Deductible HMO Plan with HRA. Jefferson St Rockville MD 20852 Kaiser Foundation Health.

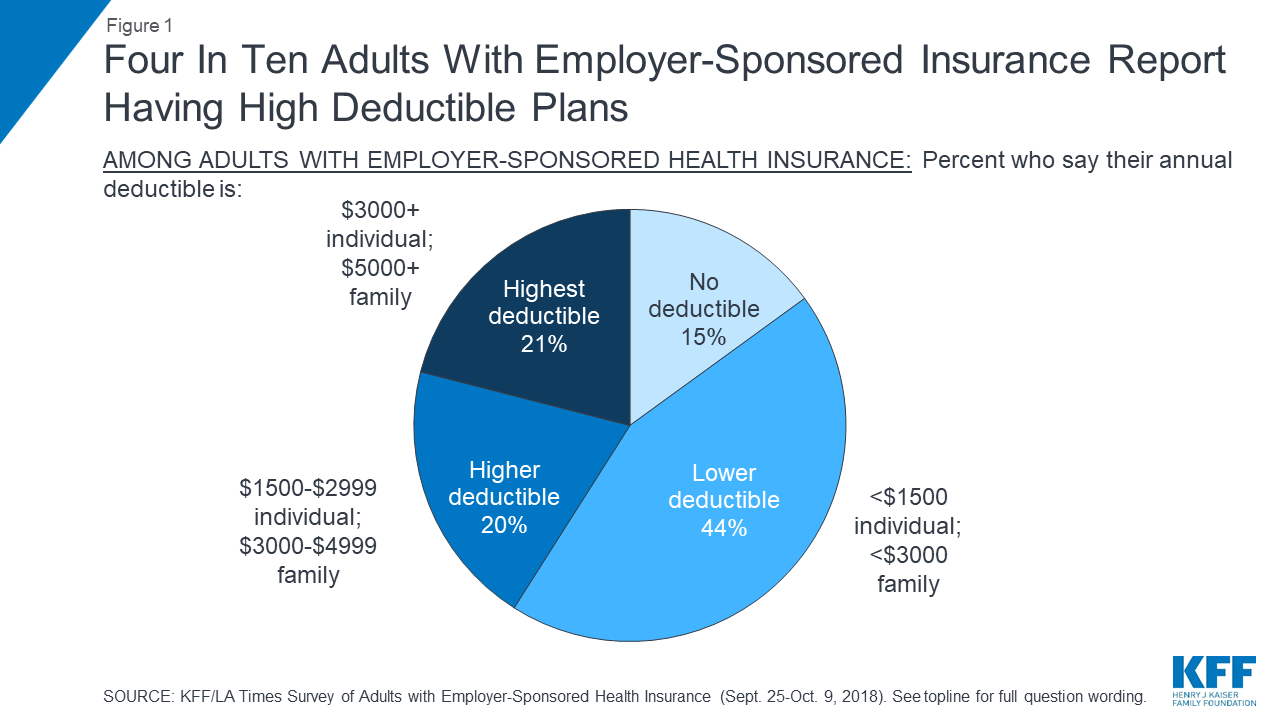

Kaiser Family Foundation La Times Survey Of Adults With Employer Sponsored Insurance Section 1 Profile Of Adults With Employer Sponsored Health Insurance And Overall Views Of Coverage 9302 Kff

Kaiser Family Foundation La Times Survey Of Adults With Employer Sponsored Insurance Section 1 Profile Of Adults With Employer Sponsored Health Insurance And Overall Views Of Coverage 9302 Kff

Services covered under your health plan are provided andor arranged by Kaiser Permanente health plans.

Kaiser employer health plans. HSA-Qualified Deductible EPO Plan. Jefferson St Rockville MD 20852 Kaiser Foundation Health. At Kaiser Permanente Federal Employees and Retirees get more than just a health plan.

Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States Inc in Maryland Virginia and Washington DC 2101 E. Shop our health plans Why choose Kaiser Permanente. Jefferson St Rockville MD 20852 Kaiser Foundation Health.

Kaiser Permanente health plans around the country. Chiropractic and Acupuncture Plan. Average Annual Family Premium per Enrolled Employee For Employer-Based Health Insurance KFF.

Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan. Annual premiums for employer-sponsored family health coverage reached 21342 this year up 4 from last year with workers on average paying 5588 toward the cost of their coverage. Annual premiums for employer-sponsored family health coverage reached 18764 this year up 3 from last year with workers on average paying 5714 towards the cost of their coverage according to.

Kaiser Permanente health plans around the country. For plans in your area please enter your home or. Kaiser Permanente health plans around the country.

Employee plans Kaiser Permanente. Kaiser Permanente offers a variety of plans for companies that supply health insurance to their employees. Jefferson St Rockville MD 20852 Kaiser Foundation Health.

HSA-Qualified Deductible HMO Plan. HEALTH INSURANCE PREMIUMS AND WORKER CONTRIBUTIONS In 2016 the average annual premiums for. KaiserHRET Survey of Employer Sponsored Health Benefits 2009 and 2014 Most workers also face additional cost sharing for a hospital admission or.

By signing on you agree to our terms and conditions and privacy practices. Research health plans and enroll online. We give you the top doctors personalized care and services you need - in a way that fits you and your lifestyle.

Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States Inc in Maryland Virginia and Washington DC 2101 E. Traditional HMO Employee Plan. Jefferson St Rockville MD 20852 Kaiser Foundation Health.

This is the eighteenth KaiserHRET survey and reflects employer-sponsored health benefits in 2016. HMO with Coinsurance Plan. Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States Inc in Maryland Virginia and Washington DC 2101 E.

In 2020 the average annual premiums for employer-sponsored health insurance are 7470 for single coverage and 21342 for family coverage Figure A. Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States Inc in Maryland Virginia and Washington DC 2101 E. Sign on to view your companys health plan information.

Kaiser Permanente health plans around the country. For COVID-19 screenings and personalized care plans for minor health conditions for example cold flu sinus problems complete an e-visit. Protect your employees with 10 essential health benefits All Kaiser Permanente plans provide the coverage mandated by the Affordable Care Act ACA so you can feel confident that your employees are getting great health protection.

To talk to an advice nurse 247 please call 1-800-611-1811 TTY 711. KFF Employer Health Benefits Survey 2019. Kaiser Permanente Washington provides health insurance coverage for individuals Medicare state and federal employees and employer groups.

The plans are tailored to meet the lifestyle and budget needs of our members. Kaiser Permanente health plans around the country. Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States Inc in Maryland Virginia and Washington DC 2101 E.

The average single premium increased 4 and. Whether you are looking for a lower monthly premium or a broader range of coverage our Employer-sponsored plans have something for you.