25 X 72000 18000. Federal poverty levels FPLs premium tax credit eligibility Income between 100 and 400 FPL.

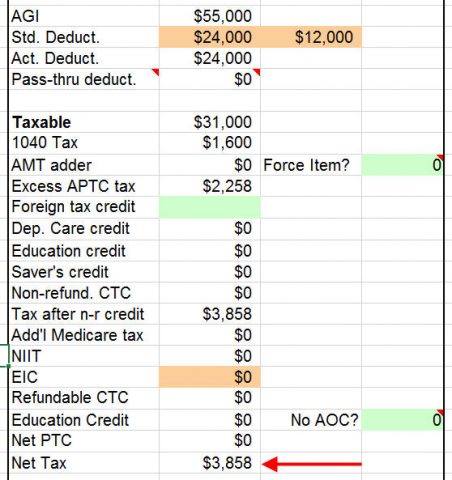

Tax Calculator With Aca Health Insurance Subsidy

Tax Calculator With Aca Health Insurance Subsidy

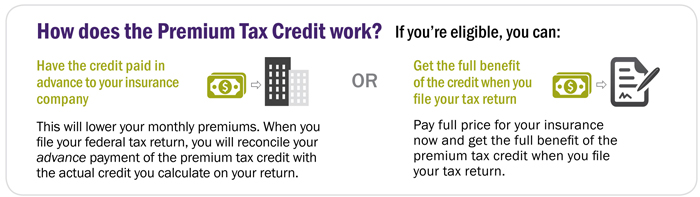

In 2019 the federal government will once again offer a Premium Tax Credit PTC to qualifying taxpayers who buy health coverage from an approved health insurance exchange.

Healthcare tax credit calculator. In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household income towards the cost of the benchmark plan or a less expensive plan the benchmark plan is the second-lowest silver plan. That was a hard cutoff. Have this information for the applicable tax year ready when using the estimator.

If you want to crunch numbers for tax year 2020 you can access the 2020 version of this calculator by clicking here. 1 The initial amount of the credit is determined before any reduction. For example for 2014 our households ABP was 73073 for 2015 it was 63780 for 2016 it was 88685 for 2017 it was 104339 and for 2018 it will be a whopping 144507.

If your income is in this range in all states you qualify for premium tax credits that lower your monthly premium for a Marketplace health insurance plan. Again subsidies have increased for 2021 and will remain larger. Step 3 - Adjust Your Premium Tax Credit by Small Business HRA Employer Contribution.

These credits are available to an estimated 4 million small businesses including nonprofits. In both cases you will need to claim the credit on your tax return. If you buy health insurance from healthcaregov or a state-run ACA exchange up through the year 2020 whether you qualify for a premium tax credit is determined by your income relative to the Federal Poverty Level FPL.

See if you qualify for the Small Business Health Care Tax Credit and if so approximately how much it would be worth. The Small Business Health Care Tax Credit Estimator. You cannot claim tax credits and Universal Credit at the same time.

Health Care Subsidy Calculator. The number and ages of the family members who are enrolled and are not eligible for other health coverage. 2 The employers withholding and Medicare taxes are 30000.

GO TO THE SHOP FTE CALCULATOR. The credit is based on your. How Do I Calculate My Health Insurance Tax Credit.

Your Projected 2018 Modified Adjusted Gross Income MAGI. Step 1 - Calculate Your Modified Adjusted Gross. Tax credits calculator.

The discount on your monthly health insurance payment is also known as a premium tax credit. Taxable employers are eligible for a maximum credit of 35 of healthcare costs. The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019.

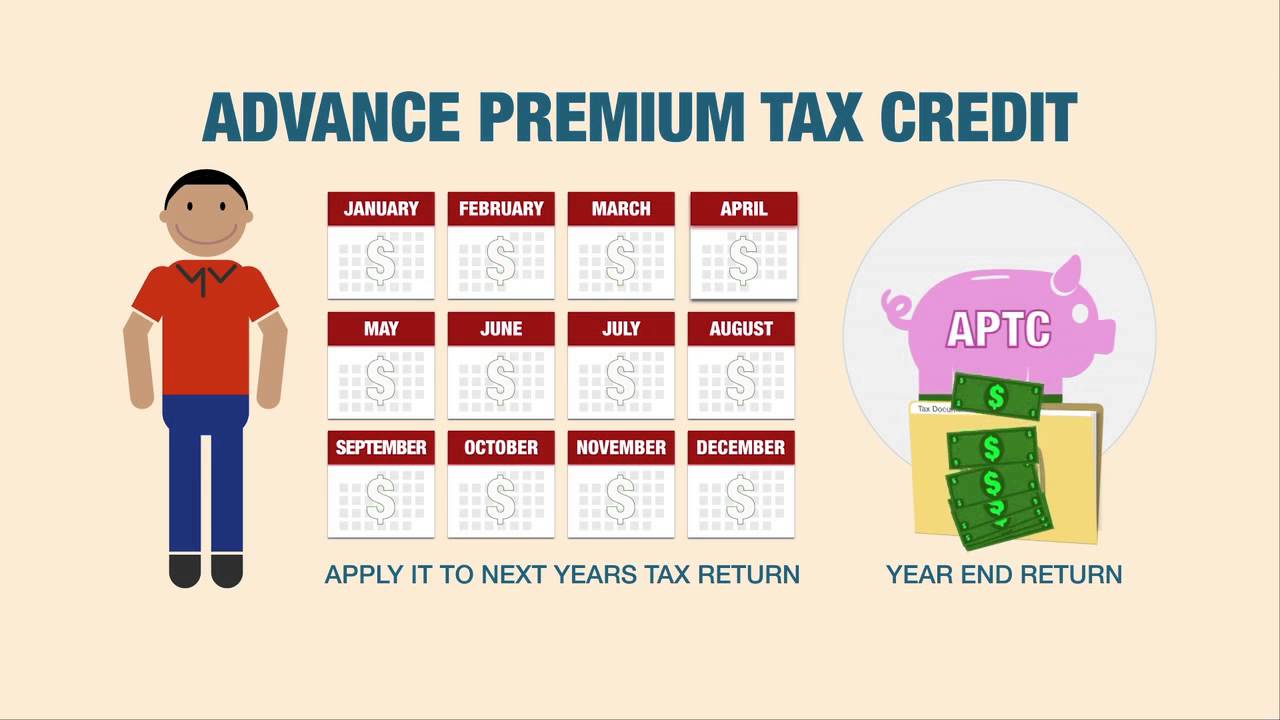

The adjustments are generally made at the end of the calendar year or beginning of the new one. Tax-exempt employers are eligible for a maximum credit of. This calculator crunches Obamacare numbers for tax year 2019.

Use our Obamacare subsidy calculator to estimate your advanced premium tax credit for next year. Your tax credit is based on the income estimate and household information you put on your Marketplace application. Total household income for the year Family size you your spouse and dependents Filing status Address and.

You didnt qualify for a premium tax credit if your income was above 400 of FPL. Your tax credits will stop. The estimator is updated annually as these figures are published.

Your ABP can vary widely from year to year. Number of employees who work at least 40 hours per week. Use this quick health insurance tax credit guide to help you understand the process.

The health care subsidy calculator below will help you calculate the amount of tax credit you should be entitled to. Heres how the credit is calculated. 3 Total tax credit for 2010 is 18000.

Step 1- Calculate Your Modified Adjusted Gross Income MAGI Step 2 - Use Your MAGI and Household Size to Determine if You are Eligible for a Tax Credit. Some of the figures used in determining the credit such as the federal poverty line are indexed to inflation. And the best part is that this tax credit is available immediately rather than having to pay for your insurance first and then get the credit refunded to you when you file your tax return.

Get an estimate of how much you could get in tax credits in a 4-week period. Or just use one of the ObamaCare subsidy calculators found below for a quick estimate on marketplace cost assistance. Our ObamaCare calculator will help you calculate tax credits and subsidies for health insurance sold on the Health Insurance Marketplace.

Health Care Premium Tax Credit Taxpayer Advocate Service

Health Care Premium Tax Credit Taxpayer Advocate Service

2019 Health Insurance Marketplace Calculator Kff

2019 Health Insurance Marketplace Calculator Kff

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

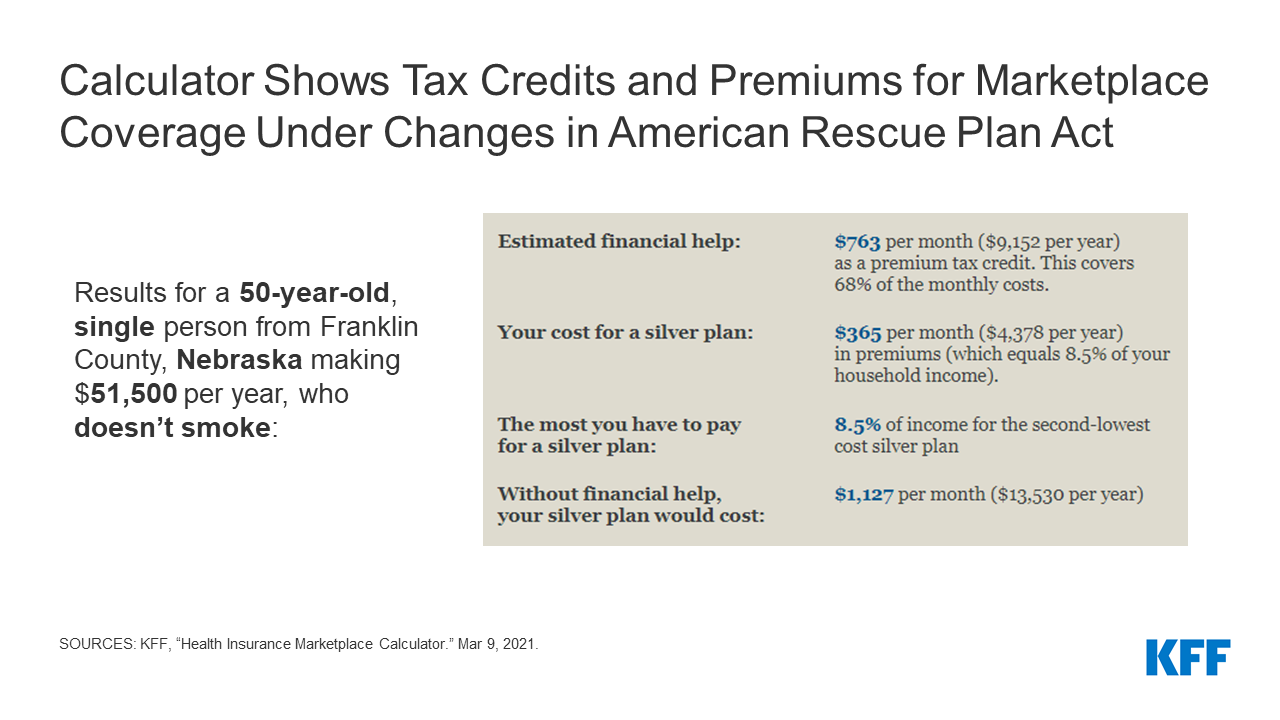

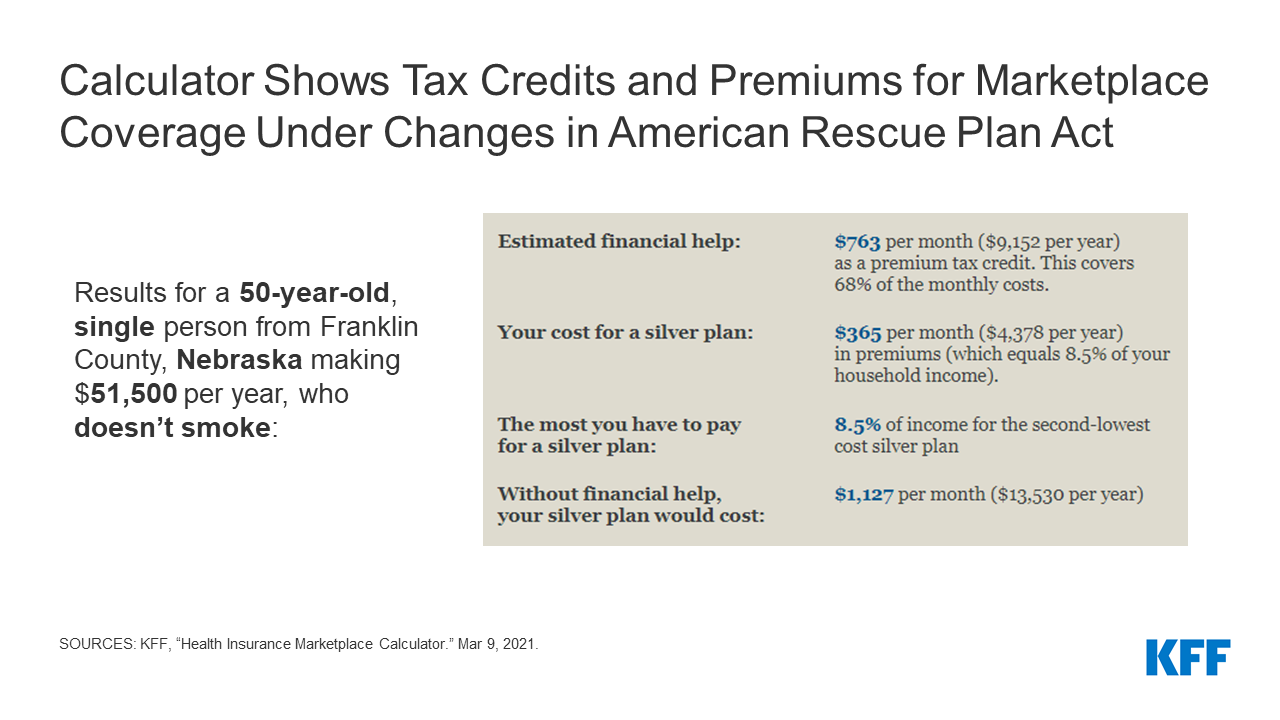

Updated Kff Calculator Estimates Marketplace Premiums To Reflect Expanded Tax Credits In Covid 19 Relief Legislation Kff

Updated Kff Calculator Estimates Marketplace Premiums To Reflect Expanded Tax Credits In Covid 19 Relief Legislation Kff

How Do I Calculate My Health Insurance Premium And Tax Credit Capstone Brokerage

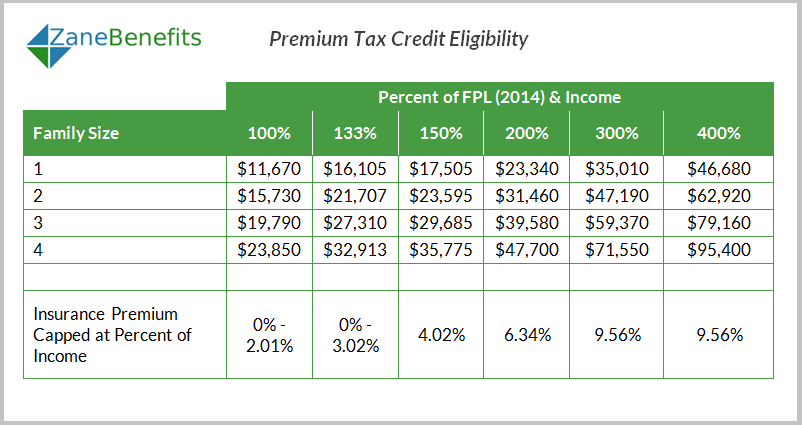

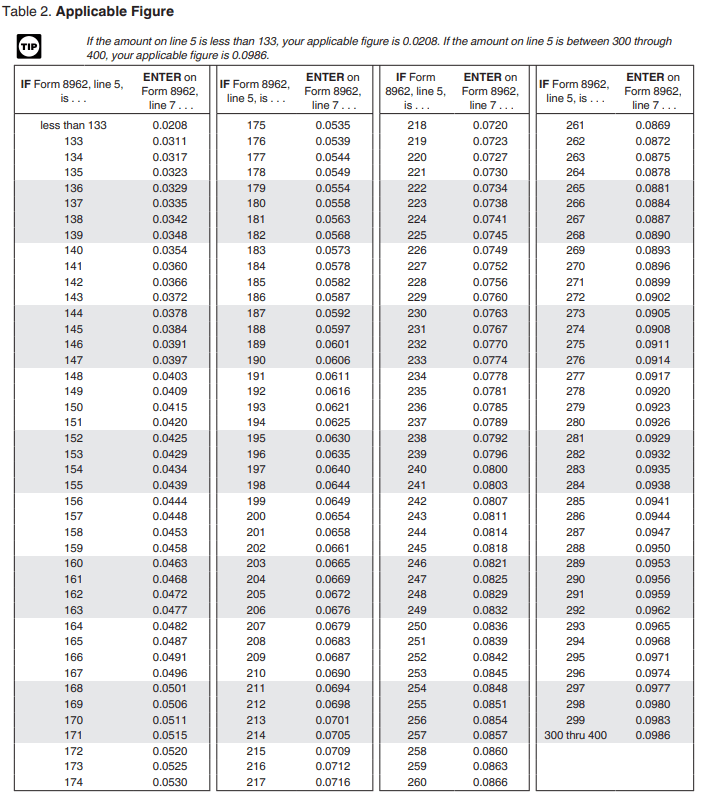

Premium Tax Credit Charts 2015

Premium Tax Credit Charts 2015

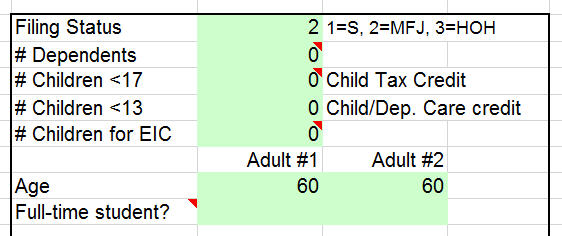

Tax Calculator With Aca Health Insurance Subsidy

Tax Calculator With Aca Health Insurance Subsidy

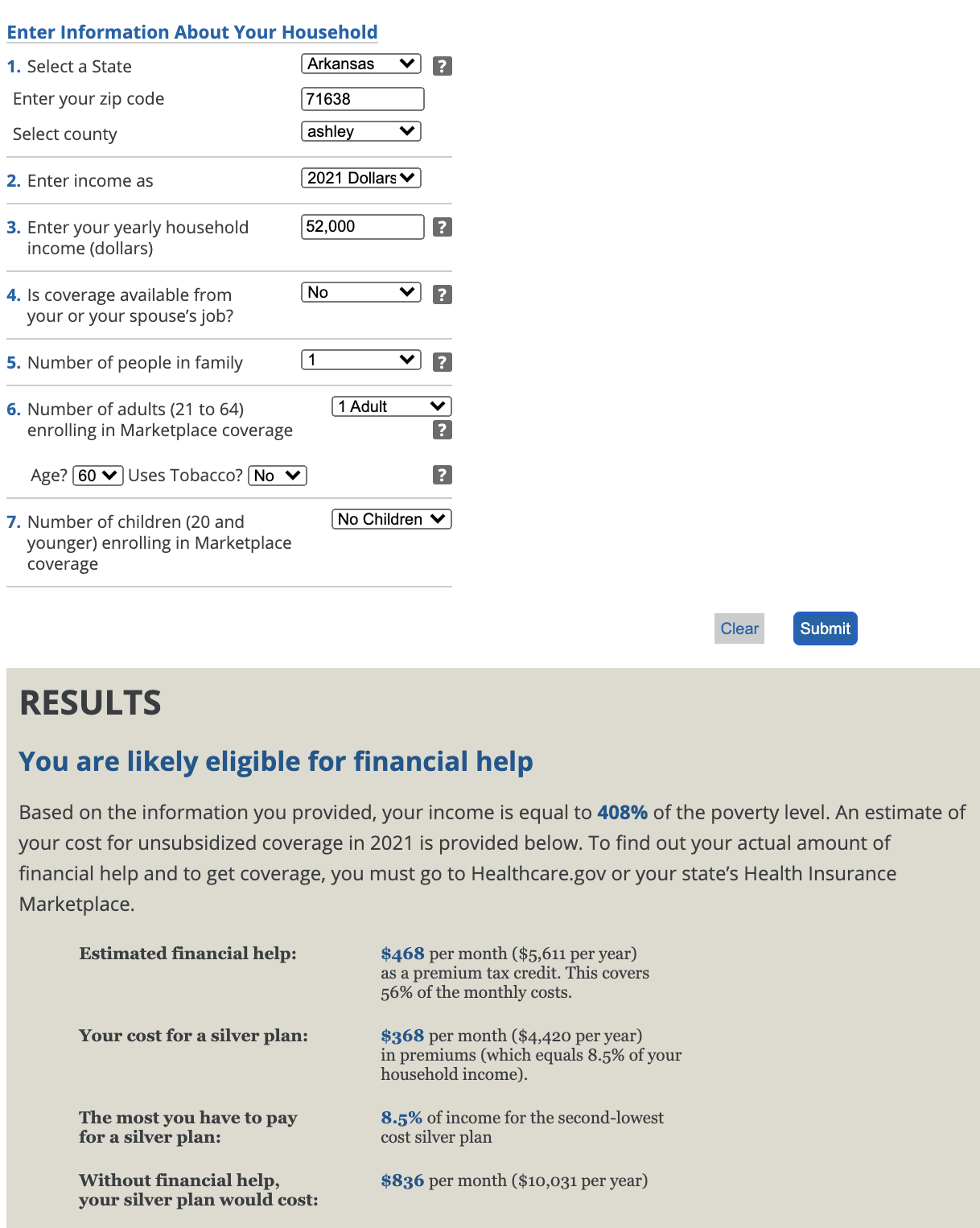

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Maximizing Premium Tax Credits For Self Employed Individuals

Maximizing Premium Tax Credits For Self Employed Individuals

Everything You Need To Know About Premium Tax Credits

Everything You Need To Know About Premium Tax Credits

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Premium Tax Credits Health Affairs

Premium Tax Credits Health Affairs

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.