibility to choose health care providers.

When I was a single guy and had my own insurance there was no question I was going with the PPO plan. If you see a provider in your network you will have smaller copays. Another cost to consider is a deductible.

An HMO plan wont cover anything if care is sought out-of-network so employees would foot the entire bill. HMOs typically require copayment fees for every type of non-preventive medical visit. In a PPO you just go to any covered physician or facility.

Between talk of deductibles copays coinsurance and coverage areas your head is likely. Another difference between HMO vs PPO plans can be found in the types of fees. HMO plans do not require a deductible PPO plans do.

Emergencies are the only exception. If you see a provider who is not on your network you can expect a higher out-of-pocket cost and there may be some services that are not covered. HMO plans have fixed prices for services PPO plans have varied costs.

But in a PPO the provider list is generally smaller than it is with an HDHP. Medicare HMO PPO. These can be done retroactively as well but its important to have a PCP that isnt an atomic douchnozzle.

An HMO plan might be right for you if lower costs are important and you dont mind choosing your doctors from within the HMOs network. Employees pay less in premiums and typically have lower deductibles than with a PPO. The main differences between the two are the size of the health care provider network the flexibility of coverage or payment assistance for doctors in-network vs out-of-network and the monthly payment.

PPO Health Insurance Plans. A PPO plan might be right for you if you already have a doctor or team of specialists you want to continue seeing but might not be in your employers HMO plan network. I was told in the past when I had to choose my first insurance plan with diabetes to never go with the HMO option.

The pros of an HMO plan is the cost which normally have lower premiums than PPOit really depends on your employer. If I went with the HMO plan it is only approx. When we think about health plan costs we usually think about monthly premiums HMO premiums will typically be lower than PPO premiums.

An HMO can save employers in health-care costs but employees sacrifice provider choice. Im looking to get my own individual plan but dont really get what the benefit of a PPO is versus an HMO.

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Difference Between Hmo And Ppo Difference Between

Ppo Blue Cross And Blue Shield Of Texas

Ppo Blue Cross And Blue Shield Of Texas

Hmo Vs Ppo Benefits Cost Comparison

Hmo Vs Ppo Benefits Cost Comparison

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

Compare Hmo Ppo And Cdhp Plans Healthcare Healthinsurance Best Health Insurance Health Insurance Healthcare Plan

Compare Hmo Ppo And Cdhp Plans Healthcare Healthinsurance Best Health Insurance Health Insurance Healthcare Plan

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

You Re Aging Off Of Your Parents Health Insurance Plan Now What Thinkhealth

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.