If you want to pay less. Why do landlords require renters insurance.

Renters coverage costs less than you might think.

Renters insurance deductible state farm. Landlords have their own insurance that protects the building but it doesnt cover potential damage to tenants personal property. For example if a fire causes 1500 in insured damage to your personal property and your deductible is 500 then your insurer will pay you 1000. We liked Assurant for its emphasis on educating new renters within its quote and signup tools.

However if you entertain company frequently at your home or if your assets exceed that amount you should consider an amount of insurance equal to at least the total value of your assets. Renters insurance is relatively inexpensive. Most renters insurance companies will allow you to choose a deductible between 5002500.

Average cost of renters insurance. Choose the right renters insurance deductible. For instance if your total personal property coverage extends to 10000 a deductible policy set at a 10 rate means you will have a 1000.

To pay for covered repairs or reconstruction of the dwelling and other structures on. However the lower your deductible the higher your premium will be. Renters insurance rates start at 162 for 20000 in personal property 100000 liability coverage and a 1000 deductible.

In other words its the amount deducted from any payout by your insurer. Like most renters insurance policies a State Farm policy covers your personal property in case its damaged or stolenThis could include items such as electronics furniture clothing and other. According to the Independent Insurance Agents and Brokers of America Inc the average renters policy costs just about 12 a month for up to 30000 in personal property coverage.

Your renters insurance premiums will reflect the deductibles you agree to. For example suppose your covered burglary claim is 10000 and your deductible is 500. How much is a 100000 renters insurance.

For example State Farm offers renters insurance deductibles up to 2000 while Lemonade Insurance Co. Travelers Insurance is the cheapest renters insurance for the state among those surveyed. Thats solid coverage for less than the cost of a few cups of coffee a week.

State Farms renters insurance policy offers a wider range of deductible options than other companies allowing customers to reduce their premium costs by choosing higher deductibles. Coverage for some of the most common causes of property damage and loss such as theft vandalism and fire is entirely up to you. Common Myths about Renters Insurance.

Deductibles may also be offered as a percentage of your policys property coverage. The landlords insurance covers your possessions Dont count on it. Deductibles for a home or renters insurance policy typically range anywhere from 500 5000 and some companies may allow you to choose a percentage of your total coverage amount.

A deductible is the amount youre responsible for when you file a claim. Do you want to pay less for insurance or repairs. The company also offers a selection of lower deductibles of 100 250 and 500 along with an.

Most landlords insurance covers only the building and damages due to negligence. However remember that a too-high deductible may render the insurance effectively useless. Renters insurance coverage is made up of several types of protection.

State Farm is an insurance company that offers both financial and insurance services the latter of which they sell through their agents. The amount of your claim settlement after applying your deductible is 9500. Farmers has some of the most deductible options in the industry with choices for 100 250 500 1000 and 2500.

The State Farm Rental Dwelling Policy covers accidental direct physical loss to your rental dwelling and your personal property located there based upon the coverage provided by your policy. Offers a specialized renters insurance policy with a 0 deductible. You can even choose a.

For renters this amount is often sufficient. The typical renters insurance policy offers 100000 in liability coverage. This insurer also stands out for including hurricane damage under its standard deductible while most other companies make you select a separate hurricane deductible.

Without renters insurance you may have to bear the. For renters insurance common deductible amounts are 500 or 1000 but 250 or lower deductibles are also possible from some insurers as are deductibles up to 2500. The online quote process offers some degree of customization allowing customers to increase or decrease their personal property coverage liability deductible and other available extras and see how these change their estimated premiums.

When renters insurance deductibles apply.

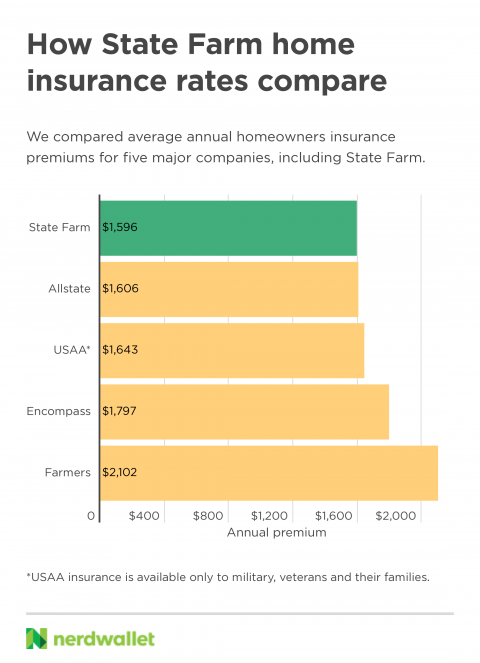

State Farm Insurance Rates Consumer Ratings Discounts

State Farm Insurance Rates Consumer Ratings Discounts

State Farm Home Insurance Review 2021 Nerdwallet

State Farm Home Insurance Review 2021 Nerdwallet

State Farm Renters Insurance Review The Simple Dollar State Farm Insurance State Farm Life Insurance State Farm Quote

State Farm Renters Insurance Review The Simple Dollar State Farm Insurance State Farm Life Insurance State Farm Quote

Assurant Renters Insurance Review Expensive Coverage With Mediocre Service Valuepenguin

State Farm Renters Insurance 2021 Insurance Guide U S News

State Farm Renters Insurance 2021 Insurance Guide U S News

State Farm Renters Insurance Review Pros Cons Pricing And Features

State Farm Renters Insurance Review Pros Cons Pricing And Features

Choosing A Renters Insurance Deductible Valuepenguin

Stay Safe From Wildfires State Farm

Stay Safe From Wildfires State Farm

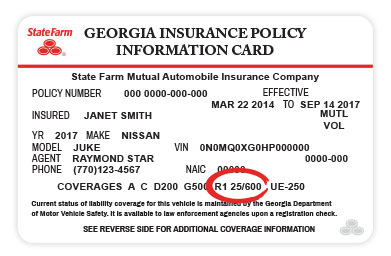

Rental Car Services Reimbursement State Farm

Rental Car Services Reimbursement State Farm

State Farm Renters Insurance Review Pros Cons Pricing And Features

State Farm Renters Insurance Review Pros Cons Pricing And Features

How Do I Know How Much Renters Insurance To Buy State Farm

How Do I Know How Much Renters Insurance To Buy State Farm

Https Clearsurance Com Blog State Farm Renters Insurance What Are State Farm Policyholders Saying

Renters Insurance Quotes Finally State Farms Quote Revealed A Few Pleasant Surprises Like Dogtrainingobedienceschool Com

Renters Insurance Quotes Finally State Farms Quote Revealed A Few Pleasant Surprises Like Dogtrainingobedienceschool Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.