Providers contact on members behalf. Blue Cross Blue Shield members can search for doctors hospitals and dentists.

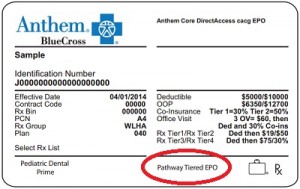

Https Www Bcbstx Com Provider Pdf Id Card Quick Guide Pdf

To quickly and easily find out if you the provider or a provider referral participate in the members plan network either log in or register for Provider Connection.

Bcbs of california provider number. Outside the United States. BCBS Provider Phone Number. To 630 pm Monday through Friday.

Find Immediate Medical Care Make an informed choice based on symptoms convenience and cost. We work collaboratively with hospitals group practices independent behavioral health care providers community government agencies human service districts and other resources. Blue Shield of California welcomes you.

Find drug lists pharmacy program information and provider resources including the prior authorization process. 800 468-9935 6 am. Official Site of Anthem Blue Cross Blue Shield a trusted health insurance plan provider.

In the United States Puerto Rico and US. Community-Based Adult Services CBAS and Long-Term Services and Support LTSS CBAS and LTSS Department for Medi-Cal and MRMIP. Provider Identification Number.

Members and Healthcare Professionals. Learn about insurance options for Individuals Families or Employers or get connected with your local Blue Cross Blue Shield company by calling 8886302583. BCBS Federal Phone Number.

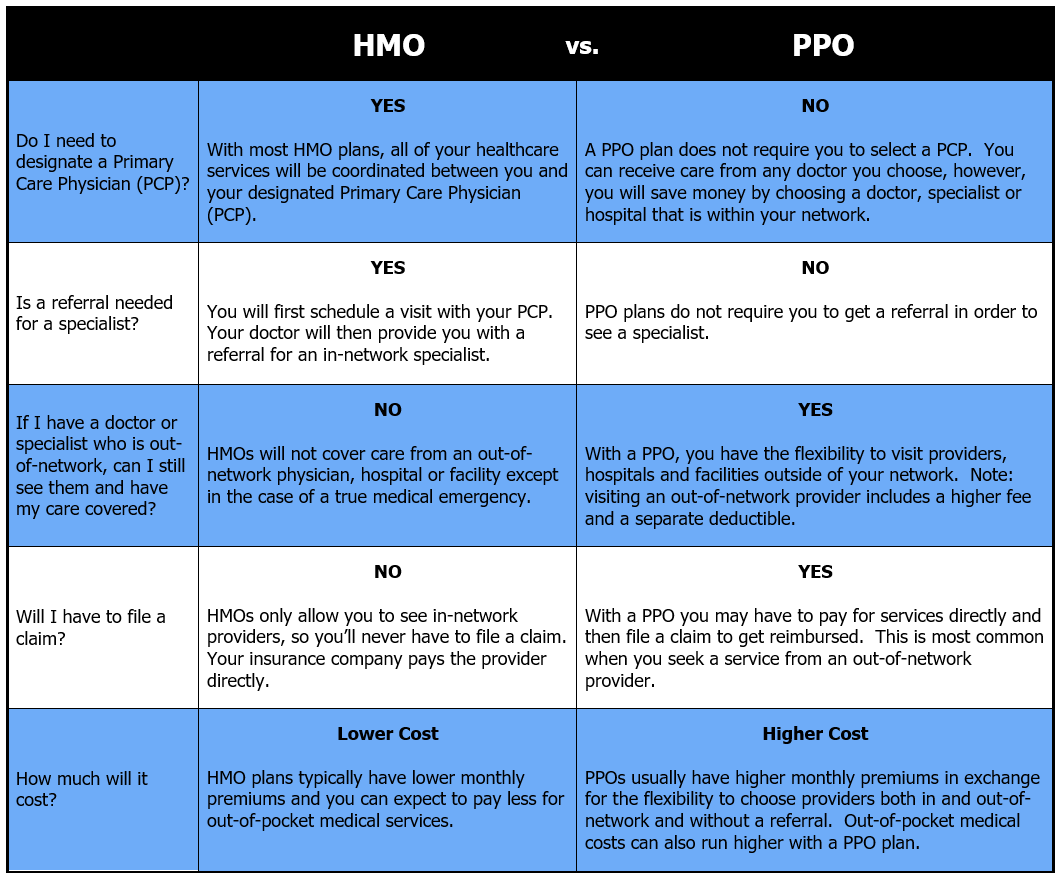

As a mixed-model HMO health plan Blue Shield Promise contracts with individual physicians and with independent physician associations IPAs and medical groups on a. Select Blue Cross Blue Shield Global or GeoBlue if you have international coverage and need to find care outside the United States. Amerihealth Caritas Phone Number Payer ID and Claim address.

Instruct members to contact number on back of ID card. Blue Shield of California member plans only. Để được trợ giúp hãy gọi cho số được ghi trên thẻ ID của quý vị hoặc số 1-888-254-2721.

63 Zeilen California Blue Shield 800 824-8839 800 633-4581 800 633-4581 800. Shop plans for Medicare Medical Dental Vision Employers. Healthfirst Customer Service-Health First Provider Phone Number-Address and Timely Filing Limit.

What is the PIN used for. Ambetter Claims address and Phone Number. Download phone quick reference guide PDF 129 KB Phone.

800 677-6669 request to speak to an interpreter. Blue Shield Promises networks comprise more than 7000 physicians 80 hospitals and hundreds of ancillary medical professionals. The Blue Cross Blue Shield Association is an.

57 Zeilen Premera Blue Card Provider Phone Number. Please call the number on your member ID card or log in to start a Live Chat. Dental Provider Resources When our network in California is combined with our affiliate networks our members have access to one of the largest dental networks in the country.

Case management for Anthem Blue Cross Cal MediConnect Plan Care Management support is available 247 through Anthem Blue Cross Cal MediConnect Plan Customer Care at 1-855-817-5786. Please see your Plan website or contact the number on the back of your card for detailed information regarding your specific benefit coverage. Please note that this number is used solely to receive calls from BCBS members seeking assistance and never to make calls to BCBS members.

Kaiser Permanente Phone Number Claims address and Timely Filing Limit. Để được giúp đỡ thêm hãy gọi cho Sở Bảo Hiểm California California Department of Insurance theo số 1-800-927-4357. Blue Shield of California Promise Health Plan Provider Services.

800 677- 6669 Interpretation. This enables Anthem to meet the needs of members with mental health and substance use disorders as well as those with intellectual and developmental disabilities. Apply for individual or family medical dental and life insurance plans.

Blue Cross Blue Shield Address. The Provider Identification Number PIN is the additional validation of an enrolled providers identity that is used when a provider conducts business transactions with the Medi-Cal program and the fiscal intermediary Xerox State Healthcare LLC Xerox.