An HSA is different from the plan types of PPO HMO or EPO. The PPO typically has a lower maximum out-of-pocket cost than an HDHP.

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

To avoid this cancel and sign in to YouTube on your computer.

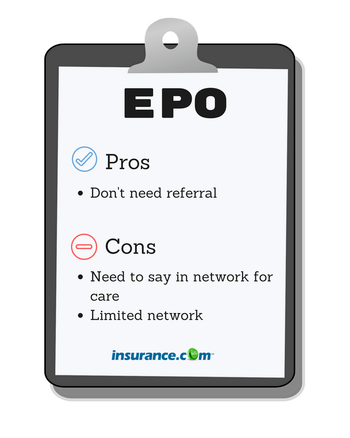

Epo vs hsa. But an EPO plan is like an HMO plan in that youre responsible for paying all your out-of-pocket costs if you go out-of-network. With an HMO plan you pick a primary care. EPO The Countys Exclusive Provider Organization EPO plan is like an HMO.

All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. I just received my benefits options from residency for health insurance i have the options of a PPO for 155month EPO for 45month and a HSA for 30month. EPO plans differ from Health Maintenance Organizations HMOs by offering participants a greater amount of flexibility when selecting a healthcare provider.

Out of Pocket Max. EPO and PPO vs HSA and HMO The main difference between EPO and PPO plans and Health Maintenance Organizations HMOs is the need for a Primary Care Physician PCP in an HMO. 12961 x 24 311064.

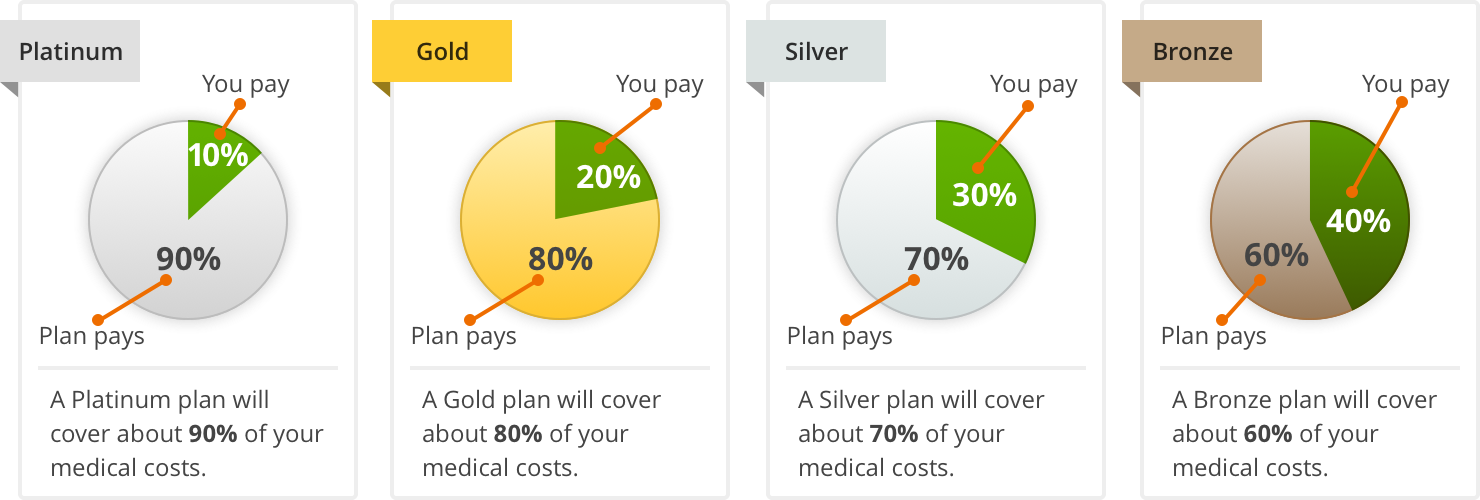

PPO choice what you really should be pondering is HDHP vs. An HDHP plan is typically about 10 cheaper than a traditional preferred provider organization PPO plan and is usually associated with a company funded tax-advantaged health savings account HSA that is meant to fund some of your medical expenses. HSA stands for health savings account and HSA-qualified plans can be HMOs PPOs EPOs or POS plans.

For most services youll have to meet a higher deductible before the HSA Plan pays its share of the cost of services than you would in the EPO or PPO Plans. 19241 x 24 pay periods 461784. EPO stands for exclusive provider organization.

All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. So you can get a PPO that is also HSA eligible but not every HSA eligible plan is a PPO and PPOs arent available in every state. Deductible then 20 500 per admission.

May 11 2013. EPO stands for exclusive provider organization. HSA stands for Health Savings Account.

An HSA is a savings account you use for medical expenses in conjunction with your insurance. You can think of that as a trade-off for the fact that the EPO limits you to only using in-network medical providers whereas PPOs will cover a portion of your costs even if you see out-of-network providers. This is the biggest difference between an HRA and an HSA.

Although this feature can be a big help it can also be a wash financially by the time you pay all of your premiums for the year. And theyre both intended to be used for qualified medical expenses. The PPO seems more flexible but it has a deductible where as the EPO has no deductible.

HSA eligible plans are available in pretty much every state. So lets take a look at how theyre different. This means that in an HMO plan you do not contact the insurer to get pre-authorization for treatment but must be referred to a specialist by a PCP who is a member of the HMOs network.

The difference between them is the way you interact with those networks. The difference between them is the way you interact with those networks. So when youre thinking about your HSA vs.

But thats about where the similarities end. 100 after 45 copay. Note that another frequently-used acronym HSA does not refer to a type of managed care.

After deductible 20 coinsurance. And in order to open an HSA you need to be covered by an eligible high deductible health plan HDHP and have no other coverage. You own your HSA but an employer owns your HRA.

I have little to no idea what plans are best to pick. 500 per day copay up to 2500. Lower out-of-pocket maximum.

HSA stands for Health Savings Account. First-dollar coverage for most services after modest co-payments YOUR monthly premium contributions are MUCH HIGHER than the HDHP The COUNTY contributes 80 of the EPO premium YOU are not eligible for COUNTY HSA contributions. The main downside of a PPO is.

Any of these plan types can be an HSA eligible plan. Because of its generally lower cost-sharing and low premiums an EPO is often one of the most economical health insurance choices. HSA stands for health savings account.

Videos you watch may be added to the TVs watch history and influence TV recommendations. But one crucial thing to remember is that unlike a PPO plan an HSA is not a health insurance plan. An error occurred while retrieving sharing.

A PPO is a type of health insurance plan that gives you access to a network of providers. 1100 paid out quarterly After deductible 20 coinsurance. You will pay the full cost of items such as prescription drugs and office visits until the plans deductible amount is met.

HSA-qualified plans must meet specific plan design requirements laid out by the IRS but they are not restricted in terms of the type of managed care they use.

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

What Is The Difference Between Hmo Ppo And Epo Health Plans Boost Health Insurance

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Comparing Health Plan Types Kaiser Permanente

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

Hsa Vs Ppo Motivhealth Insurance Company

Hsa Vs Ppo Motivhealth Insurance Company

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Https Www Communitycare Com Dynamicfile Health Insurance Guide Pdf

Comparing Health Plan Types Kaiser Permanente

Hmo Vs Epo Vs Ppo Which Is Better What S The Cheapest

Hmo Vs Epo Vs Ppo Which Is Better What S The Cheapest

Types Of Health Insurance Plans Medical Mutual

Types Of Health Insurance Plans Medical Mutual

Hplc Chromatograms Of Internal Reference Standard Of Epo Hsa In Download Scientific Diagram

Hplc Chromatograms Of Internal Reference Standard Of Epo Hsa In Download Scientific Diagram

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.