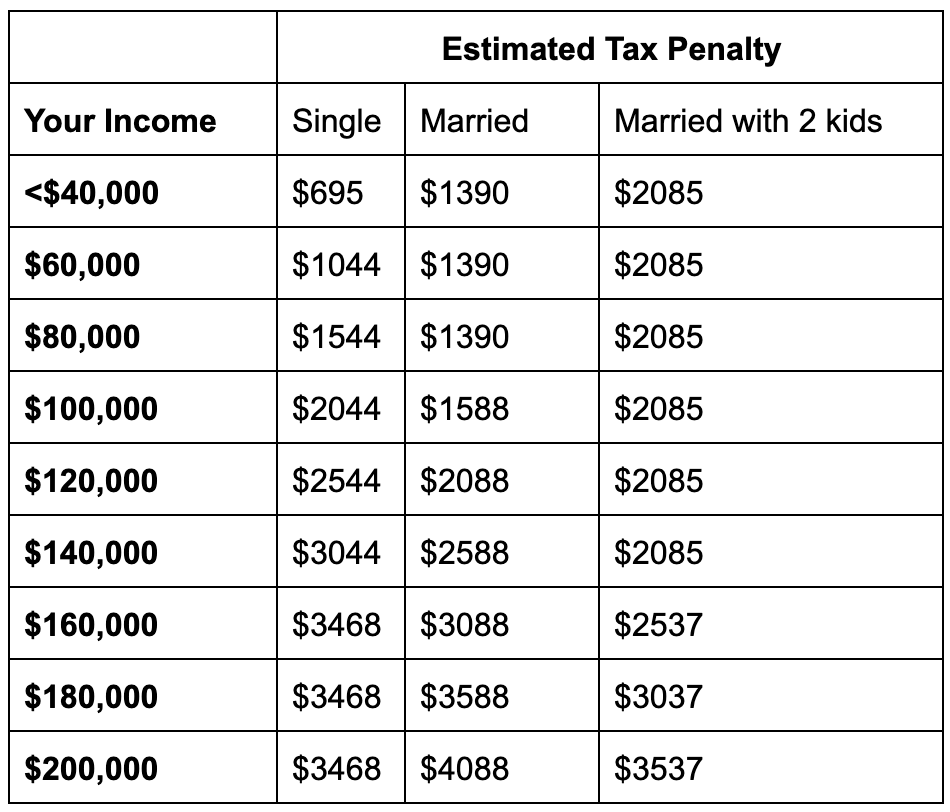

Maximum contribution is the amount that the consumers household is expected to contribute toward the. Covered California income table revised to reflect new subsidy eligibility.

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

Keep in mind that Tax deductions can lower your income level and may help you qualify for government assistance.

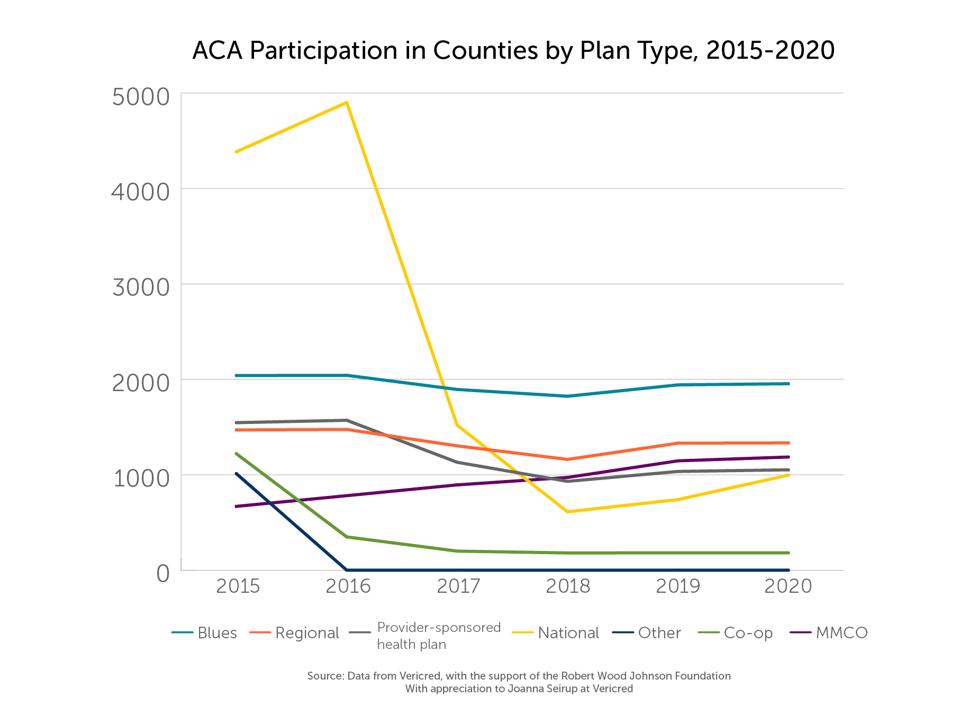

Covered california subsidy chart. Estimated 922000 Californians to be newly eligible for Covered Californias health insurance state subsidy. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. This new lower cap on the percentage of a familys household income that goes toward premiums addresses the subsidy cliff for those with household incomes above 400 of the federal poverty level FPL.

Covered California Subsidy Eligible Maps The Covered California subsidy-eligible maps are separated into distinct PDF books between the eight Covered California sales areas. You may qualify for help to lower your health care costs. Modeling assumes uninsured population characteristics match Covered California membership including plan.

Answer these questions to. Some families get a thousand dollars a month in savings even those making up to 154500 a year. Maximum contribution and benchmark premium.

View the below chart for 2017 Covered California income limits. Bronze Silver and Gold The out-of-pocket maximum is going up from 7800 to 8200 on the Bronze Silver and Gold Plans. When their net premium is reduced from 12000 to 3140 thats nearly 9000 in subsidy from the state of California.

Covered California Income Tables. If you make 601 of the FPL you will be ineligible for any subsidies. Instead of no premium tax credits for individuals and families making more than 400 FPL the new law will make premium tax credits available to these families and caps how much.

Using Steps 1 and 2 look at the top of the chart to see if you qualify for Medicaid Cost Sharing Subsidy Subsidy Only or No Subsidy. According to Covered California getting a state subsidy depends on the difference between two numbers. The unshaded columns are associated with Covered California eligibility ranges.

Find your gross family income level. Federal Tax Credit 100600 FPL Silver 94 100150 FPL Silver 87 over 150200 FPL Silver 73 over 200250 FPL. For example for a household at 500 of FPL the subsidy.

The unshaded columns are associated with Covered California eligibility ranges. Find your family size in the left panel. Again the best way to see is getting the free quote.

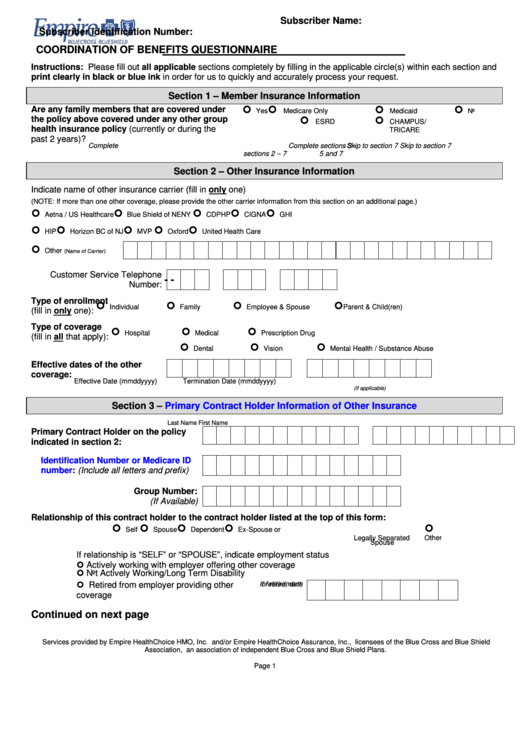

Email OutreachandSalesCoveredcagov or contact your local Outreach and Sales Field Representative in your region. The 9000 health insurance subsidy from the state is over six times the California state income tax they pay. The new higher income amount concurs with the issued Medi-Cal income table for 2020.

Those over 400 of FPL do not qualify for federal subsidies. The income table shows the minimum amount of annual income to qualify for either Medi-Cal or tax credits for a private plan through Covered California. Covered California uses FPL limits from the prior year to determine eligibility for its programs as required by regulation.

Click here and get a complementary proposal benefits and subsidiy calculation. In certain northern counties till 322 of fpl. Do you mean on Medi-Cal or with Covered CA subsidies.

Expanded California State Subsidy program begins in 2020. Even if you dont qualify for Medi-Cal with subsidies. Households newly eligible include 400 up to 600 of Federal Poverty.

For more information about the new state subsidies please review the design documents which have more details about the program. Covered California uses FPL limits from the prior year to determine eligibility for its programs as required by regulation. California State Subsidy 0138 FPL over 200600 FPL Federal Tax Credit 100400 FPL Enhanced Silver Plans 100250 FPL.

The threshold for Medi-Cal 138 FPL jumped from 17237 on the September chart up to 17609 on the new revised income table. Covered California rates are going up 06 on average and the plan benefits are not changing very much. To view the monthly Medi-Cal eligibility income amounts please visit my Medi-Cal Page.

Individuals with income up to 74940. Current Covered California consumers who will receive subsidies will pay an estimated 119 less per month per household on average which translates to 1428 per year. Even an individual earning close to 75000 may qualify for financial help.

Note that Medi-Cal is 138 of FPL for the whole family. The information below will help us determine your potential health coverage program eligibility. Tell us a little bit about yourself.

The eight sales areas were created based on the 19. Get help over the phone 800 787-6921. From 0 to 138 of FPL legal residents and US Citizens in California will either get federal subsidies through Medi-Cal the Medicaid program for California or they may qualify for state subsidies through Covered California if they are ineligible for Medi-Cal.

If an adult is under 138 percent based on their monthly income they are determined eligible for Medi-Cal and ineligible for the Covered California subsidy. For a married couple with 70000 AGI their California state income tax is about 1400. If you are above that the parents can get Covered CA with enhanced silver and subsidies while the children stay on till 266 of FPL.

Covered California Expands State Subsidy for 2020. However starting in 2020 in California those between 400 and 600 of FPL may qualify for state subsidies.

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)