The percentage of healthcare costs you owe after your insurance company covers its share. You schedule an MRI which costs 2000.

Coinsurance Everything You Need To Know Harris Insurance

Coinsurance Everything You Need To Know Harris Insurance

No copays do not count toward the deductible.

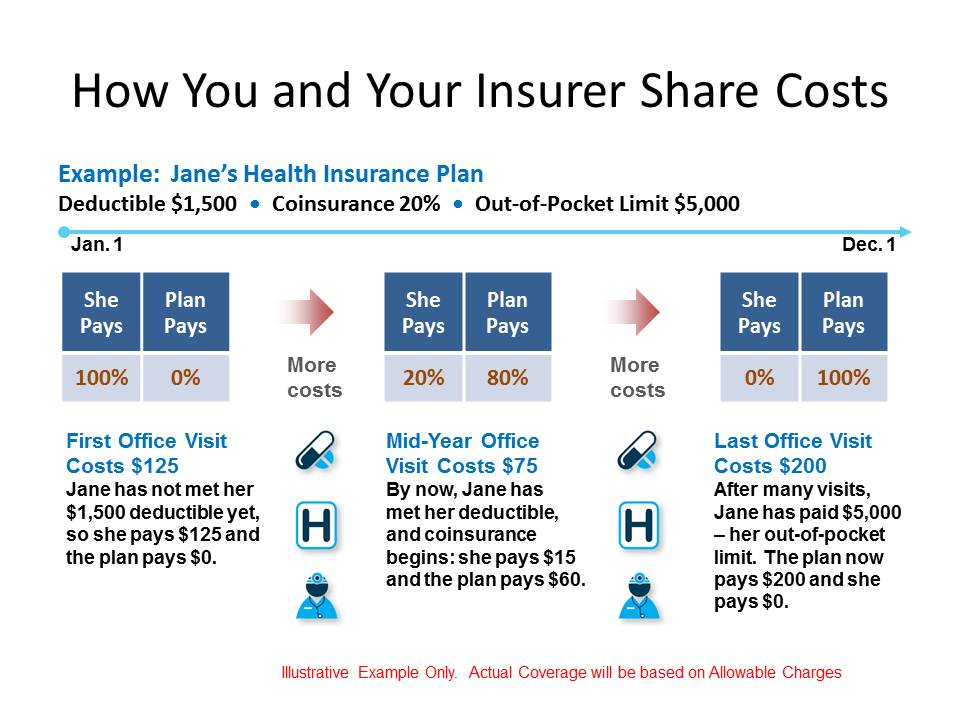

Copay vs coinsurance vs deductible. However health insurance policy in certain countries such as the United States does not cover 100 of the patients bill and requires the patient to make a. Your deductible is a fixed amount but your coinsurance is a variable amount. Coinsurance What is coinsurance.

Copay vs Deductible Health insurance offers a patient coverage against the costs of medical expenses. The amount A deductible is the fixed amount that you have to pay as a share of your medical bill upon which your policy comes into effect. A copay is a fixed amount you pay for a health service seeing your doctor or filling a prescription.

You may have a copay before youve finished paying toward your deductible. The amount youll pay for your healthcare before your insurance benefits kick in. All three are different types of cost sharing which is the portion you pay for a medical service or prescription drug.

It can be a fixed amount per the nature of the treatment of a fixed percentage. Depending on how your plan works what you pay in copays may count toward meeting your deductible. Coinsurance is a portion of the medical cost you pay after your deductible has been met.

You pay the first 2000 of covered medical expenses your deductible out-of-pocket and 20 coinsurance on the remaining cost 18000 or 3600. Once deductible amount INR 4000 is met if the co-pay or coinsurance is applicable for your policy that needs to be paid. Your deductible is 1000 and your coinsurance responsibility is 20.

1 Copay or copayment. And the remaining cost will be settled by the insurance company. You may also have a copay after you pay your deductible and when you owe coinsurance.

Your doctor decides you need an MRI. Policies with higher deductibles will have a. Difference between Coinsurance and Deductible.

Prudence has now paid 1990 toward her medical costs this year not including. Deductibles and coinsurance are clauses that are mostly implemented together under one single insurance plan. Plans that dont have copays will have coinsurance which means the patient is responsible for 100 of the cost of care until they meet their deductible.

After that 500 mark has been reached the insurance company will begin to assume. If you have a copay of 20 for a regular doctor visit you will pay 20 flat when you have an appointment even if you havent met your deductible yet. The total cost for your knee surgery is.

Now that we have fully rounded up the process of covering medical expenses from start to finish there is only one thing left to do understand the difference between copay and coinsurance. The deductible is fixed but coinsurance is variable. If you have a 1000 deductible its still 1000 no matter how big the bill is.

100 for the ER copay 200 for remaining deductible 20 coinsurance 640 940. What is a copay. Your health insurance plan includes a 2000 annual deductible 20 coinsurance and an out-of-pocket maximum of 4000.

Difference between Copay and Co-insurance. Coinsurance is the percentage of costs you pay after youve met your deductible. The most common types are copays deductibles and coinsurance.

A copay is a set rate you pay for prescriptions doctor visits and other types of care. No matter which kind of health coverage policy you have its essential to know the difference between coinsurance and copay. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent.

The fixed amount you may pay for a covered health care service after youve paid your deductible. The fact that both terms carry the same prefix may give you some initial idea. Total out-of-pocket costs.

You know when you enroll in a health plan exactly how much your deductible will be. You go to the doctor for an aching back. Your primary care copay is 30 so you pay that before seeing the doctor.

The definitions presented above make it all clearer. Your Blue Cross ID card may list copays for some visits. Copay is the fixed amount that you have to pay for your treatment.

A deductible is an amount that must be paid for covered healthcare services before insurance begins paying. While copay deductible and coinsurance are cost-sharing terms their applicability can make a huge difference to your overall health insurance plan. Your plan determines what your copay is for different types of services and when you have one.

Your knee surgery will cost 20000. Do copays count toward the deductible. Copays and deductibles are both features of most insurance plans.

The annual deductible specified in your plan is the total coinsurance you must pay in a calendar year before the insurance company starts paying for any healthcare costs. For example if a plan has a deductible of 500 then the insured party must spend 500 on services out of pocket. These and other out-of-pocket expenses affect how much youll.

So What S The Difference Between A Premium Deductible Copay Coinsurance And Max Out Of Pocket

So What S The Difference Between A Premium Deductible Copay Coinsurance And Max Out Of Pocket

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

Copays Vs Coinsurance For Health Insurance

Coinsurance And Medical Claims

Coinsurance And Medical Claims

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

25 Fresh Copay Coinsurance And Deductible And Out Of Pocket

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Copay Vs Coinsurance The Differences And Why They Matter Professional Insurance Programs

Copay Vs Coinsurance The Differences And Why They Matter Professional Insurance Programs

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.