Get a Personalised Quote. Help Protect You Your Family When Moving Abroad.

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

The insurance company also sets a maximum amount.

Out of pocket meaning for health insurance. This amount of money can range from small copays to astronomical personal finds that one must pay from their own pocket. In terms of health insurance out-of-pocket expenses are your share of covered healthcare costs including the money you pay for deductibles copays and coinsurance. Many times insurance companies will have out of pocket.

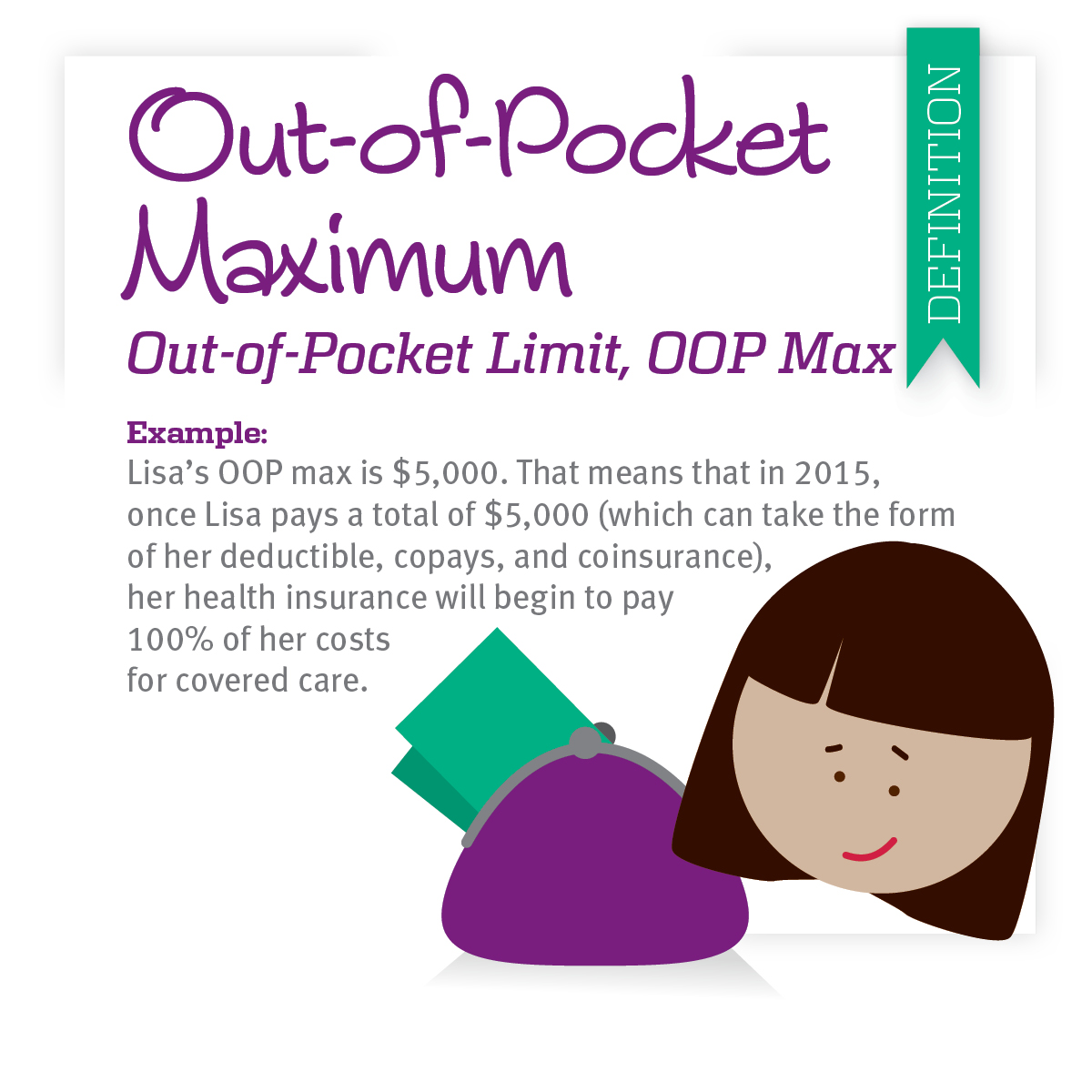

An out-of-pocket maximum is a predetermined limited amount of money that an individual must pay before an insurance company or self-insured employer will pay 100 of an individuals covered health care expenses for the remainder of the year. Access High Levels of Medical Cover in the UK Abroad. Get a Personalised Quote.

Medical services that are covered by your insurance plan can still have an out-of-pocket component. An out-of-pocket maximum is the most money that an insurance customer has to pay per year out of their own pocket. After you spend this amount on deductibles copayments and coinsurance for in-network care and services your health plan pays 100 of the costs of covered benefits.

Out-of-pocket maximum mean is the most a health insurance policyholder will pay each year for covered healthcare expenses. Annonce Private International Health Cover. Your out-of-pocket maximum may read differently depending on what type of health insurance plan you have.

Out-of-pocket costs sometimes called OOP There are often out-of-pocket costs you must pay when you use health care services even when you have insurance such as a visit to the doctor or. A copayment is an out of pocket payment that you make towards typical medical costs like doctors office visits or an emergency room visit. It is also called the out-of-pocket limit.

Some health insurance plans call this an out-of-pocket limit. An out of pocket maximum is the set amount of money you will have to pay in a year on covered medical costs. The out-of-pocket limit doesnt include.

If you meet that limit your health plan will pay 100 of all covered health care costs for the rest of the plan year. Health insurance plans have an. Help Protect You Your Family When Moving Abroad.

These could include copayments or other medical expenses associated with a persons insurance plan. The most you have to pay for covered services in a plan year. These limits help policyholders.

Some plans will include your deductible in your out of pocket limit but most dont. For example many health care and insurance companies have out-of-pocket expenses that are later reimbursed. Annonce Private International Health Cover.

Increasing out-of-pocket payments for health care represent a barrier to basic health services. Out-of-pocket expenses are the costs of medical care that are not covered by insurance and that you need to pay for on your own or out of pocket In health insurance your out-of-pocket expenses include deductibles coinsurance copays and any services that are not covered by your health plan. Within the context of healthcare out-of-pocket often refers to out-of-pocket costs specifically medical expenses which you pay by yourself instead of expenses where your insurance foots the bill.

An out-of-pocket maximum is a cap or limit on the amount of money you have to pay for covered health care services in a plan year. Health insurance out of pocket generally means the amount you must pay for your share of in network coinsurance after you have satisfied your deductible. Access High Levels of Medical Cover in the UK Abroad.