Your health and your money are two of your most important assets. How does an HSA.

Bcbsks Blog Infographic What S The Difference Between A Fsa Hsa And An Hra

Bcbsks Blog Infographic What S The Difference Between A Fsa Hsa And An Hra

If you have a high deductible health plan you may be eligible for a health savings account or HSA.

Bcbs health savings account. You must be covered by a high-deductible health plan to open an HSA. Flexible and easy to use an HSA plan empowers you to take charge of your health your money and your future. Sign in or create a MyBlue account to see your personal Year.

To be eligible to establish an HSA you must be enrolled in a qualified High Deductible Health Plan HDHP. A health savings account or HSA is an account you use to pay for qualified medical pharmacy dental and vision expenses and save on taxes. By law only people with a High-Deductible Health Plan HDHP can open an HSA.

QualifiedHigh-Deductible Health Plans QHDHPs and Health Savings Accounts HSAs are designed to be used together. Health savings account or HSA plans are sometimes called high-deductible health plans but that isnt what theyre all about. A few things you need to know about HSAs.

Health savings account or HSA. Track your deductible spending account balance discounts and more all in one place all on your phone. Consumer-directed health plans are sometimes called high-deductible health plans.

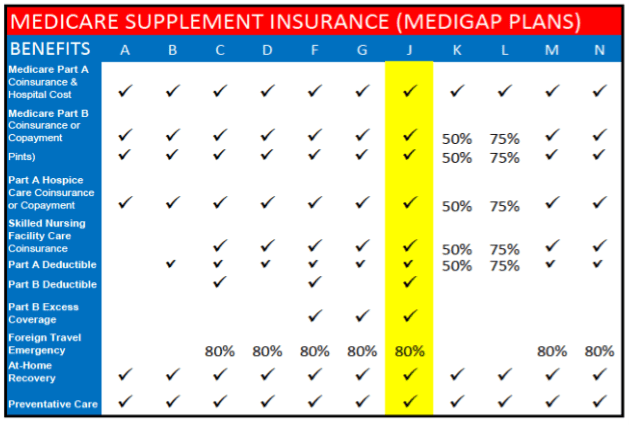

Then health spending accounts might be for you. Health spending accounts come in three forms. A Health Savings Account also known as an HSA is a tax-advantaged individually-owned account that is used to pay for qualified medical expenses now and in the future includes dental and vision.

Owning and managing a health savings account HSA Health savings account user guide. An HSA will allow you to use tax-deductible dollars to pay for your out-of-pocket. Things to Know About HSAs.

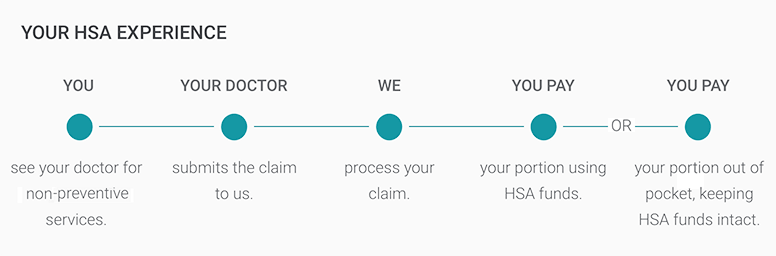

Hood will make an annual contribution to the HSA of 500 for employee only coverage and 1000 if you cover yourself and any of your eligible dependents. With an HSA you own and control the money and how it is spent. You can use the money in your HSA to help pay for your share of costs for your care or for certain health-related expenses that traditional health plans dont cover.

Once the deductible is met your health care expenses are paid according to the terms of your health plan. 8 rows Health Savings Account Plans Embedded Deductible Plans Health Plan Ded InOut. The key things to know about HSAs are.

Select a topic below to learn more about how they work. Money in an HSA rolls over year after year and is owned by the participant even if they change jobs or health plans. Consumer Directed HealthSelectSMhigh deductible health plan HDHP administered by Blue Cross and Blue Shield of Texas works with your Consumer Directed HealthSelect health savings account HSA.

A medical savings account called an HSA With a CareFirst BlueCross BlueShield HSA plan such as BlueChoice HMO HSAHRA Gold 1500 90 or BlueChoice Advantage HSAHRA Gold 1500 90 you are responsible for the full cost of your medical coverage until you meet your annual deductible. The federal government defines both the minimum deductible required for an HDHP each year as well as the annual contribution limits. A health savings account is one of three kinds of health spending accounts.

Theyre also called HSA-compatible plans because they can be paired with a health savings account. An HSA is a type of bank account to help you save for your health care expenses. You can save money in your HSA account before taxes and use the funds to pay for eligible health care expenses.

An HSA is a bank account you and your employer can put tax-free money into each benefit year. Horizon Blue Cross Blue Shield MyWay HSA pairs a high-deductible health plan with a Health Savings Account HSA to cover eligible medical expenses. This contribution is pro-rated for new hires.

A health savings account HSA is a tax-advantaged account that works in conjunction with an HSA-eligible health plan that meets IRS guidelines and allows the participant to save tax-free money for eligible medical expenses. Instead of spending money on higher premiums you can keep that money in an HSA to use on your health care expenses. Think of your HSA as not just part of your benefits.

Health Savings Account HSA Health Savings Account HSA A Health Savings Account HSA is a type of investment account that was created by Congress and is designed to help you save for future healthcare needs. A Health Savings Account HSA is a way to secure more affordable health coverage for you and your family while you save on taxes. You own your HSA and the money in it.

In-network preventive services are not subject to the deductible. HSAs can also help you save for retirement when you can use the funds to pay for general living expenses without penalty. These plans include the option to add an HSA which can help you take more control of where your health care dollars are going.

Blue Cross Blue Shield of Massachusetts sends weekly claim files to HealthEquity so you can pay providers directly from your account. Compare Switch Accounts. Flexible spending account or FSA.

An HSA works with a health plan that has a high deductible. Health reimbursement arrangement or HRA. Health savings account user guide.

Benefits of an HSA. You can use these accounts for qualified medical expenses such as deductibles and copays. Since QHDHPs generally have lower monthly premiums and more out-of-pocket costs HSAs help you pay for qualified health care expenses like prescriptions coinsurance vision dental and more until you reach your deductible.

An HSA is a tax-exempt savings account for eligible out-of-pocket medical expenses.