The Rules for California Small Business Health Insurance This is a summary of the rules that govern small group health insurance plans in California. Covered california small business plans business owner health insurance options cigna small business health insurance small business health plans california covered california business california small group health insurance employee insurance for small business health insurance for small business Policy Research on baggage must offer Premium Class.

Individual Vs Small Business Insurance California Guide

In fact Kaiser Permanente has been rated the most cost-efficient plan in the markets we serve.

Business health insurance california. 2020 gross written premium. Managing small business health insurance costs If saving on health care costs is important to your business Anthem has great options to choose from. Use the links below to enroll in small business health insurance through Covered California including dental.

If you choose coverage from California Choice you control the amount you want to spend on employees health benefits. UnitedHealthcare can help you build a healthy business. We offer a broad selection of California health plans for individuals families and small businesses from most of the leading California health insurance companies.

For a small business health insurance is a critical factor in retaining and recruiting. California Small Group Rules protect small businesses that purchase health insurance for their employees. Our plans are priced with your business in mind.

Get health insurance for your small business. Blue Shield of California. UnitedHealthcare can help you understand your small business health insurance options.

Learn More About California Small Business Plans. And 5 pm excluding holidays. We offer your employees access to a broad range of hospitals physicians pharmacies dental and vision professionals and other providers.

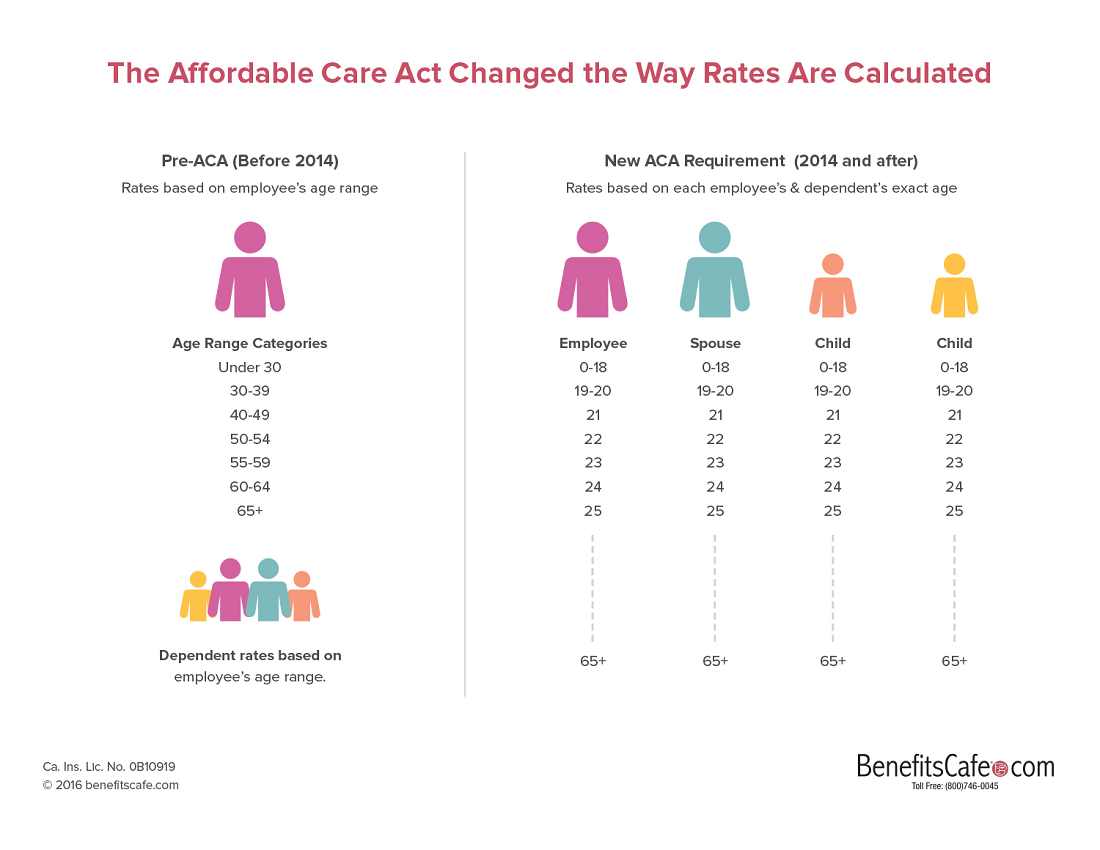

Because employees have the opportunity to compare and select health plans at a variety of price points the result is greater choice and coverage that is more closely tailored to individual needs. CHIF defines small business health insurance in California as plans that cover no more than 50 employees. These rules apply to companies with up to 100.

While companies this small may not legally have to offer group medical insurance they may find that health plans help keep and attract good employees. 2 Let us help you make the right investment in your business for yourself and for your employees. It makes the process smooth and efficient.

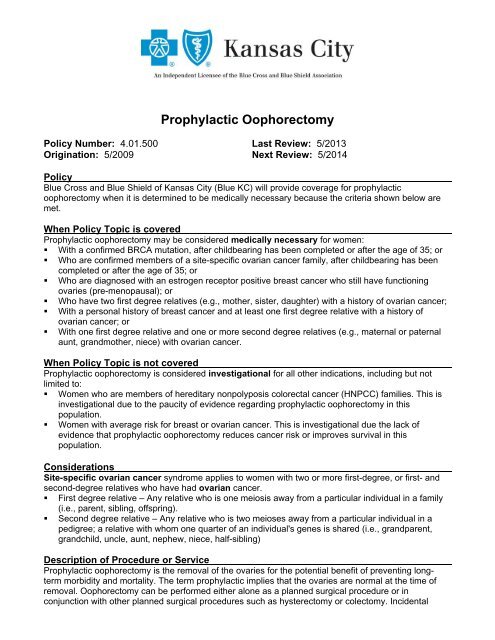

Covered CA Small Business Employer Application Enroll your business. Looking to purchase group health insurance in California. This document describes the rights and obligations of small businesses that purchase coverage for small business health insurance in California.

Based on 2019 revenue. Our small business health plans offer whole person care with coverage options for medical dental vision life and disability to groups in California that range from 2 to 100 employees. We provide comprehensive tailored business insurance solutions with expertise and care to help protect your people property and reputation.

The company health insurance covers California small. Liberty Mutual at a glance 77 on the US. The rules described in this document include the Obama Care Affordable Care Act ACA guidelines and are current and up-to-date as of May 2021.

Helping small businesses across California stay healthy At Blue Shield of California our mission is to ensure all Californians have access to high-quality health care at an affordable price. The medical insurance companies follow the guidelines that the Federal Government and the State of California dictates. Covered California for Small Business has six health insurance companies that are available for year-round enrollment in the small-business program.

Tax Considerations of Group Health Insurance in California. If you have a small business with between one and 100 employees get a free quote from Health for California. We make it easier to find and purchase health insurance for California small businesses.

Call Covered California for Small Business CCSB at 844 332-8384 Monday through Friday between 8 am. Health insurance for small businesses in California has rules and regulations. Employee Application Enroll specific employees on the.

Get a customized quote for your small business in just minutes. Find a health care plan that works for your small business. You can choose a Fixed Percentage of 50 to 100 of the cost for a specific plan andor benefit or you can choose.

Our forms make it easy to sign up and you can quickly find the lowest-cost plans or get the right balance of service and cost for your workers. And these rules apply to businesses with up to 100 employees. Global property and casualty insurer.