Formulary is a term that will become more familiar to you once you have been enrolled in Medicare Part D for a longer period of time. Search for Your Prescription Drug Across All Medicare Part D or Medicare Advantage Plans There are three ways to find your medication.

Comparing Medicare Plans How To Get To The Right Plan For You

Comparing Medicare Plans How To Get To The Right Plan For You

The formulary is organized into tiers with each tier.

Compare medicare part d formularies. Learn about formularies tiers of coverage name brand and generic drug coverage. Only the drugs covered under the Medicare Part D plan are listed on the formulary. A formulary is the list of drugs that each of the Part D plans decides to cover.

Learn more about options. Select the starting letter for the drug you wish to find. Qualify for a Special Enrollment Period.

A Medicare Part D deductible is an amount you have to pay out of pocket before the plan begins to pay. Overall coverage of the top Part D covered drugs by the VA formulary FEHBP formulary and the formularies of the two highest enrollment Medicare Part D plans remains largely unchanged since the 2007 analysis. It is important to understand that there is not a one-size-fits all National formulary that is put out by Medicare.

Some plans may set lower deductibles such as Medicare Part D. Most Part D plans use a tiered formulary. Kay This article is merely pointing out the importance of comparing formularies for 2011 Part D plans.

Learn about the types of costs youll pay in a Medicare drug plan. Medicare drug plans arent required to cover certain drugs such as benzodiazepines barbiturates drugs for weight loss or gain and drugs for erectile dysfunction. Every Medicare Part D plan uses a drug list called a formulary which includes all of the medications the plan covers and the amount you have to pay for each.

The list is usually divided into groups. A Medicare Part D Formulary refers to the entire list of prescription drugs covered under a Part D Prescription Drug Plan PDP. Continue without logging in.

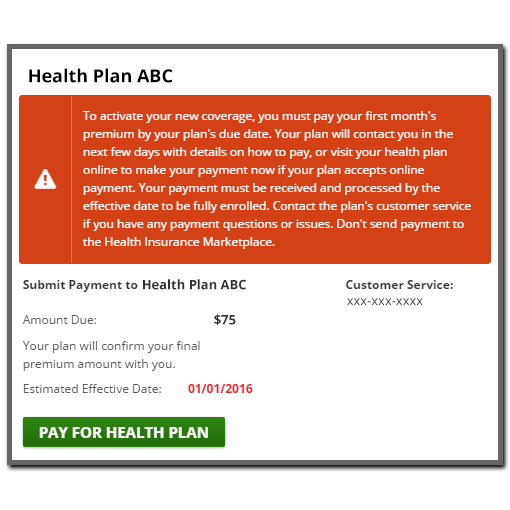

A second cost that most Medicare Part D plans have is the deductible although some plans have a 0 deductible. The exact cost of each of these depends on the individual plan. However since our data is provided by Medicare it is possible that this may not be a complete listing of plans available in your service area.

There are hundreds of Part D plans and formularies can vary from. How Part D works with other insurance. This is because it will have a direct effect on the amount that you pay for your prescription medications.

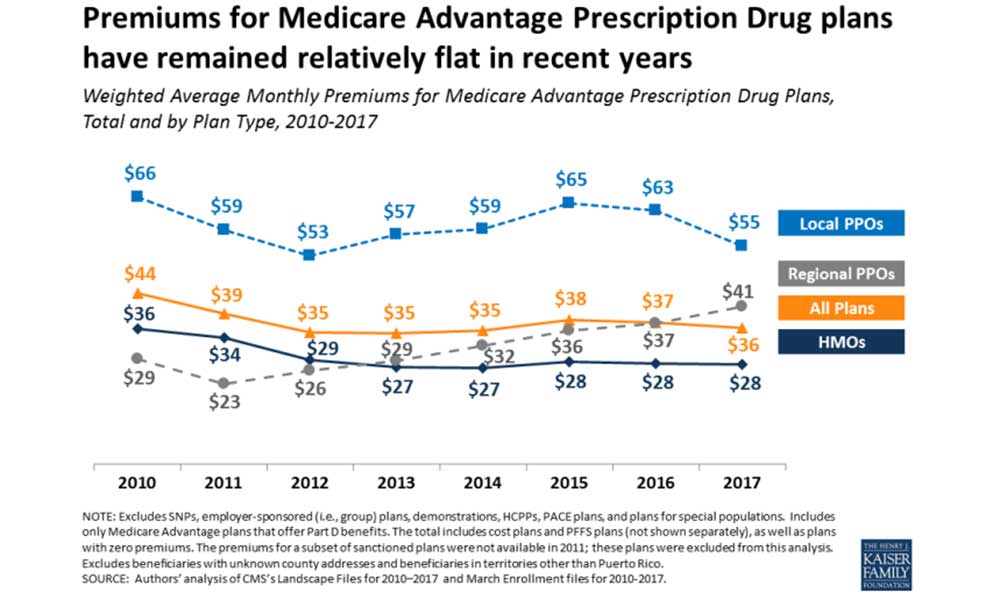

The Medicare Part D Formulary is a list of covered drugs on your prescription drug plan. As you see here Medicare Part D plan Juliet has more than double the monthly premium that Medicare Part D plan Penelope has. Select your State and enter your drugs 11-digit National Drug Code NDC or.

All commercially available vaccines medically necessary to prevent illness except those covered by Medicare Part B. Medicare drug formularies can feature both generic and name brand drugs. Youll want to find the formulary that fits with the medications you take.

Premiums can vary widely. The FEHBP and Medicare Part D formularies that we analyzed all provide a greater breadth of drug coverage than the VA formulary. Log in or Create Account.

Medication used to treat depression and other mental health disorders including. The federal maximum for the deductible is 405 in 2018. Medicare formulary requirements.

The formulary is needed to determine if the plan is right for your needs. The exact cost of each of. Select your State and enter at least the first three letters of your drug name or.

Log in or Create Account Continue without. Overview of what Medicare drug plans cover. All other medications are not covered.

Plans cover both generic and brandname prescription drugs. Log in or create account to change your 2021 coverage. Costs for Medicare drug coverage.

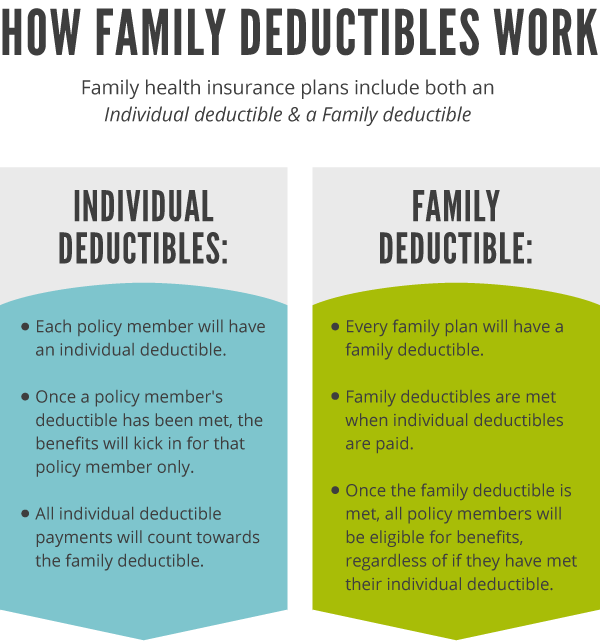

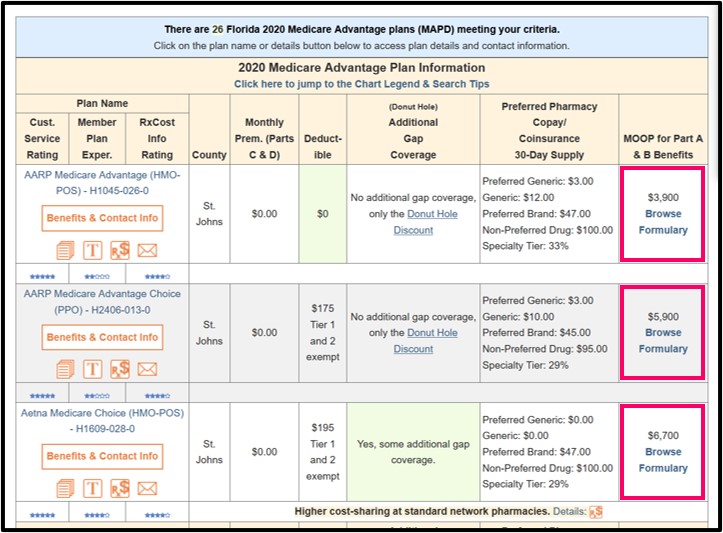

You pay less for drugs in the lower tiers and more out-of-pocket for drugs. Medicare Prescription Drug Plans have their own list of covered prescriptions called a formulary. Comparing prices of Part D plans is best done when factoring in all aspects of a particular plan including the formulary.

What Medicare Part D drug plans cover. Learn about your options enroll in a plan. The formulary may change at.

We make every effort to show all available Medicare Part D or Medicare Advantage plans in your service area. The drug formulary of one Medicare plan may differ from another plans formulary. A Medicare Part D formulary is simply a list of covered prescription drugs and vaccines.

While the formularies for each Medicare plan are different all Medicare Part D formularies include the following. The plan can change the formulary anytime but they must notify you. A Medicare formulary can change throughout the year.

For 2019 and beyond drug plans offering Medicare drug coverage Part D that meet certain requirements also can immediately remove brand name drugs from their formularies and replace them with new generic drugs or they can change the cost or coverage rules for brand name drugs when adding new generic drugs. If youre taking these drugs youll get information about the. You will be taken to a page showing all Medicare Part D.

Some plans may cover these drugs as an added benefit. Both Medicare Advantage plans and stand-alone Medicare Part D Prescription Drug Plans have formularies. Whereas a Tier 2 drug may have a 10 copay.

A Tier 1 drug may have a 0 copay. These could include the shingles vaccine the pneumonia vaccine the tetanus vaccine and more. Find a Medicare plan You can shop here for drug plans Part D and Medicare Advantage Plans.

Although Medicare Part D formularies vary they must all cover certain categories. For a complete listing please contact 1-800-MEDICARE TTY users should call 1-877-486-2048 24 hours a day7 days a week or. This means if your doctor recommends a vaccine.

Each plan has a different list of drugs. Medicare Part D has different associated costs including a monthly premium deductibles and copays. Rather each of the Medicare Part D.

These groups are based on your cost under the plan and referred to as tiers.