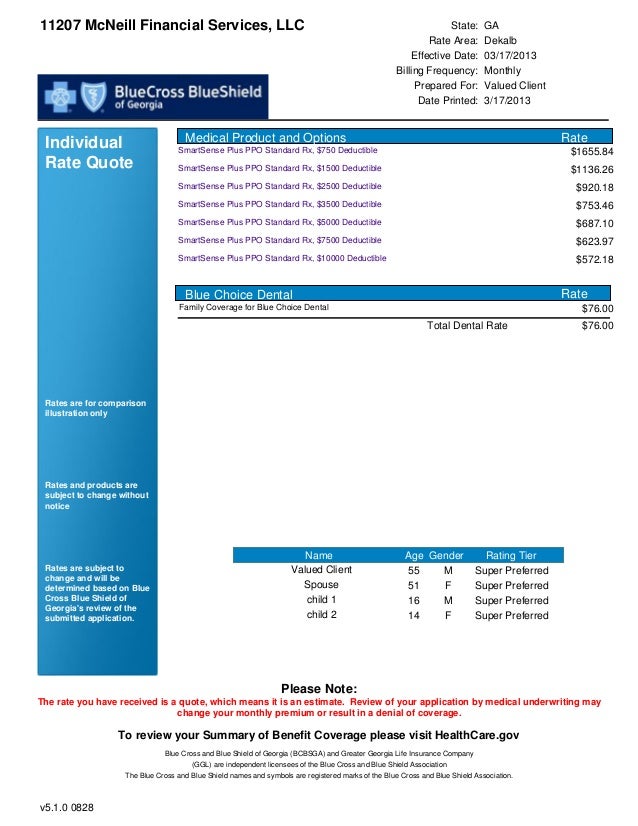

Blue Access-Effective 01012021 Covered Medical Benefits Cost if you use an In-Network Provider Cost if you use a Non-Network Provider Overall Deductible 500 person. Select HMO This summary of benefits is a brief outline of coverage designed to help you with the selection process.

Blue Cross Blue Shield Amends Error Ridden 2018 Benefits Outline Michigan Radio

This summary does not reflect each and every benefit exclusion and limitation which may apply to the coverage.

Anthem blue cross ppo deductible. Covered Medical Benefits Cost if you use an In-Network Provider Cost if you use a Non-Network Provider Overall Deductible. Prudent Buyer PPO. Anthem Blue Access PPO Heritage Thermal Services.

Anthem Blue Access PPO HSA The Heritage Employee Benefit Trust Base Plan. Anthem Blue Cross HDPPO 1500 Deductibles Copays. Family for In-Network Providers.

Anthem Blue Cross Your Plan. Anthem Blue Cross Your Plan. Deductible 80 coinsurance after deductible 30 copayment per visit 50 coinsurance after deductible 50 coinsurance after deductible Not Covered information.

Maximum of three separate deductiblesfamily Deductible for non-Anthem Blue Cross PPO hospital or residen-tial treatment center 500admission waived for emergency admission Deductible for non-Anthem Blue Cross PPO hospital or. So understanding how deductibles work is more important than ever. Benesch Friedlander Coplan Aronoff LLP-Anthem Blue Access PPO with Essential Rx Formulary on the National wR90 Network with Optional Home Delivery Your Network.

Calendar year deductible Cross application applies 250member. Calendar year deductible Cross application applies 250member. To qualify as an HDHP the IRS says a plan must have a deductible of at least 1350 for an individual and 2700 for a family.

Anthem Health Plans Inc. Lots of people are choosing the new high deductible plans now because the monthly cost is often lower. Prudent Buyer PPO This summary of benefits is a brief outline of coverage designed to help you with the selection process.

Deductibles contribute toward the out-of-pocket annual maximum. Anthem Elements Choice PPO 6000 Essential Formulary 520506530 500 Deductible Your Network. This summary does not reflect each and every benefit exclusion and limitation which may apply to.

Blue Cross Blue Shield Healthcare Plan of Georgia Inc. Covered Medical Benefits Cost if you use an In-Network Provider Cost if you use a Non-Network Provider Overall Deductible 500 person 1000 family 1200 person. Maximum of three separate deductiblesfamily Deductible for non-Anthem Blue Cross PPO hospital or residen-tial treatment center 500admission waived for emergency admission Deductible for non-Anthem Blue Cross PPO hospital or residen-.

This summary of benefits is a brief outline of coverage designed to help you with the. Anthem 100 Deductible Select PPO Your Network. Important Questions Answers Why this Matters.

Anthem Blue Cross and Blue Shield. Anthem Blue Cross. A deductible is simply the total youll pay out-of-pocket for health care services before a plan begins paying for those expenses.

The deductibles for this plan are 1500 Individual 3000 Family calendar year if accessing services with preferred providers. Anthem Blue Cross and Blue Shield is the trade name of. National PPO BlueCard PPO This summary of benefits is a brief outline of coverage designed to help you with the selection process.

The deductible for In-Network and Non-Network are added together and do apply towards each other. Physician visits include diabetic management and limited family planning services see certificate for covered services. Covered Medical Benefits Cost if you use an In-Network Provider Cost if you use a Non-Network Provider Overall Deductible 4000 person 8000 family.

Like the name says this type of plans deductible is higher than most traditional plans. If you are pregnant Office visits 20visit deductible does not apply. Anthem Blue Cross and Blue Shield.

Anthem 1500 Deductible Select HMO Your Network. One member may not contribute any more than the individual deductible toward the family. Deductibles apply only to specified services.

Deductibles are per calendar year. This summary does not reflect each and every benefit exclusion and limitation which may apply to. You may still be responsible for 20 of services after the deductible has been.

Anthem Blue Cross PPO hospital or residential treatment center deductible applies waived for emergency admission 10 coinsurance for Inpatient Physician Fee PPO Providers. 50 coinsurance deductible does not apply for Inpatient Physician Fee Non-PPO Providers. Anthem Blue Cross Your Plan.

HMO products underwritten by HMO Colorado Inc. 100 person 200 family 100 person. Anthem Blue Cross.

What is the overall deductible. This is only a summary. Rocky Mountain Hospital and Medical Service Inc.

Anthem 2500 Deductible Classic PPO HSA Compatible Your Network. Retail Health Clinic a Retail Health clinic visit.