In this case youd pay 1200 for the MRI on top of the 30 copay. The amount the insurance provider pays at this point will vary from plan to plan.

What Is A Deductible Copay And Coinsurance Policy Advice

What Is A Deductible Copay And Coinsurance Policy Advice

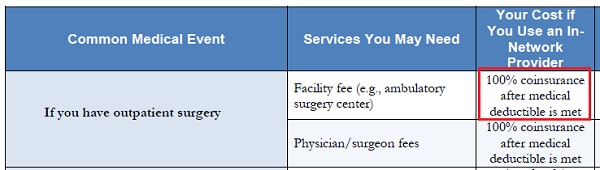

This is the percentage of a covered health service you will pay for yourself after you have met your deductible.

What is 30 coinsurance after deductible. For example if you have a 20000 surgery bill your 30 coinsurance will be a whopping 6000. It is your share of the medical costs which get paid after you have paid the deductible for your plan. Coinsurance is the amount you will pay for a medical cost your health insurance covers after your deductible has been met.

In other words until your deductible is met you will pay the. Practically every kind of health insurance plan has something known as coinsurance. When you pay coinsurance you split a certain cost with the insurance company at a ratio determined by the terms of your insurance plan.

The 30 percent you pay is your coinsurance. Now if your office visit costs 200 and you have 30 coinsurance you will pay 60 of the bill in addition to your copay. What is Coinsurance After Deductible.

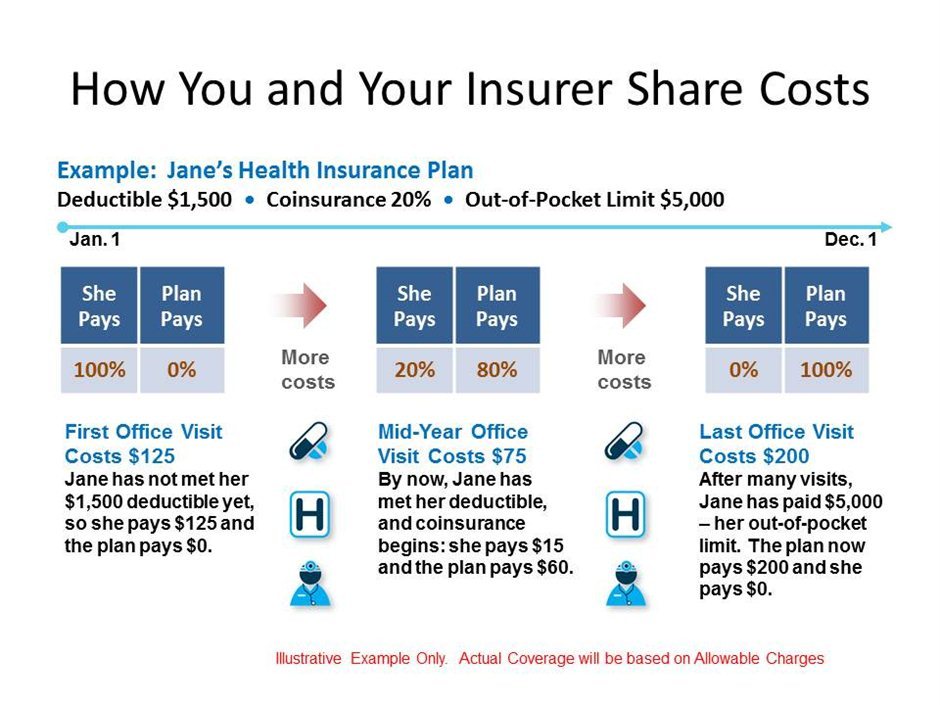

Its usually figured as a percentage of the amount we allow to be charged for services. You start paying coinsurance after youve paid your plans deductible. When you go to the doctor instead of paying all costs you and your plan share the cost.

You pay 20 of 100 or 20. Coinsurance is often 10 30. After you pay the deductible amount your insurer will begin paying forth their portion of the insured loss.

For example your plan pays 70 percent. Youve paid 1500 in health care expenses and met your deductible. After meeting a deductible beneficiaries typically pay coinsurance a.

The percentage of costs of a covered health care service you pay 20 for example after youve paid your deductible. When you pay coinsurance you split a certain cost with the insurance company at a ratio determined by the terms of your insurance plan. You would pay 100 along with 30 percent of the remaining 900 up to your out-of-pocket maximum which would be the most you would pay in a year.

An example of paying coinsurance and your deductible would be if you have 1000 in medical expenses and the deductible is 100 with 30 percent coinsurance. In that case youd pay the 1000 for the deductible portion and youd also be on the hook for the remaining 20 with the health plan picking up the other 80. A deductible is a fixed amount a patient must pay each year before their health insurance benefits begin to cover the costs.

Coinsurance is an additional cost that some health care plans require policy holders to pay after the deductible is met. A copay is a type of insurance cost that is a set amount designated to be paid by the insured party whereas coinsurance is a percentage of health care costs covered by the insurer after the deductible is met. The insurance company pays the rest.

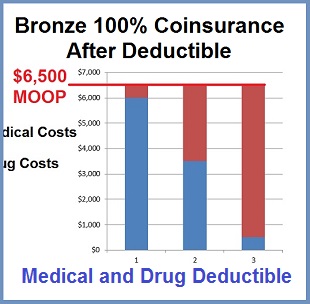

Since your coinsurance is a variable amounta percentage of the billthe higher the bill is the more you pay in coinsurance. There are plans that offer 100 after deductible which is essentially 0 coinsurance. Dont forget that you must also pay your deductible.

This means that once your deductible is reached your provider will pay for 100 of your medical costs without requiring any coinsurance payment. For example if you are robbed and you have 6000 of stolen items but you have a 1000 deductible you will pay the first 1000 of loss and the insurance company will pay the remaining 5000. Factors Affecting Coinsurance Amount.

Both copays and coinsurance are forms of cost-sharing meaning you are splitting medical bills with your health insurance company. What does this mean 0 coinsurance after deductible. Out-of-pocket maximum of 5000.

As mentioned earlier coinsurance is the percentage of health care services youre responsible for paying after youve hit your deductible for the year. Only after youve paid your full deductible will you be sharing the cost of your care with your. If youve paid your deductible.

Then you will pay only a percentage of the costs while the. You must pay 4000 toward your covered medical costs before your health plan begins to cover costs. Before reaching your deductible you have to pay all of your medical costs.

Your deductible is 1000 and your coinsurance responsibility is 20. This makes coinsurance riskier for you since its harder to budget for. However coinsurance only applies after you spend enough to reach your deductible.

After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30. Lets say your health insurance plans allowed amount for an office visit is 100 and your coinsurance is 20. Coinsurance does not begin until after you meet your deductible meaning youll pay all of your medical costs except for certain covered services until reaching your deductible.

Coinsurance is often 10 30. On some health plans youll have to pay the entire deductible before your health plan begins to pay part of the cost of your non-preventive care. Coinsurance is your share of the costs of a health care service.

When you look at your policy youll see your coinsurance shown as a fractionsomething like 8020 or 7030. Copays often apply regardless of whether youve reached your deductible. Coinsurance is an additional cost that some health care plans require policy holders to pay after the deductible is met.

Your deductible if you werent aware is the amount you have to pay.

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

25 Awesome Health Insurance Deductible Vs Copay

25 Awesome Health Insurance Deductible Vs Copay

25 Best What Is Coinsurance After Deductible

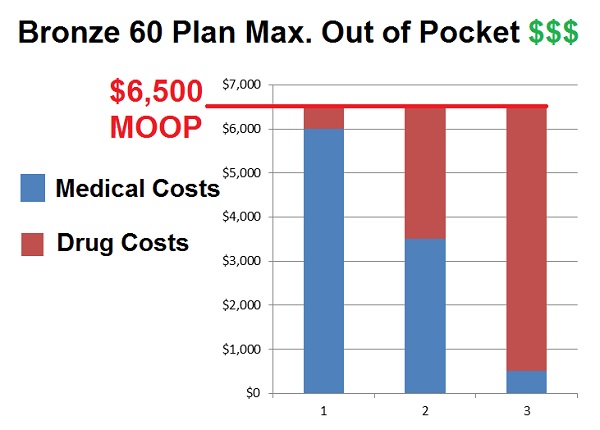

Bronze 60 100 Coinsurance After The Deductible Confusion

Bronze 60 100 Coinsurance After The Deductible Confusion

What Is Coinsurance Healthmarkets

What Is Coinsurance Healthmarkets

Copay Vs Coinsurance The Differences And Why They Matter Nerdwallet

Copay Vs Coinsurance The Differences And Why They Matter Nerdwallet

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Bronze 60 100 Coinsurance After The Deductible Confusion

Bronze 60 100 Coinsurance After The Deductible Confusion

Bronze 60 100 Coinsurance After The Deductible Confusion

Bronze 60 100 Coinsurance After The Deductible Confusion

Coinsurance After Deductible How To Choose Between 100 And 0

Coinsurance After Deductible How To Choose Between 100 And 0

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Https Www Centergrove K12 In Us Site Handlers Filedownload Ashx Moduleinstanceid 9596 Dataid 20761 Filename 2020 20hdhp 20summary Pdf

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Health Insurance Basics How To Understand Coverage

Health Insurance Basics How To Understand Coverage

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.