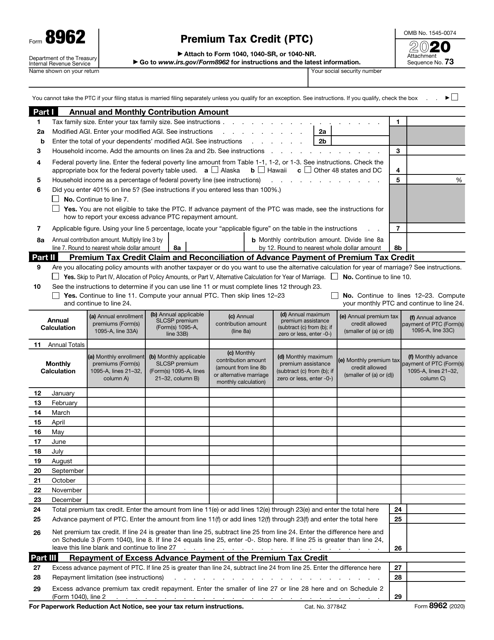

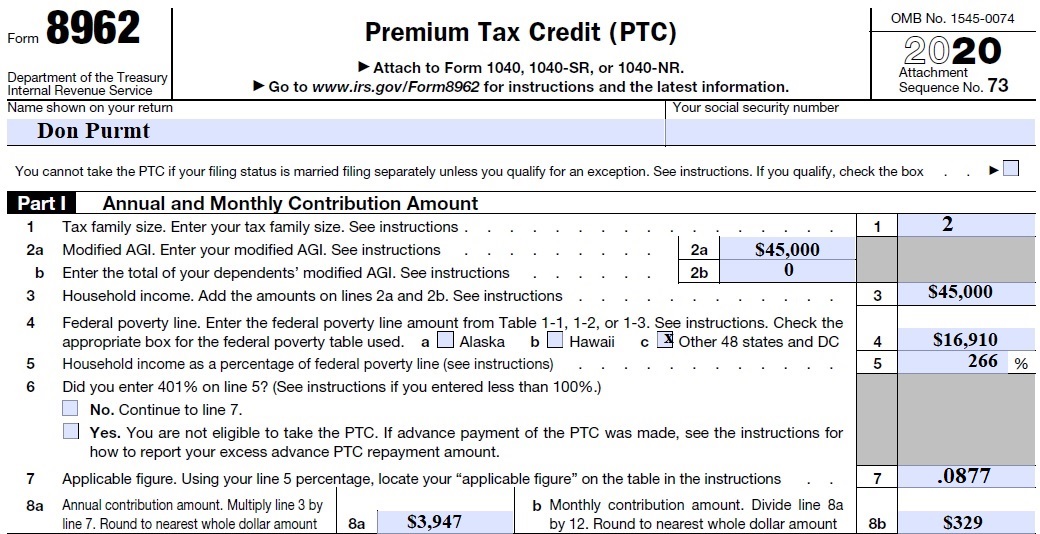

You will need Form 1095-A to complete Form 8962. Form 8962 and the IRS electronic filing program provides for entries of dollars only.

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

I know I submitted my healthcare information but Ill.

Irs form 1095 a and irs form 8962. Go to wwwirsgovForm8962 for instructions and the latest information. The request for Form 8962 and Form 1095-A is usually sent to taxpayers on the IRSs 12C Letter. Name shown on your return.

According to the IRSs Understanding Your Letter 12C page When we receive the requested information well use it to process your original tax return. I received a letter in the mail from the IRS stating according to our records advance payments of the premium tax credit were made for health care coverage from the health marketplace for you or someone listed on your return at first I thought this was a mistake to. This form must be filed if APTC payments were applied to your insurance premiums or if you want to claim the premium tax credit on your annual tax return.

She lives in California. I finally got a letter from the IRS asking for those two forms. The information on Form 1095-A is used to complete IRS Form 8962 Premium Tax Credit.

Your social security number. Information about Form 8962 Premium Tax Credit including recent updates related forms and instructions on how to file. That is done on the second page of form 8962.

I helped my daughter file her return online she lives 500 miles away. That said if youre married and live together you cant use head of household of status. The instructions will tell you what to do for each line.

Now she got a letter from the IRS asking for her Form 1095-A and Form 8962. Now I need the address to mail them to. You have to use either married filing jointly or married filing separately.

You will use the information from Form 1095-A to complete Form 8962 to reconcile advance payments of the premium tax credit or if you are eligible to claim the premium tax credit on your tax return. Form 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR. Youll enter the number of exemptions and the modified adjusted gross income MAGI from your 1040 or 1040NR.

IRS to report certain information about individuals who enroll in a qualified health plan through the Health Insurance Marketplace. Ive been waiting for my federal tax return only to be told I need to submit a 1095-A and a 8962. IRS wants a copy of 1095-A form and 8962.

Form 8962 is used along with Form 1095-A to reconcile the difference between the amount of. The Marketplace uses Form 1095-A to report certain information to the IRS about individuals who enrolled in a qualified health plan through the Marketplace. Your Form 1095-A may include amounts in dollars and cents.

Before you dive in to Part I write your name and Social Security number at the top of the form. Take the premium tax credit. Individuals to allow them to.

Form 8962 is divided into five parts. She no longer has her letter from the IRS. Okay so for the year 2019 I still have not received a federal tax refund.

After you reply to the IRS. Form 1095-A Health Insurance Marketplace Statement. Posted by 5 months ago.

Because the form 1095A is issued in your ex-spouses name - he will need to prepare form 8962 with his tax return and allocate Marketplace premiums to children which are not listed on hos tax return. Form 8962 mostly uses numbers from your return that you already prepared and some numbers from Form 1095-A. If you use married filing separately you wont be eligible for the premium tax credit thats helping you pay for the insurance.

You should round the amounts on Form 1095-A to the nearest whole dollar and enter dollars only on Form 8962. Form 8962 and file it with your tax return Form 1040 Form 1040-SR or Form 1040-NR if any amount other than zero is shown in Part III column C of this Form 1095-A meaning that you received premium assistance through advance payments of the premium tax credit also called advance credit payments or if you want to take the premium tax credit. The Marketplace sends copies to.

She sent me the 1095-A and I was able to fill out the Form 8962. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to. I understand that the pandemic has caused a lot of setbacks but its been 8 months since I filed.

Advanced premium credits are paid to your health insurance plan and reduce your monthly premium payments. Thanks if you can help. However some taxpayers may receive a second Form 1095-A because the information on the initial form was incorrect or incomplete.

Health Insurance Marketplaces furnish Form 1095-A to. If youre due a refund well send it about 6-8 weeks after we receive your response. Entering amounts from Form 1095-A.

Part I is where you enter your annual and monthly contribution amounts.

Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Form 8962 Fill Out And Sign Printable Pdf Template Signnow

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Irs Form 8962 Accounts Confidant

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

Irs Form 8962 Premium Tax Credit Community Tax

Irs Form 8962 Premium Tax Credit Community Tax

8962 Form 2021 Irs Forms Zrivo

8962 Form 2021 Irs Forms Zrivo

Health Insurance 1095a Subsidy Flow Through Irs Tax Return

Health Insurance 1095a Subsidy Flow Through Irs Tax Return

Premium Tax Credit Form 8962 And Instructions

Premium Tax Credit Form 8962 And Instructions

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

What Individuals Need To Know About The Affordable Care Act For 2016

What Individuals Need To Know About The Affordable Care Act For 2016

2020 Form Irs 8962 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 8962 Fill Online Printable Fillable Blank Pdffiller

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

Https Www Irs Gov Pub Irs Prior F8962 2014 Pdf

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.