One of our CHOICE editors saved herself over 1800 annually just by reviewing and switching cover for. Insurance Policy for Married Couple - HDFC Life.

Best Health Insurance For Young Married Couples Special Enrollment

Best Health Insurance For Young Married Couples Special Enrollment

Buyonlinehdfclifein Tel No.

Best health insurance plan for married couple. If you get health insurance through your employer your employer can establish its own rules for health insurance coverage and some employers extend benefits to domestic partners while others dont extend benefits even to spouses. There are a range of couples policies on offer with different coverage to suit either young couples who are relatively healthy those planning a family and needing cover for pregnancy and birth-related services established couples with no kids or mature couples. Youll need to check the terms of your.

But term life is almost always the most affordable type of life insurance and its definitely the simplest. Say within a married couple one of you is healthy and the other has more health issues. One of the benefits of marriage is often access to a family health insurance plan.

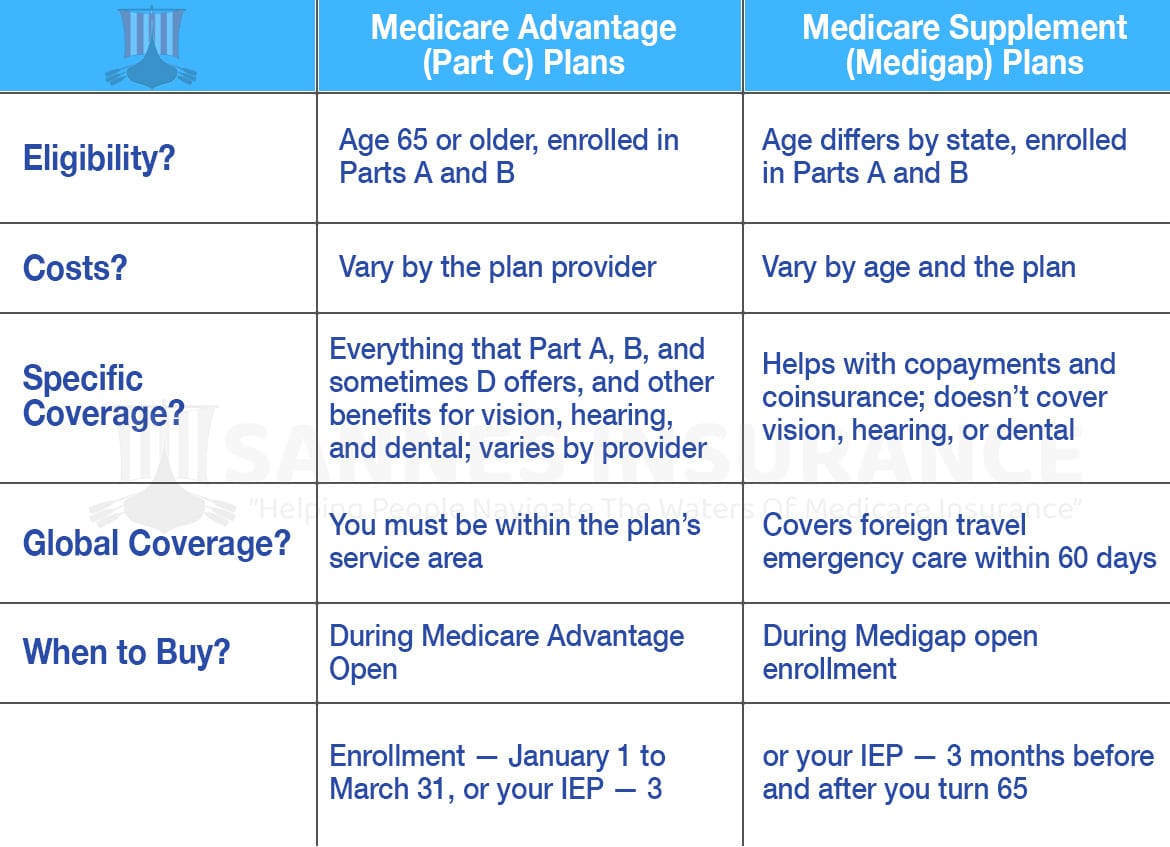

It covers you for a fixed period of time until youre self-insured saving you from paying for life insurance long after you need it. If you have family coverage through an HSA-eligible health plan you and your spouse could max-out the annual contribution instead of being limited by having one HSA plan and one non-HSA plan. You can put the healthy person in a less expensive Bronze plan with a higher deductible and you can put the other person in a Gold plan with no deductible and a low out-of-pocket maximum.

Availability and affordability of health insurance especially for those with lower incomes and medical conditions. These plans typically offer discounts because they cover more than one person. HDFC Life Insurance Company Limited.

The Affordable Care Act ACA aims to improve the quality and increase the. Our health insurance experts have put together a handy five-step action plan to help you through the process of reviewing comparing and switching your health insurance policy. When you get married health insurance providers typically offer the option for carrying a joint plan.

The most affordable option for a health insurance plan is usually one that is. If you die your spouse will take the. How Much Life Insurance Do Married Couples Need.

Just a few minutes could potentially save you hundreds of dollars a year. Whether you buy your own insurance in the open market or have a choice of plans from your insurer consider using a federally-qualified high-deductible health plan with a health savings account. Using a hypothetical 30-year-old couple from Denver.

Joshi Marg Mahalaxmi Mumbai 400 011. Under these plans your routine preventative care including physicals and well-woman visits vaccinations and many screening tests is usually covered at no cost. Sproutt is an independent insurance broker that connects you with a policy and provider to match up with your budget and needs.

Health Savings Account HSA Options. We recommend getting 1012 times your annual salary. Whatever course you choose having options when it comes to healthcare is always a plus.

If youre under 26 you can be included on your parents insurance policy. The healthier spouse may decide a bronze-tiered plan which tends to have the lowest monthly costs best meets his or her needs while the spouse that requires more healthcare opts for a gold-tiered plan which tends to have out-of-pocket costs that max out at only around 10 of your medical bills. Best Health Insurance for Young Married Couples Employer Insurance.

Declining health and insufficient care consequences that will follow many of them into Medicare. Lodha Excelus 13th Floor Apollo Mills Compound NM. Its implementation promises to reduce.

Insurance For Couples. Like other insurance policies couples health insurance can include hospital cover hospital and extras cover or extras only depending on your choice of policy. If your employer offers insurance its often a better deal than buying your own on the open market.